Car Insurance For High risk Drivers In Colorado

Car Insurance For High Risk Drivers In Colorado

What is High Risk Drivers?

High Risk Drivers in Colorado are those who have had a DUI, multiple at-fault accidents, or multiple traffic violations. They are considered higher risk due to their past driving behavior and the likelihood that they will have an accident again in the future. As a result, car insurance companies often charge higher premiums for these drivers.

Why is Car Insurance for High Risk Drivers in Colorado So Expensive?

Car insurance for high risk drivers in Colorado can be expensive for a number of reasons. Insurance companies take into account the driver’s past driving record, the type of vehicle they drive, and the area they live in when setting premiums. For example, if a driver has had multiple DUI convictions or multiple at-fault accidents, they may be seen as a higher risk, so their premiums will be higher than someone with a clean driving record.

Tips to Help Lower Car Insurance Costs for High Risk Drivers in Colorado

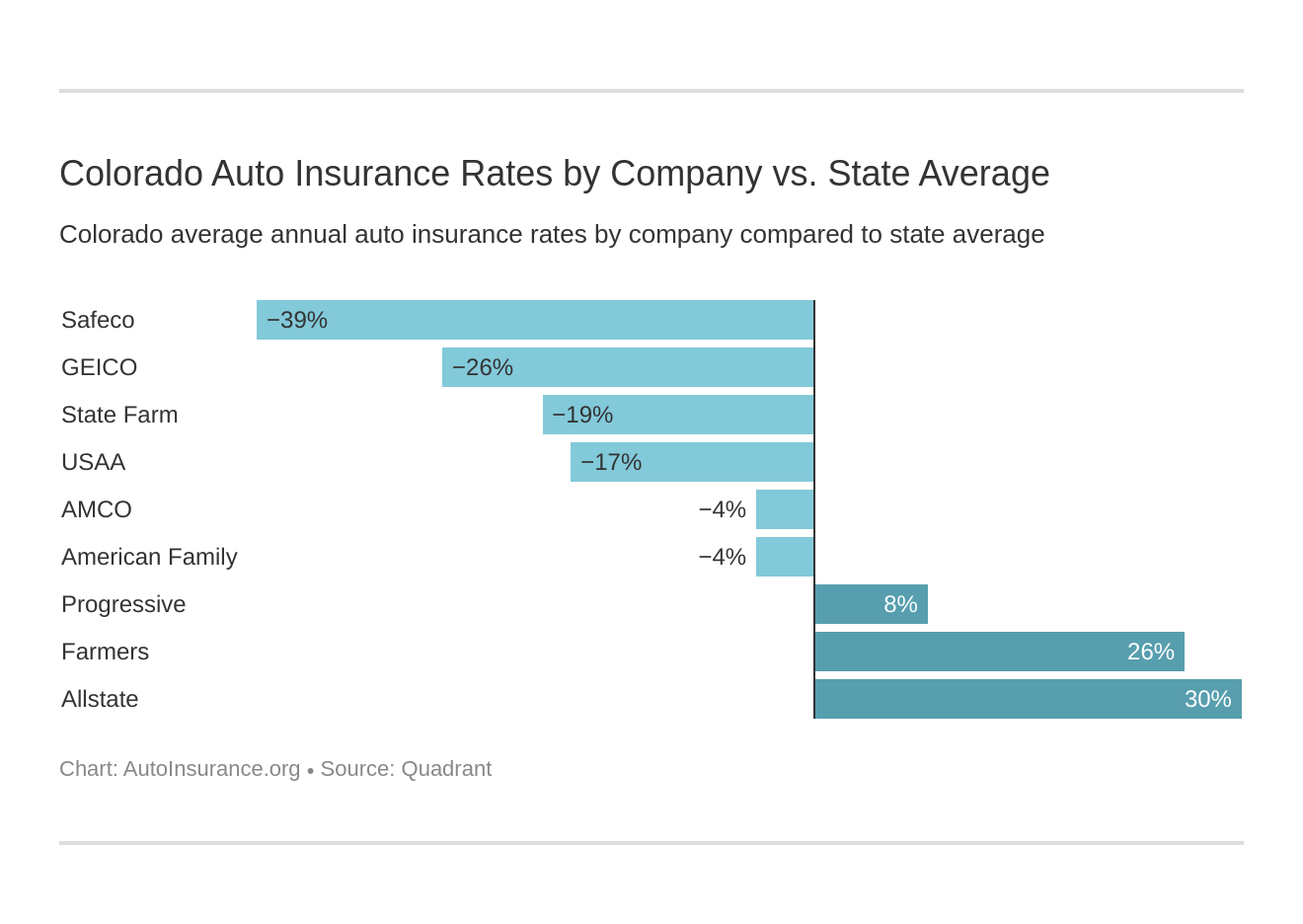

High risk drivers in Colorado can do a few things to help lower their premiums. One thing is to shop around and compare quotes from different insurance companies. It is important to look for discounts or other incentives that insurance companies may be offering. Some insurance companies may offer a discount for completing a driver’s education course or for taking a defensive driving class. Additionally, drivers should consider raising their deductible, as this can often result in lower premiums.

Alternatives to Traditional Car Insurance for High Risk Drivers in Colorado

High risk drivers in Colorado may also want to consider alternative insurance options. One option is a non-standard auto insurance policy. This type of policy is usually offered by smaller insurance companies and can be a good option for those who have had difficulty finding insurance through a traditional insurer. Non-standard policies are usually more expensive than traditional policies, but they may provide the coverage needed.

Other Options for Drivers in Colorado

Drivers in Colorado may also want to consider purchasing a high risk auto insurance plan from the Colorado Automobile Insurance Plan. This plan is designed for drivers who are unable to get traditional car insurance due to their driving history. The plan offers coverage for liability, uninsured motorist, and physical damage, and drivers can purchase additional coverage if desired. The premiums for this type of policy are usually higher than those of traditional policies, but they can be a good option for drivers who have had difficulty getting insurance elsewhere.

Final Thoughts

High risk drivers in Colorado have options when it comes to car insurance. Shopping around and comparing quotes is a good way to find the best rates. Additionally, there are other options available such as non-standard policies and the Colorado Automobile Insurance Plan. While these policies may be more expensive than traditional policies, they can provide the coverage that high risk drivers need.

car insurance quotes colorado - YouTube

Texas Minimum Car Insurance Requirements - dailydesigns2

Cheap Auto Insurance Colorado / Car Insurance Rates By State 2020 Most

Car Insurance Companies For High Risk Drivers - CARUCUS

Car Insurance 101: Car Insurance for First-Time Drivers