Kotak Mahindra Car Insurance Claim Settlement Ratio

Kotak Mahindra Car Insurance Claim Settlement Ratio

A Comprehensive Overview of Kotak Mahindra Car Insurance Claim Settlement Ratio

Kotak Mahindra is a leading car insurance provider in India. With its wide range of car insurance plans, the company has been providing coverage to four-wheeler owners for decades. As a reliable provider, it is important for Kotak Mahindra to maintain a good Claim Settlement Ratio (CSR). The Claim Settlement Ratio is the percentage of the total number of claims settled by an insurance provider to the total number of claims received. A higher Claim Settlement Ratio indicates that the insurer is reliable and has a good track record of settling claims. Thus, it is important to understand the Claim Settlement Ratio of Kotak Mahindra Car Insurance.

What is Claim Settlement Ratio?

Claim Settlement Ratio is a measure of the efficiency of an insurance provider to settle claims. It is the percentage of the total number of claims settled by an insurance provider to the total number of claims received. The higher the Claim Settlement Ratio, the more reliable the provider is, as it indicates a good track record of settling claims.

Kotak Mahindra Car Insurance Claim Settlement Ratio

Kotak Mahindra has been providing car insurance coverage to four-wheeler owners for many years. It is one of the most trusted car insurance providers in India. The Claim Settlement Ratio of Kotak Mahindra Car Insurance is around 95%. This means that the company has a satisfactory track record of settling claims. This is an impressive feat, considering the large number of claims received by the company.

Benefits of Higher Claim Settlement Ratio

A higher Claim Settlement Ratio is beneficial for customers, as it indicates that the provider is reliable and has a good track record of settling claims. This gives customers assurance that their claims will be settled in a timely manner, ensuring that they get the coverage that they need. Furthermore, a higher Claim Settlement Ratio also shows that the insurance provider is efficient and has a good customer service.

Conclusion

Kotak Mahindra Car Insurance is a reliable provider with a satisfactory track record of settling claims. The company has a Claim Settlement Ratio of 95%, which is higher than the industry average. This indicates that their customers can trust them to provide the coverage they need. Furthermore, a higher Claim Settlement Ratio also shows that the company is efficient and has a good customer service.

Car Insurance Renewal - Check Claim Settlement Ratios

Claim Settlement Ratio for Term Insurance by IRDAI : 2014-15

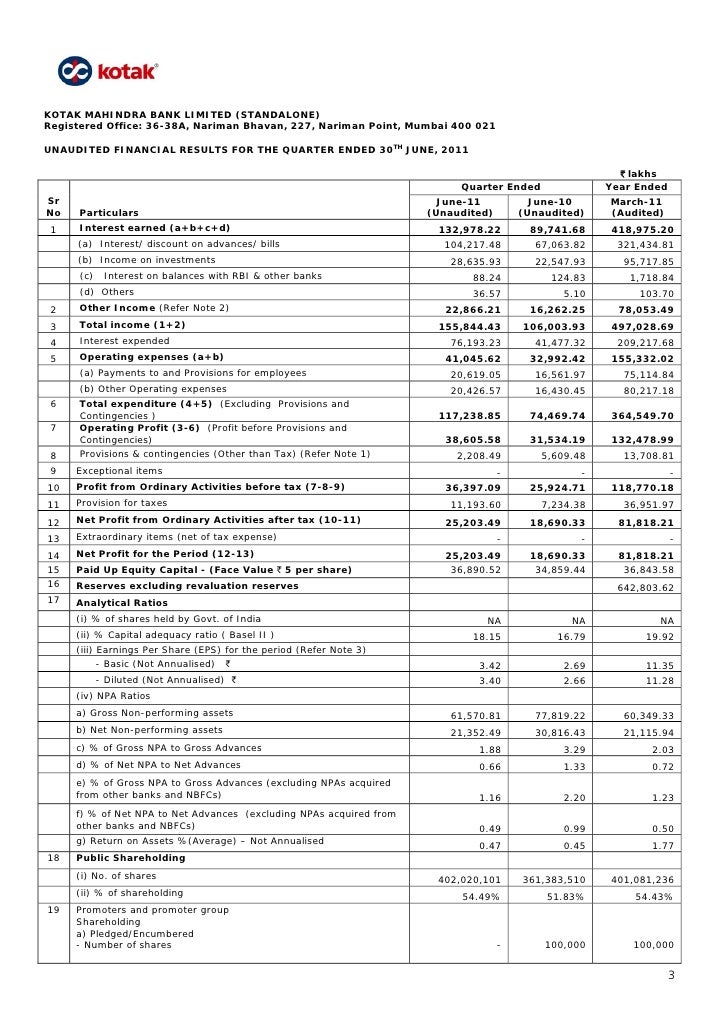

Kotak Mahindra Bank Q1 FY12

Hdfc Health Insurance Claim Settlement Ratio - idesignque