State Farm Bank Auto Loan

Get the Best Deal on Your Next Auto Loan from State Farm Bank

The Benefits of an Auto Loan from State Farm Bank

If you’re shopping for a new car, you’ve probably already looked into the various auto loans out there. One of the best options for an auto loan is from State Farm Bank. This bank offers a variety of benefits that make it a great choice for your auto loan.

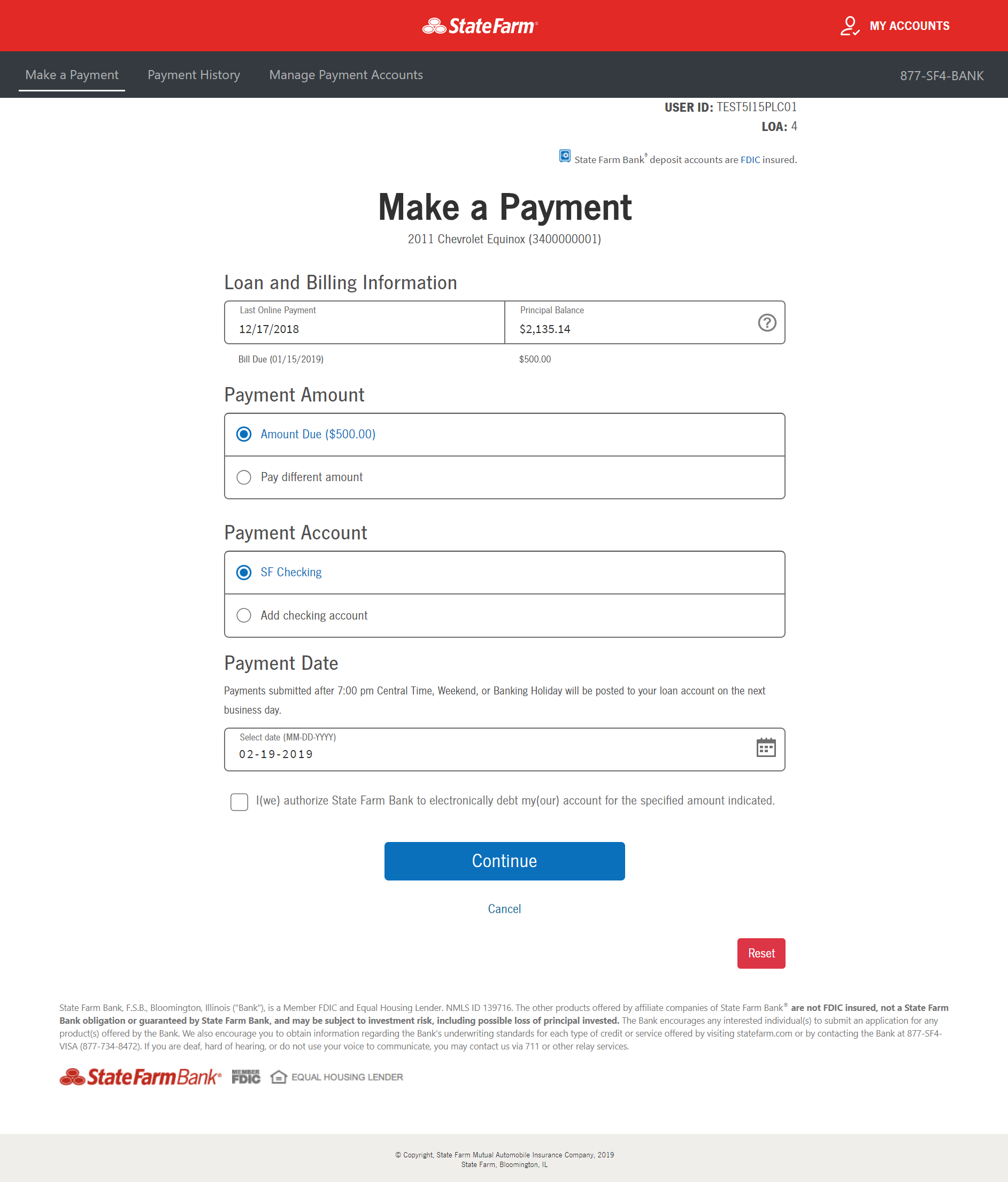

First, an auto loan from State Farm Bank is fast and easy to get. All you need to do is fill out the online application and you’ll get a decision in just a few minutes. Once you’re approved, you can start shopping for the car that you want.

Second, the interest rates on auto loans from State Farm Bank are competitive. You’ll get a loan with a low rate that will save you money over the life of the loan. Plus, you can also get a fixed rate loan that won’t change over time.

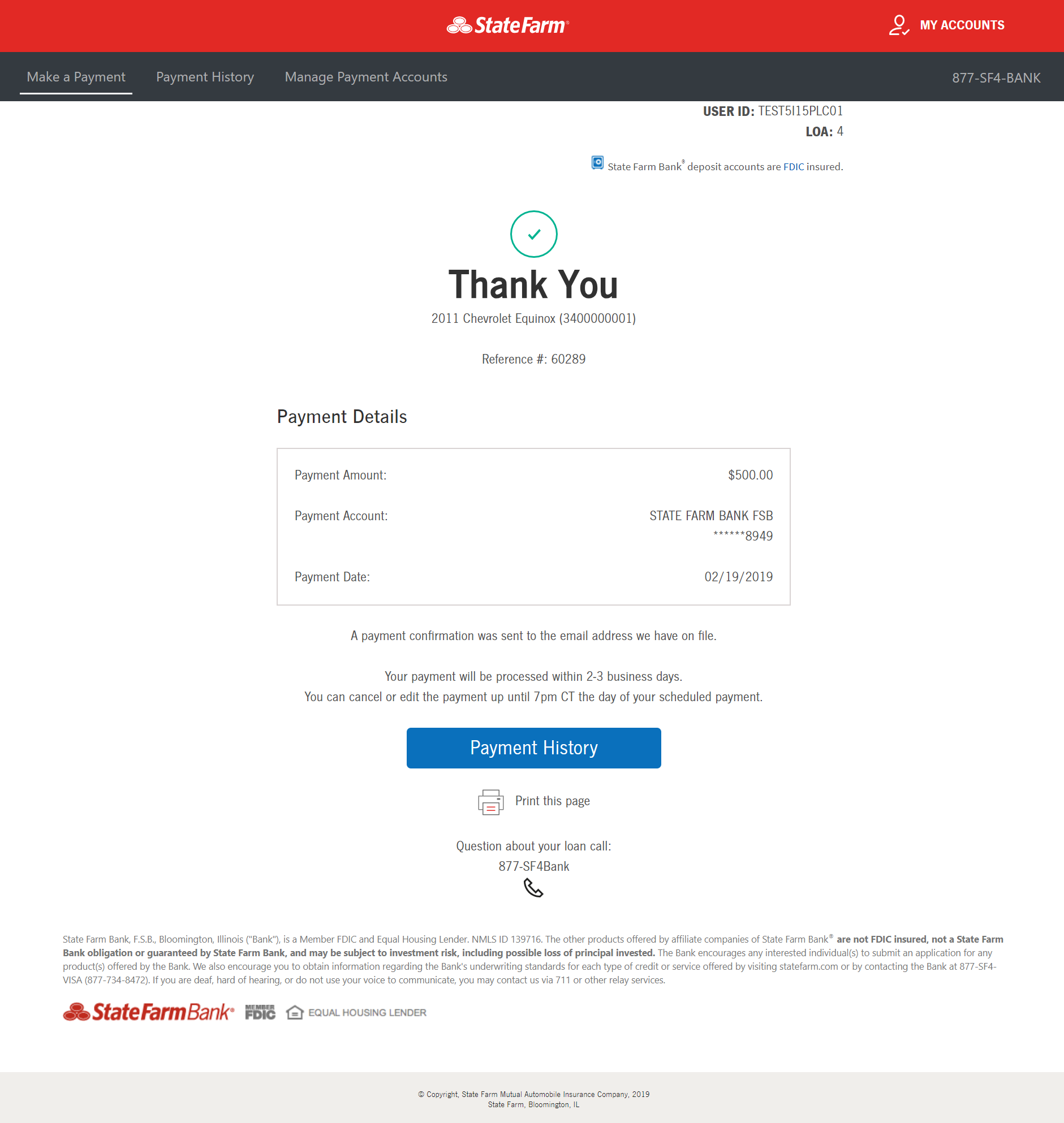

Third, State Farm Bank offers flexible repayment terms. You can choose the length of your loan and the payment schedule that works for you. You can also pay off your loan early without any penalty.

Finally, State Farm Bank offers a variety of discounts and incentives that make it a great option for your auto loan. You can get discounts on insurance, fuel and more. Plus, you can also get access to exclusive State Farm Bank rewards.

How to Get an Auto Loan from State Farm Bank

Getting an auto loan from State Farm Bank is easy. All you need to do is fill out the online application. You’ll need to provide some basic information such as your name, address and Social Security number. You’ll also need to provide information about your income and expenses.

Once you submit your application, you’ll get a decision in just a few minutes. If you’re approved, you can start shopping for the car that you want. You’ll need to provide some additional information in order to complete the loan process.

Once you’ve found the car that you want, you’ll need to provide the required documentation such as your driver’s license and proof of insurance. You’ll also need to provide proof of income such as pay stubs or tax returns.

Once you’ve provided all the necessary documentation, you’ll be ready to sign the loan agreement. Make sure that you read the agreement carefully so that you understand all the terms and conditions. When you’re ready, you can sign the agreement and you’ll be ready to drive off with your new car.

Get the Best Auto Loan from State Farm Bank

If you’re looking for an auto loan, State Farm Bank is a great option. You’ll get a low interest rate, flexible repayment terms and access to exclusive discounts and rewards. Plus, the application process is fast and easy. Get started today and you could be driving off in your new car in just a few days.

State Farm Car Loan Reviews | TBC

State Farm Bank® - Vehicle Loan Help Center

State Farm Bank® - Vehicle Loan Help Center

Car Credit tips State Farm Bank auto loan costs just 2,24% in 2016

State Farm Auto Loans - Home Collection