Car Insurance Provisional Licence Uk

Provisional Licences and Car Insurance in the UK

What is a Provisional Licence?

A provisional licence is the first step to driving in the UK. It’s the licence you need to get before you can take your driving test. It’s issued by the Driver and Vehicle Licensing Agency (DVLA) and is valid for 10 years. It entitles you to drive a car or van on a public road under certain conditions. These conditions are that you must be accompanied by an approved driving instructor and display ‘L’ plates on the front and back of your car.

How to Get a Provisional Licence

Getting a provisional licence is relatively straightforward. You need to be 17 or over and have a valid UK passport or other approved form of identification. You also need to pass a medical test and pass the theory test. This test covers the Highway Code, the rules of the road and safety. Once you’ve passed the test, you’ll be issued with a provisional licence. You will then be ready to book your practical driving test.

Car Insurance for Provisional Licence Holders

Once you have a provisional licence, you can start looking for car insurance. You may have seen some ads for ‘learner driver insurance’, which is designed for provisional licence holders. This type of insurance is typically short-term and can be bought for 30 days or up to a year. It’s designed for learner drivers who don’t yet have a full licence and can be quite expensive. It may be worth shopping around to find the best deal.

Insuring a Car with an Existing Licence

If you already have a full UK driving licence, you can start looking for car insurance straight away. The good news is, it’s possible to get cheaper car insurance if you’ve been driving for a while and don’t have any accidents or convictions. It’s important to shop around and compare prices from different providers. It’s also important to make sure you’re getting the right level of cover for your needs.

How to Save Money on Car Insurance

There are a few different ways to save money on car insurance. One way is to pay for your insurance in one lump sum rather than monthly. This can reduce the cost of your premiums. You can also reduce the cost of your insurance by increasing your voluntary excess. This is the amount you’ll have to pay in the event of a claim. Finally, you can also save money by taking an advanced driving course, which can reduce your premiums.

Conclusion

Getting a provisional licence is the first step to driving in the UK. It’s relatively easy to get and allows you to start looking for car insurance. If you already have a full UK licence, you can start looking for car insurance straight away. There are a few different ways to save money on car insurance, such as paying in one lump sum and increasing your voluntary excess. Ultimately, it’s important to shop around and compare prices from different providers to make sure you’re getting the best deal.

Insurance Companies That Insure Provisional Drivers - noclutter.cloud

permanent resident card how to tell if fake - Shela Magee

Getting your provisional license - Driving lessons in Eastbourne

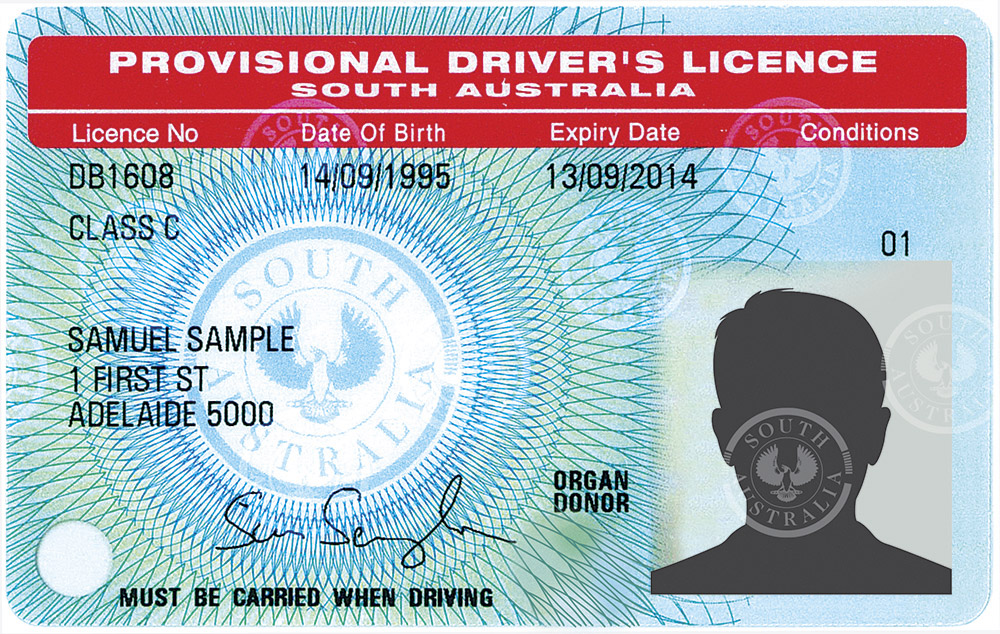

On The Right Track - P2 provisional licence

Driving Licence Types | Driving Licence Categories | Tempcover