Types Of Motor Vehicle Insurance Policies

Types Of Motor Vehicle Insurance Policies

What is Motor Vehicle Insurance?

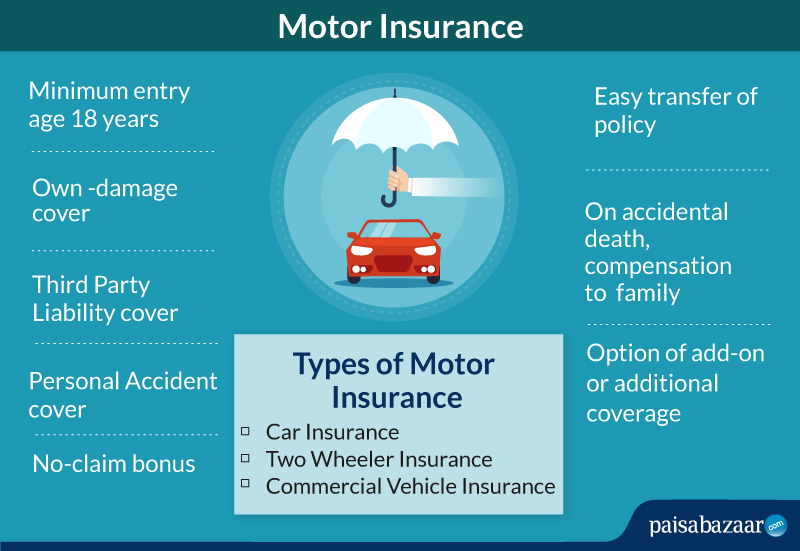

Motor vehicle insurance is an insurance policy that protects an individual, group, or organization in the event of an accident involving a motor vehicle. It covers the cost of damages to both the injured party and the insured vehicle. Motor vehicle insurance policies are typically required by law in many countries, and is a common part of car ownership. It is important to understand the different types of motor vehicle insurance policies available, in order to make an informed decision when choosing a policy.

Types of Motor Vehicle Insurance Policies

There are various types of motor vehicle insurance policies available, depending on the type of coverage desired. Some of the most common types of motor vehicle insurance policies are:

Liability Insurance

Liability insurance is the most basic type of motor vehicle insurance. It covers the costs associated with damages caused by the insured vehicle to another person, property, or vehicle. This type of coverage is typically required by law in order to legally operate a motor vehicle. It is important to understand the limitations of liability insurance, as it does not cover damages to the insured vehicle.

Collision Insurance

Collision insurance is a type of motor vehicle insurance that covers the cost of damages to the insured vehicle caused by an accident. This type of coverage is typically optional, and can be added to a liability insurance policy for additional protection. It is important to understand the limits of coverage, as some policies may only cover certain types of damages. Additionally, some policies may require a deductible to be paid in order for the coverage to take effect.

Comprehensive Insurance

Comprehensive insurance is a type of motor vehicle insurance that covers a wide range of damages to the insured vehicle, including non-accident related damages. This type of coverage is typically optional, and can be added to a liability or collision insurance policy for additional protection. It is important to understand the limits of coverage, as some policies may exclude certain types of damages. Additionally, some policies may require a deductible to be paid in order for the coverage to take effect.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is a type of motor vehicle insurance that covers the cost of damages caused by an uninsured or underinsured driver. This type of coverage is typically optional, and can be added to a liability or collision insurance policy for additional protection. It is important to understand the limits of coverage, as some policies may exclude certain types of damages. Additionally, some policies may require a deductible to be paid in order for the coverage to take effect.

Conclusion

Motor vehicle insurance is an important part of car ownership, as it provides protection in the event of an accident. It is important to understand the different types of motor vehicle insurance policies available, in order to make an informed decision when choosing a policy. Liability insurance is the most basic type of motor vehicle insurance, and covers the costs associated with damages caused by the insured vehicle to another person, property, or vehicle. Collision insurance, comprehensive insurance, and uninsured/underinsured motorist coverage are additional types of motor vehicle insurance that can be added to a liability policy for additional protection.

Find out which types of car insurance you should be looking into for

What Type Of Car Insurance Are There Ideas | Qarbit

Motor Insurance in India: Types, Coverage, Claim & Renewal

Learn the Different Types of Car Insurance Policies

When To Get Automobile Insurance coverage?