How To Read State Farm Auto Insurance Policy

Understanding Your State Farm Auto Insurance Policy

Having auto insurance is a necessity in most states. Understanding what your policy covers and what it doesn't is important so you know when to file a claim and when to look for other solutions. State Farm auto insurance is amongst the most popular in the U.S., and it can be beneficial to know the ins and outs of your policy and what it covers. Read on to learn how to read and understand your State Farm auto insurance policy.

Read your policy

Your policy is the document that contains all the information you need to know about your State Farm auto insurance. It covers all aspects of your coverage and offers an explanation of the various exclusions and limitations. Take the time to read through your policy carefully, so you understand what it covers and what it does not. Don’t be afraid to ask questions if you don’t understand something. Your State Farm agent can provide clarification if needed.

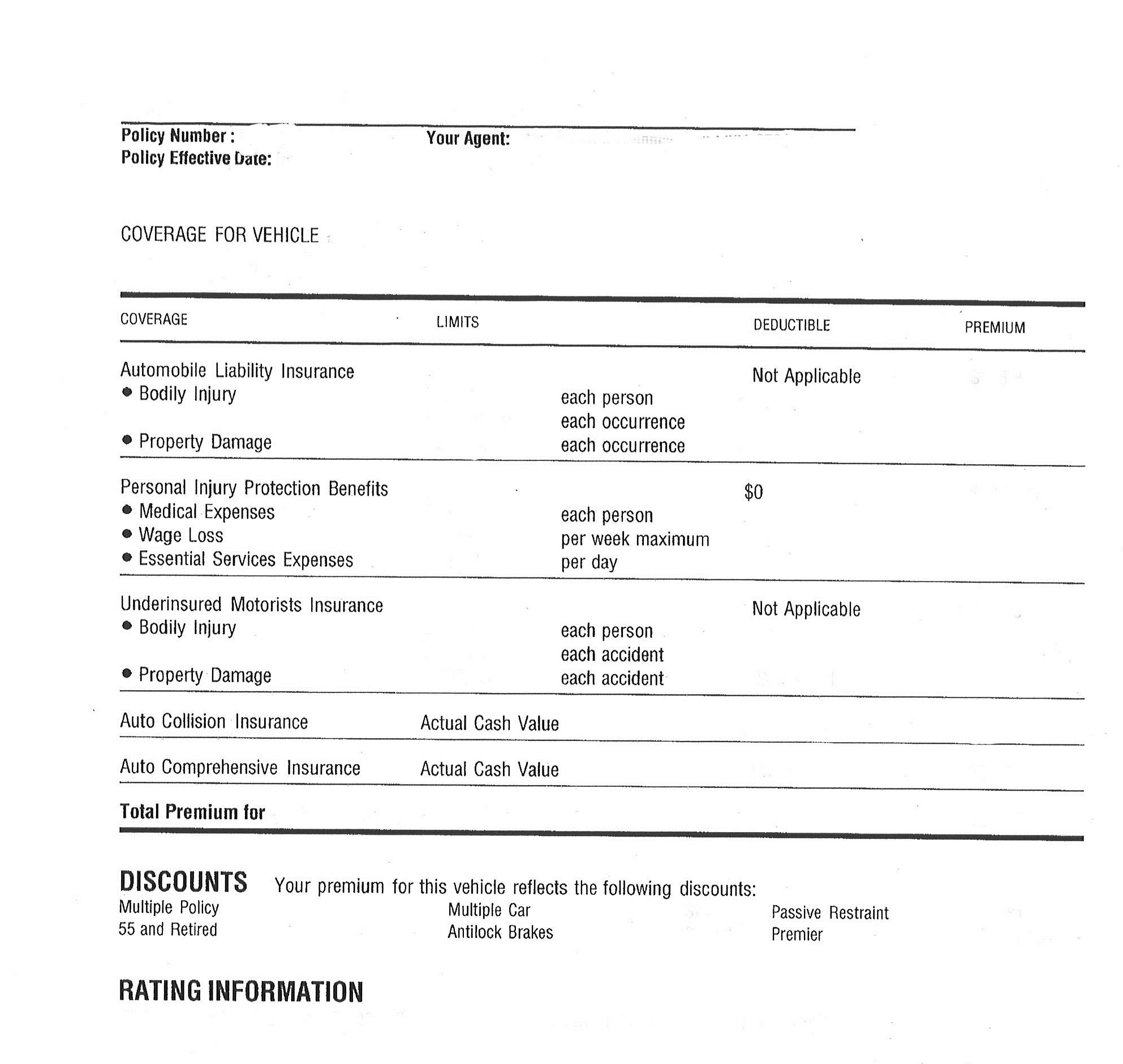

Understand Your Coverage

Once you have read your policy, you should have a good understanding of the type of coverage you have. The policy will explain the different types of coverage you have, such as liability, collision, comprehensive, medical payments, underinsured/uninsured motorist, and rental car reimbursement. Each of these coverages has its own limits and exclusions, so it is important to understand what is covered and what is not. Additionally, many policies offer a variety of discounts, such as safe driver discounts, multi-car discounts, and discounts for having certain safety features on your car.

Know Your Deductibles

Your State Farm auto insurance policy will also outline the deductibles for each coverage you carry. The deductible is the amount that you are responsible for paying out of pocket before your insurance company will pay for any damages. Knowing your deductibles can help you to make an informed decision if you need to file a claim. Generally, the higher the deductible, the lower the premium, but it is important to determine what is right for you and your budget.

Be Aware of Exclusions

Exclusions are items that are not covered by your insurance policy. These can vary depending on the type of policy you have, so it is important to read through the policy to understand what is covered and what is not. Common exclusions include damage caused by floods, earthquakes, and wear and tear. Additionally, some policies may exclude coverage for certain types of drivers, so it is important to understand who is covered and who is not.

Ask Questions

If you have any questions about your State Farm auto insurance policy, don’t hesitate to ask your insurance agent. They will be able to explain the coverage you have and provide more details about the exclusions and deductibles. Additionally, they can provide guidance on how to lower your premiums or add additional coverage if needed. Knowing the details of your policy can help you to make the best decision when it comes to filing a claim or looking for other solutions.

State farm auto insurance policy pdf - insurance

State Farm Auto Insurance Declaration Page

State Farm Car Insurance Card / Progressive Insurance Id Card Template

Insurance Quotes State Farm Auto - Inspiration

State Farm Auto Insurance Declaration Page