How Much Is Gap Insurance Usaa

All About Gap Insurance Through USAA

What is Gap Insurance?

Gap insurance, also known as "guaranteed auto protection" or "guaranteed asset protection," is an optional form of coverage that you can purchase for your auto insurance policy. Gap insurance helps cover the difference between the actual cash value of a vehicle and the balance still owed on the financing (car loan, lease, etc.) in the event of an accident or theft. When you are the victim of a vehicle accident or theft, you may find yourself owing the lender more money than the vehicle is worth. Gap insurance comes in handy in such situations.

How Does USAA Gap Insurance Work?

When you purchase gap insurance through USAA, you are essentially buying a policy that pays the difference between the amount you owe on your car loan and the actual cash value (ACV) of your car, should it be deemed a total loss. If you are leasing a vehicle, gap insurance can help you pay the difference between the ACV and the residual value of the vehicle. USAA gap insurance also pays for the cost of taxes and fees associated with the loan and/or lease, up to the state maximum.

What Does Gap Insurance Cost Through USAA?

The cost of gap insurance through USAA varies depending on a number of factors, such as the type of vehicle, the age of the vehicle and the length of the loan or lease. Generally speaking, USAA gap insurance can range anywhere from $20 to $30 per year. USAA also offers a “Gap Plus” policy, which provides additional coverage for up to $1,000 of the vehicle’s depreciation per year.

Who Should Buy USAA Gap Insurance?

Gap insurance is an optional form of coverage that is typically not included in standard auto insurance policies. That said, if you are leasing or financing a vehicle and owe more money than the vehicle is worth, then it is a good idea to consider purchasing gap insurance. This type of coverage can help protect you from owing a large sum of money in the event of an accident or theft.

How Do I Purchase USAA Gap Insurance?

You can purchase gap insurance through USAA by calling their customer service line at 800-531-8722. To purchase a policy, you will need to provide information about your vehicle, such as the make, model, year, and VIN number. You will also need to provide information about your loan or lease, such as the amount you owe, the interest rate, and the length of the term. Once you have provided all of the necessary information, a USAA representative will be able to provide you with a quote for gap insurance.

Conclusion

Gap insurance is an optional form of coverage that can help protect you from owing a large sum of money in the event of an accident or theft. USAA offers competitive rates for gap insurance, and you can purchase a policy by calling their customer service line at 800-531-8722. You should consider purchasing gap insurance if you are leasing or financing a vehicle and owe more money than the vehicle is worth.

Gap Insurance: Usaa Gap Insurance Coverage

How Much Is Gap Insurance Usaa : Coronavirus Usaa Will Return 280

How Much Is Car Worth For Insurance

Understanding Auto Insurance "Gap Coverage"

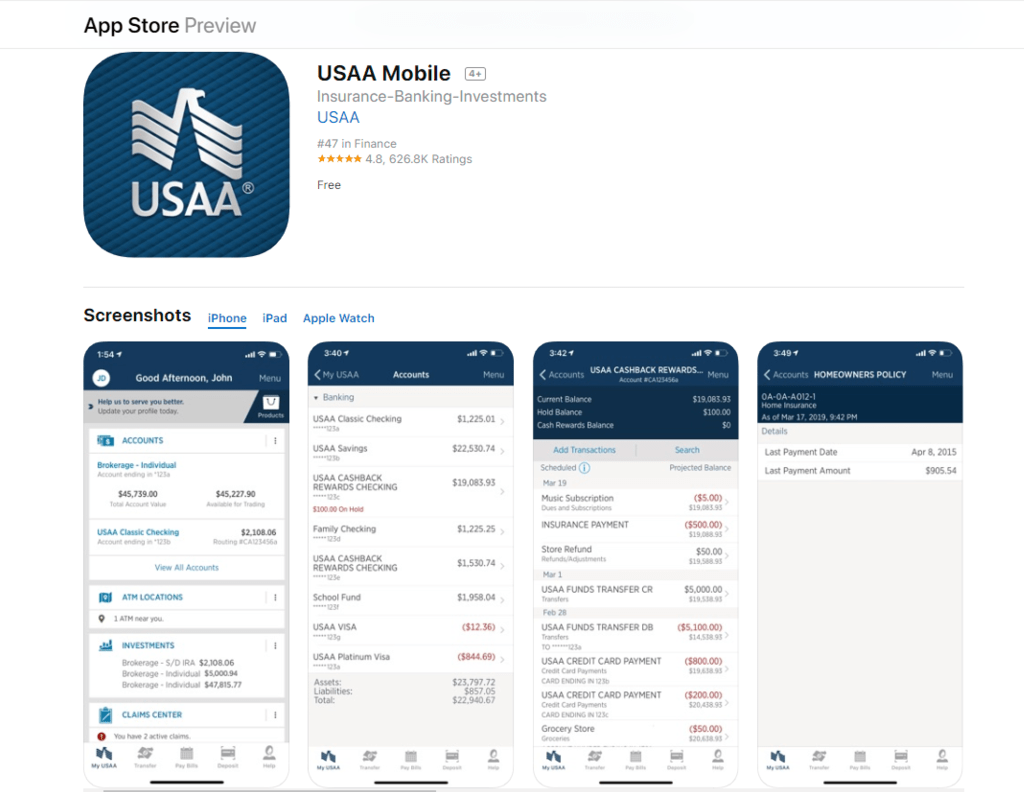

USAA Car Insurance Guide [Best And Cheapest Rates + More] - Puriwulandari

![How Much Is Gap Insurance Usaa USAA Car Insurance Guide [Best And Cheapest Rates + More] - Puriwulandari](https://greatoutdoorsabq.com/wp-content/uploads/parser/usaa-auto-insurance-quote-1.png)