Best Non Standard Auto Insurance

The Best Non-Standard Auto Insurance for Drivers

Auto insurance is an essential part of driving. It helps protect you financially in the event of an accident, and also helps protect other drivers on the road. The standard auto insurance coverage offered by most insurance companies covers the basics, but it may not be enough for some drivers. If you’re looking for additional coverage, non-standard auto insurance may be the right choice for you.

What Is Non-Standard Auto Insurance?

Non-standard auto insurance is designed to provide higher levels of coverage and additional protection for drivers who may have difficulty obtaining standard auto insurance coverage. Non-standard auto insurance usually covers drivers who have bad credit, a history of traffic violations, or who are considered high-risk drivers. It can also help drivers who have been rejected for standard coverage. Non-standard auto insurance is typically more expensive than standard auto insurance, but it can provide the coverage and protection that you need.

Benefits of Non-Standard Auto Insurance

Non-standard auto insurance can provide a variety of benefits for drivers. It can provide higher levels of coverage, including bodily injury and property damage liability, uninsured motorist coverage, medical payments coverage, and rental reimbursement. It can also provide additional coverage for drivers who have special needs, such as coverage for antique or classic cars. In some cases, non-standard auto insurance can also provide coverage for drivers with a suspended license.

Finding the Best Non-Standard Auto Insurance

Finding the best non-standard auto insurance can be a challenge. There are many different companies that offer non-standard auto insurance policies, and the coverage and rates can vary greatly. It’s important to compare policies and rates from different companies to make sure you’re getting the best deal. You should also shop around to find a company that offers the coverage and protection that you need at a price you can afford.

Making Sure You Have the Right Coverage

Once you’ve found the best non-standard auto insurance for your needs, it’s important to make sure that you have the right coverage. Make sure that the coverage you choose will cover you in the event of an accident, and also make sure that it covers all of your assets. You should also check to make sure that the company you choose is reliable and reputable, and that they have a good track record of paying out claims.

Non-Standard Auto Insurance Can Provide the Coverage You Need

Non-standard auto insurance can provide the coverage and protection that you need if you’re having difficulty obtaining standard auto insurance coverage. It can provide higher levels of coverage and additional protection for drivers who may have difficulty obtaining standard auto insurance coverage. It’s important to compare policies and rates from different companies to make sure you’re getting the best deal. With the right non-standard auto insurance policy, you can be sure that you’re protected in the event of an accident.

Non-Standard Auto Insurance 101 | AutoInsuranceApe.com

The Real Deal About Non-Standard Auto Insurance? - Priority Insurance LLC

Did you know antique auto insurance usually costs less than a standard

What Is Non-Standard Auto Insurance? - ValuePenguin

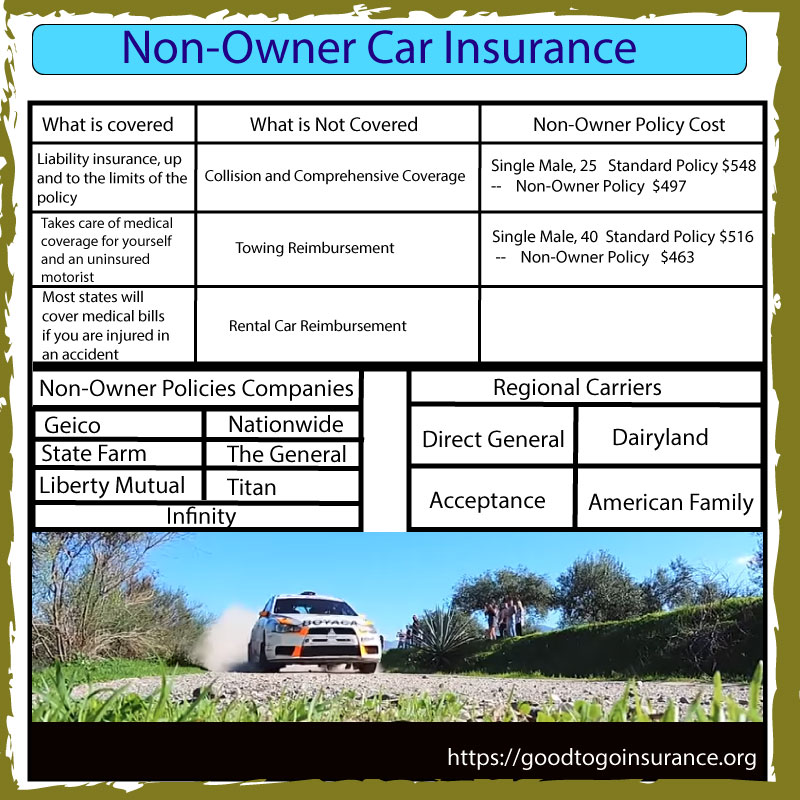

Non Owner Auto Insurance | Compare quotes wih Good to Go