Does Searching For Car Insurance Affect Your Credit Score

Does Searching For Car Insurance Affect Your Credit Score?

What is a Credit Score?

A credit score is a number that represents the creditworthiness of an individual. It is determined by the information in the individual’s credit report. Credit scores range from 300 to 850 and the higher your credit score is, the more creditworthy you are considered to lenders. A credit score is used by lenders to determine if you are eligible for a loan, the interest rate you will be charged, and the amount you will be able to borrow.

How Does Searching for Car Insurance Affect Your Credit Score?

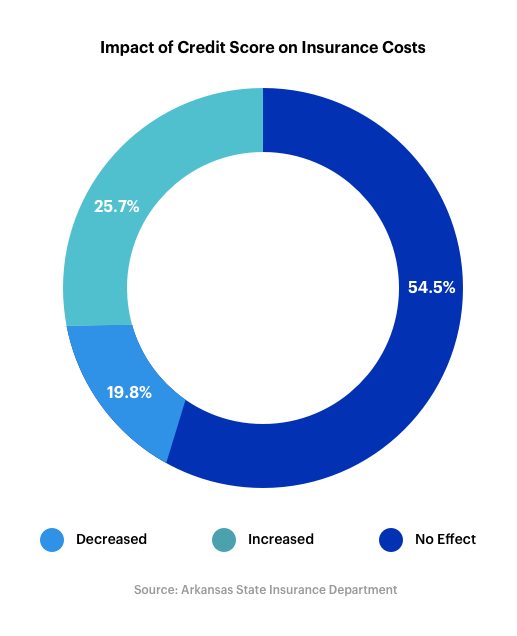

When you search for car insurance, insurers will often check your credit score to determine the premiums they will charge you. This is known as a “soft inquiry” and it does not impact your credit score. Insurers use credit scores to help determine risk and premiums, so it is important to maintain a good credit score if you want to get the best rates for car insurance.

What is a Hard Inquiry?

A hard inquiry occurs when a lender or creditor pulls your credit report to determine whether or not you are eligible for a loan or credit card. This type of inquiry will have an impact on your credit score and can stay on your credit report for up to two years. It is important to remember that hard inquiries can lower your credit score, so it is important to be mindful of the number of hard inquiries you make when applying for loans or credit cards.

What Should You Do To Protect Your Credit Score?

The best way to protect your credit score is to always pay your bills on time and to keep your credit utilization ratio low. Additionally, you should avoid applying for too many loans or credit cards at once, as this can cause numerous hard inquiries to appear on your credit report, which can lower your credit score. Finally, remember that searching for car insurance does not affect your credit score, so you can shop around for the best rates without worrying about your credit score.

Conclusion

In conclusion, searching for car insurance does not affect your credit score. A hard inquiry is the only type of inquiry that can affect your credit score and these inquiries will stay on your credit report for up to two years. To ensure that your credit score remains high, it is important to pay your bills on time and to keep your credit utilization ratio low. Additionally, you should avoid applying for too many loans or credit cards at once.

Does Car Insurance Affect Your Credit? | Credit score infographic, Good

How Credit Scores Affect Your Car Insurance Rate - Cover

How a Bad Credit Score Affects Your Auto Loan Rate - International

How Do Credit Scores Affect Car Insurance? - Lexington Law

Does your credit score affect car insurance in the UK? | Bobatoo