Third Party Car Insurance Price List

Friday, April 21, 2023

Edit

Third Party Car Insurance Price List

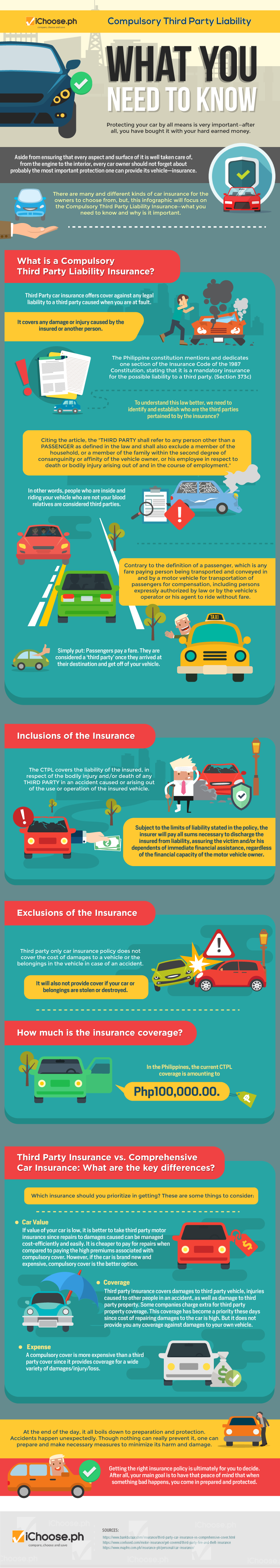

What Is Third Party Car Insurance?

Third party car insurance is the most basic form of car insurance you can have, and it’s the cheapest. It provides coverage for third-party liabilities, such as people or property in an accident you’re involved in. It won’t cover you for any damage to your car, or any injuries you sustain, however. It’s one of the most popular and widely-used car insurance products, as it’s much more affordable than comprehensive cover.

What Does It Cover?

Third party car insurance covers you for any damage you cause to another person’s car or property in an accident. It also covers you for any legal costs you incur in the event that you are taken to court for an accident you were responsible for. It does not cover you for any damage to your own car, or any injuries you sustain. It also does not cover you for any damage caused by another driver.

Third Party Car Insurance Price List

The cost of third party car insurance varies depending on the type of car you drive, your age, and the insurer you choose. Generally, third party car insurance is much cheaper than comprehensive cover. To get an idea of the price range, here’s a list of the typical costs for third party car insurance:

-For a young driver aged 18-25, the average cost is around $1000 per year.

-For a mid-age driver aged 26-35, the average cost is around $800 per year.

-For a senior driver aged 36-45, the average cost is around $500 per year.

-For a car with a high performance engine, the average cost is around $2000 per year.

Factors That Impact The Price

When it comes to car insurance, there are a few factors that can impact the price of your policy. These include your age, the type of car you drive, your driving history, and the type of coverage you choose.

Your age is one of the biggest factors that can affect your car insurance price, as younger drivers are seen as higher risk. The type of car you drive is also a factor, as cars with a high performance engine can be more expensive to insure. Your driving history is also taken into account, as drivers with a good driving record will often get a cheaper rate. Finally, the type of coverage you choose also has an effect on the price, as comprehensive cover is more expensive than third party.

How to Get The Best Price

When looking for car insurance, it’s important to shop around to get the best price. You should compare quotes from different insurers to find the best deal for you. It’s also a good idea to look for any discounts or special offers that could save you money. Finally, if you’re a safe driver with a good driving record, you may be eligible for a no claims bonus, which could also save you money.

In conclusion, third party car insurance is the most basic form of car insurance and is the cheapest. It provides coverage for third-party liabilities, such as people or property in an accident you’re involved in. The cost of third party car insurance varies depending on the type of car you drive, your age, and the insurer you choose. Factors such as your age, the type of car you drive, your driving history, and the type of coverage you choose can all impact the price. When looking for car insurance, it’s important to shop around to get the best price.

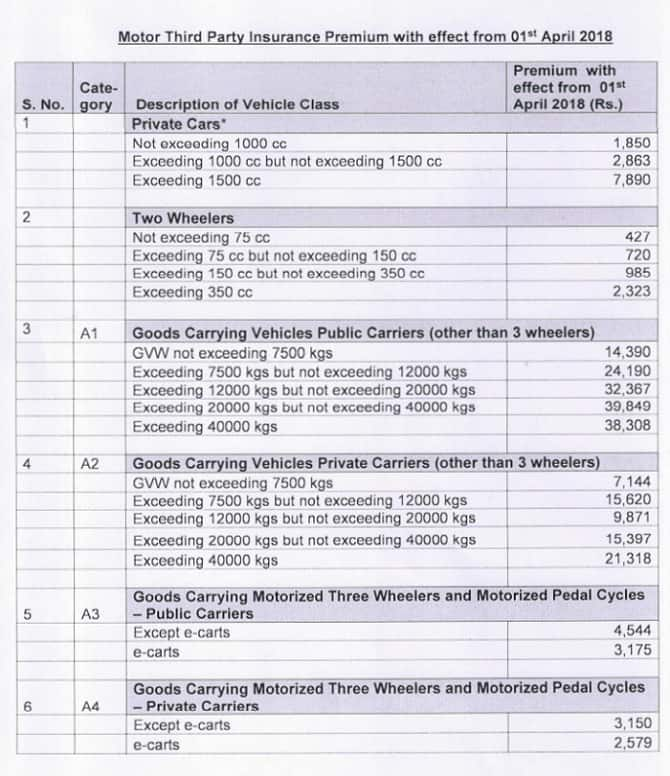

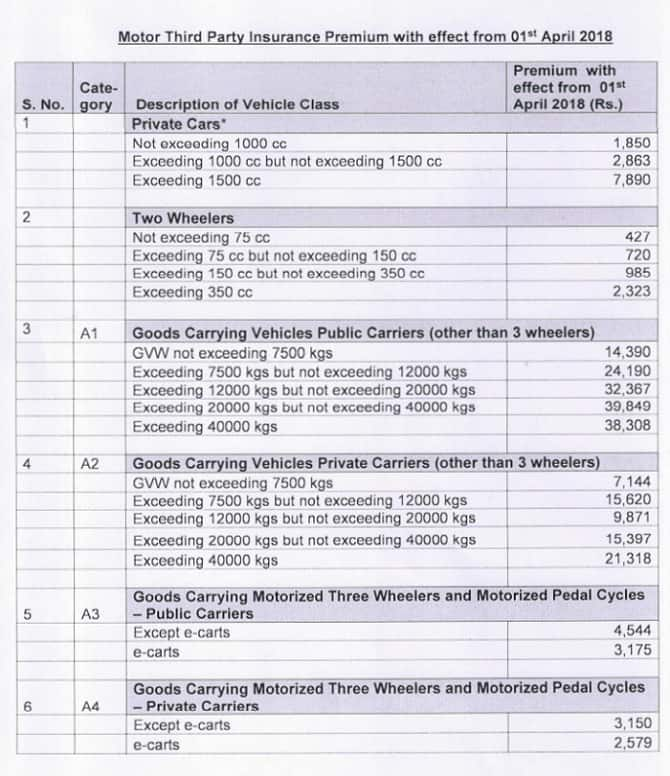

Exclusive | Third party insurance premium on commercial vehicle could

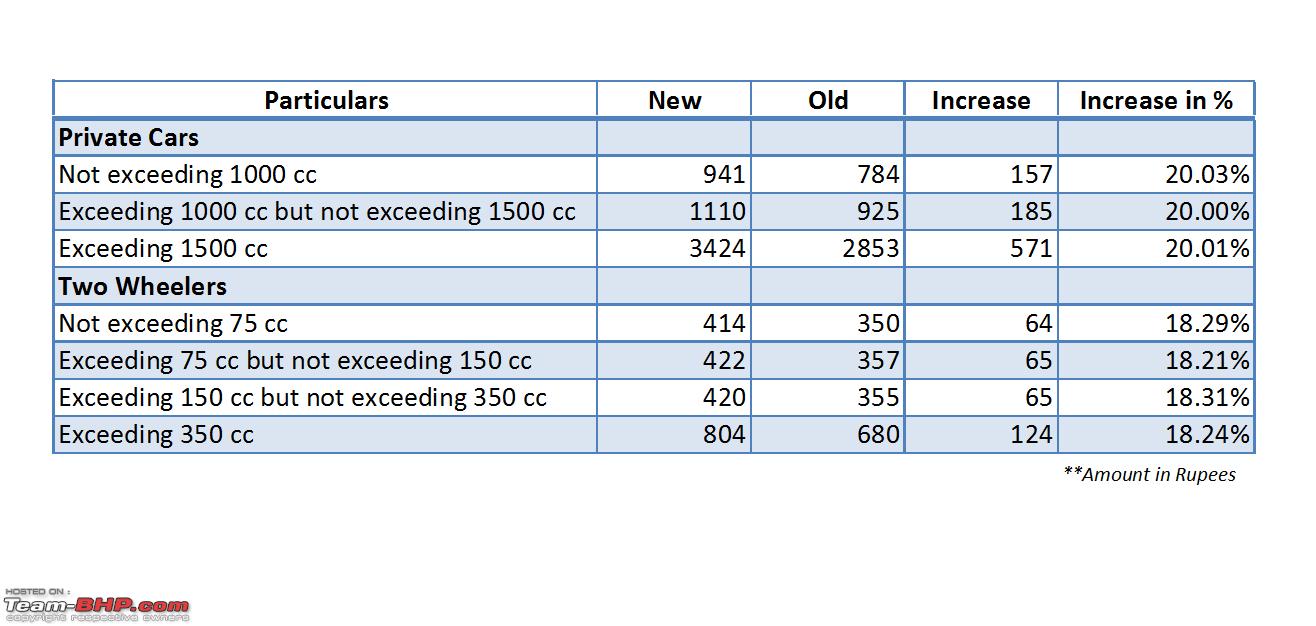

Third Party Insurance Premium to go up W.e.f 1st April 2013 - Team-BHP

SC: Long-term 3rd party insurance a must for cars & bikes at the time

Third Party Car Insurance: November 2015

Compulsory Third Party Liability What You Need to Know | iChoose