Bajaj Allianz Motor Insurance Claim Process

Bajaj Allianz Motor Insurance: An Easy Guide to Claim Process

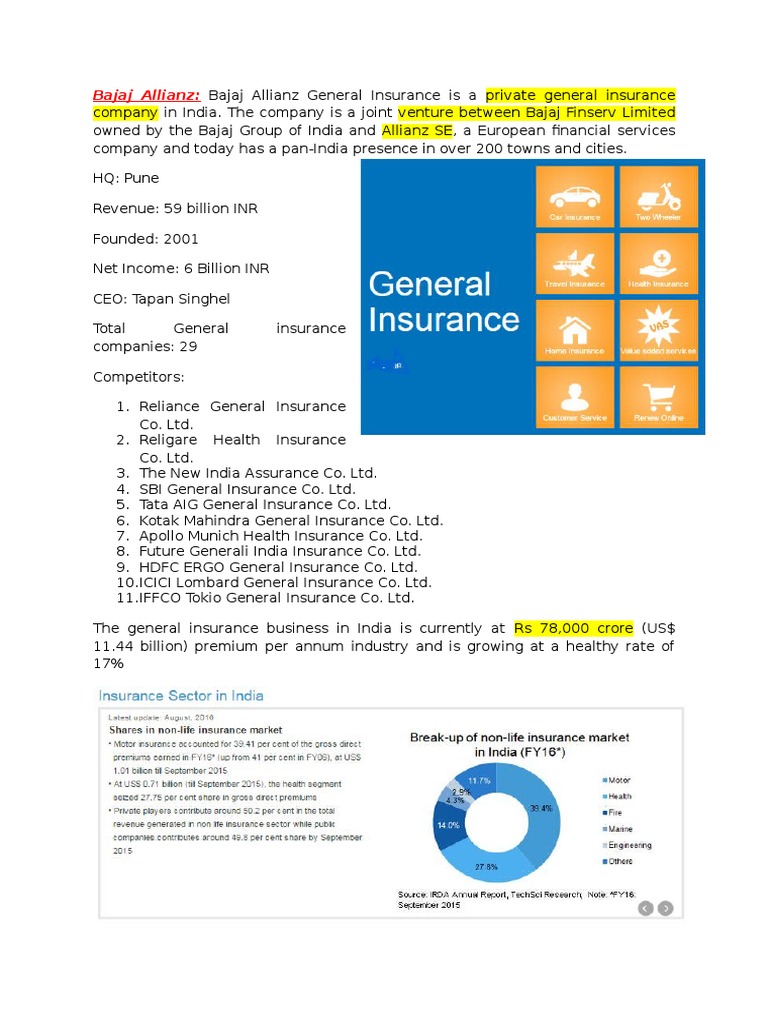

What is Bajaj Allianz Motor Insurance?

Bajaj Allianz Motor Insurance is a comprehensive motor insurance policy offered by Bajaj Allianz General Insurance. This insurance plan provides cover against any financial liability arising out of the damage or loss of your vehicle due to an accident, theft, fire, or any other unforeseen event. It also provides coverage against any third party legal liabilities arising out of the use of the vehicle. The policy also reimburses medical expenses incurred due to an accident.

What are the Benefits of Bajaj Allianz Motor Insurance?

Bajaj Allianz Motor Insurance provides a number of benefits that make it an attractive option for vehicle owners. First and foremost, it provides comprehensive coverage for your vehicle, including any third party liabilities. The policy also offers a personal accident cover for the driver, which will provide financial compensation in case of any injury or death due to an accident. Furthermore, the policy also offers a 24x7 roadside assistance service in the event of any breakdown or emergency.

What is the Claim Process for Bajaj Allianz Motor Insurance?

The claim process for Bajaj Allianz Motor Insurance is fairly simple. The policyholder is required to intimate the company about the incident within 7 days of the occurrence. The company will then send an authorized surveyor to assess the damage and the cost of repair. Once the surveyor’s report is received, the claim amount will be paid out to the policyholder, subject to the terms and conditions of the policy. In case of any fraudulent activities or false information, the claim will be rejected.

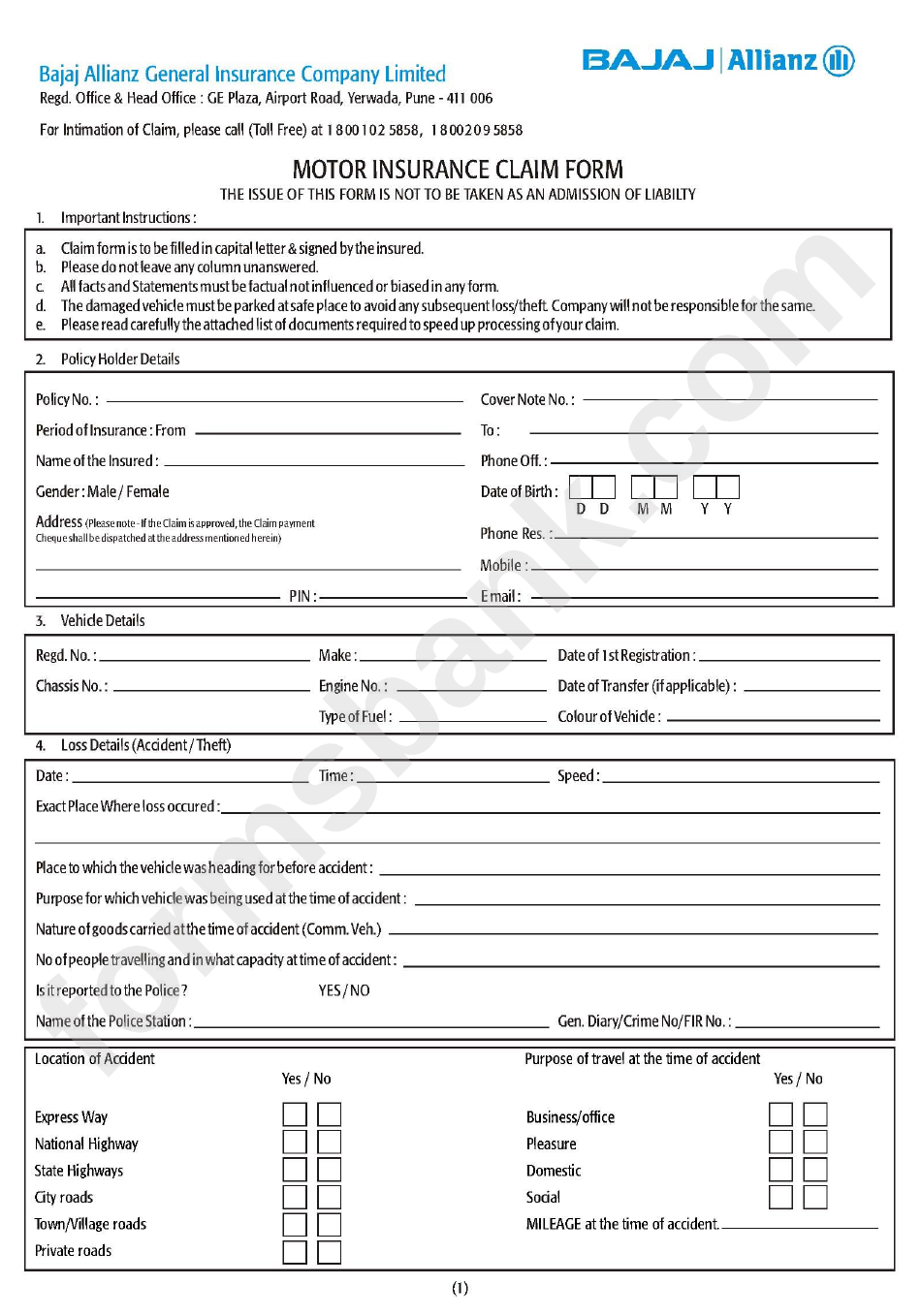

What Documents are Required to File a Claim?

To file a claim, the policyholder is required to submit the following documents:

- Claim Form duly filled and signed by the policyholder

- Original Registration Certificate (RC) of the vehicle

- Copy of the Driving License of the driver at the time of the accident

- Copy of the insurance policy

- Repair invoice and payment receipt from the garage

- Copy of the FIR (First Information Report) in case of theft or malicious acts

- Post-mortem report in case of death due to an accident

What are the Exclusions of Bajaj Allianz Motor Insurance?

The Bajaj Allianz Motor Insurance does not cover any liabilities arising out of the following events:

- Normal wear and tear of the vehicle

- Driving without a valid license

- Driving under the influence of drugs or alcohol

- Damage caused while participating in racing or speed tests

- Damage caused due to war or nuclear weapons

- Damage caused due to natural disasters such as floods, earthquakes, etc.

Conclusion

Bajaj Allianz Motor Insurance is a comprehensive motor insurance policy that provides cover against any financial liability arising out of the damage or loss of your vehicle due to an accident, theft, fire, or any other unforeseen event. The claim process is simple and straightforward, and the policy also offers a number of benefits like personal accident cover, roadside assistance, etc. However, it does not cover any liabilities arising out of certain events, like driving without a valid license, damage caused due to natural disasters, etc.

Bajaj Allianz Health Guard Individual Policy Review

Bajaj Allianz Two Wheeler Insurance: Claim & Renewal Process

Motor Claim Form - Bajaj Allianz printable pdf download

Bajaj Allianz | Insurance | Service Industries

BAJAJ ALLIANZ TWO WHEELER INSURANCE DUPLICATE COPY PDF