Is Texas A No Fault State For Auto Insurance

Sunday, May 14, 2023

Edit

Is Texas A No Fault State For Auto Insurance?

What is No Fault Auto Insurance?

No Fault Auto Insurance is a type of insurance policy that pays out for medical costs and lost wages resulting from an auto accident. It also covers any damage done to the insured’s car, regardless of who is at fault for the accident. This type of insurance is also known as Personal Injury Protection (PIP) insurance. It is designed to protect the policyholder from the financial burden of an unexpected auto accident.

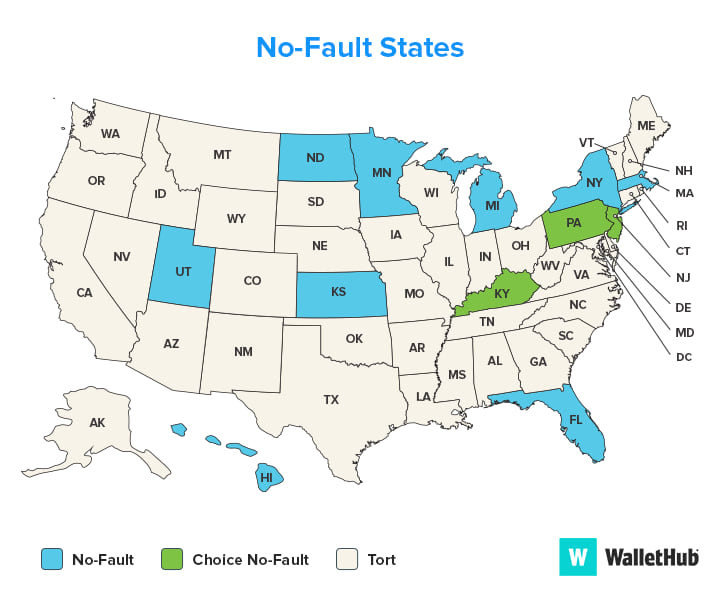

No Fault Auto Insurance is available in many states across the United States. In some states, such as Texas, it is mandatory for drivers to carry this type of insurance. In other states, it is optional.

What Does No Fault Auto Insurance Cover?

No Fault Auto Insurance coverage varies from state to state. Generally, it covers medical expenses, lost wages, and other costs associated with an auto accident. It may also include coverage for funeral expenses, pain and suffering, and other related costs.

In most cases, No Fault Auto Insurance coverage does not cover damage to the vehicle, unless it is an insured driver's fault. This means that if you are in an accident caused by another driver, No Fault Auto Insurance will not pay for the damage done to your vehicle.

Is Texas a No Fault State?

Yes, Texas is a no fault state when it comes to auto insurance. This means that drivers in Texas are required to carry No Fault Auto Insurance coverage. The minimum amount of coverage required is $30,000 per person and $60,000 per accident. This coverage pays out for medical costs and lost wages resulting from an auto accident.

Additionally, Texas law requires drivers to carry Liability Insurance. Liability Insurance covers damage done to other people or property in an accident caused by the insured driver. The minimum amount of Liability Insurance required in Texas is $30,000 per person, $60,000 per accident, and $25,000 for property damage.

What About Uninsured Motorists?

In Texas, drivers are required to carry Uninsured Motorists coverage. This type of coverage pays for medical costs and lost wages resulting from an auto accident caused by an uninsured driver. The minimum amount of coverage required is $30,000 per person and $60,000 per accident.

Additionally, Texas law requires drivers to carry Uninsured Motorists Property Damage coverage. This type of coverage pays for damage done to the insured’s vehicle in an accident caused by an uninsured driver. The minimum amount of coverage required is $25,000.

Final Thoughts On Is Texas A No Fault State For Auto Insurance?

Yes, Texas is a no fault state when it comes to auto insurance. Drivers in Texas are required to carry No Fault Auto Insurance, Liability Insurance, Uninsured Motorists coverage, and Uninsured Motorists Property Damage coverage. The minimum amounts of coverage required vary, depending on the type of coverage. It is important to understand the requirements of your state and the coverage you need to protect yourself and your vehicle.

Ultimate Guide to No-Fault Auto Insurance

Can Someone Sue you for a Car Accident if you Have Insurance - Honest

No Fault Insurance | Best rates in Your State | Ogletree Financial

No-Fault Insurance: Guide for 2022

AK Law