How Much Is Insurance On A Second Car

Understanding The Cost of Car Insurance for a Second Vehicle

When it comes to buying a second car, there are many factors to consider. Along with the cost of purchasing the vehicle, gas, and maintenance, car owners must also take into account the cost of car insurance. Insurance for a second vehicle can be a bit more expensive than insurance for a primary vehicle, so it’s important to understand the different factors that make up the cost of insurance and what you can do to lower your premium.

Factors That Influence the Cost of Car Insurance for a Second Vehicle

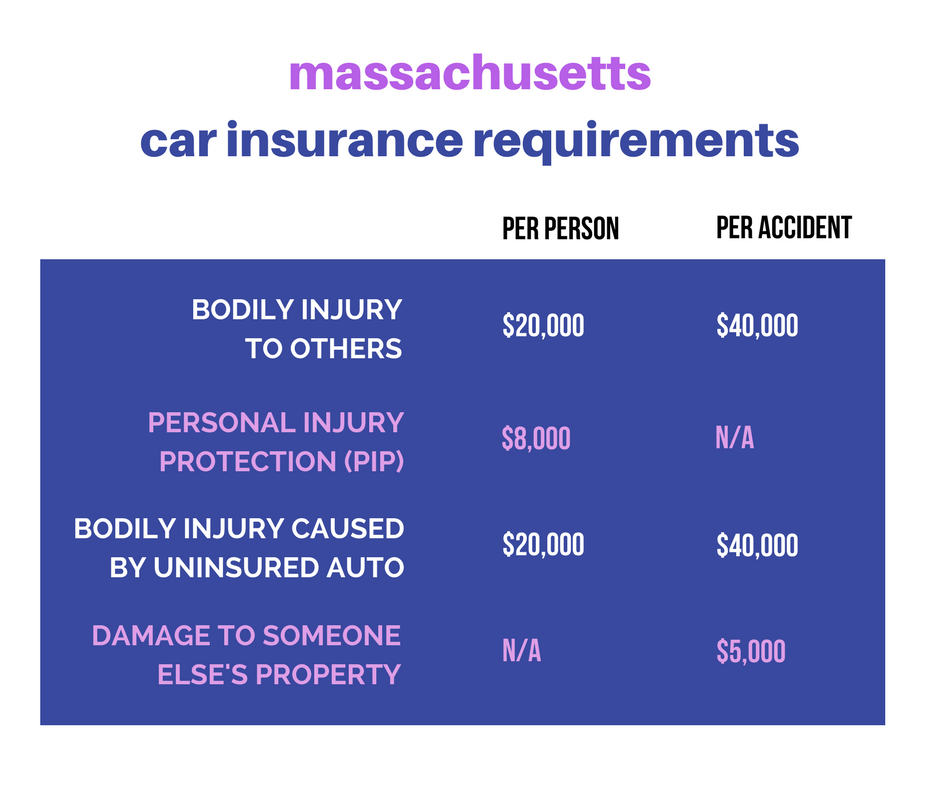

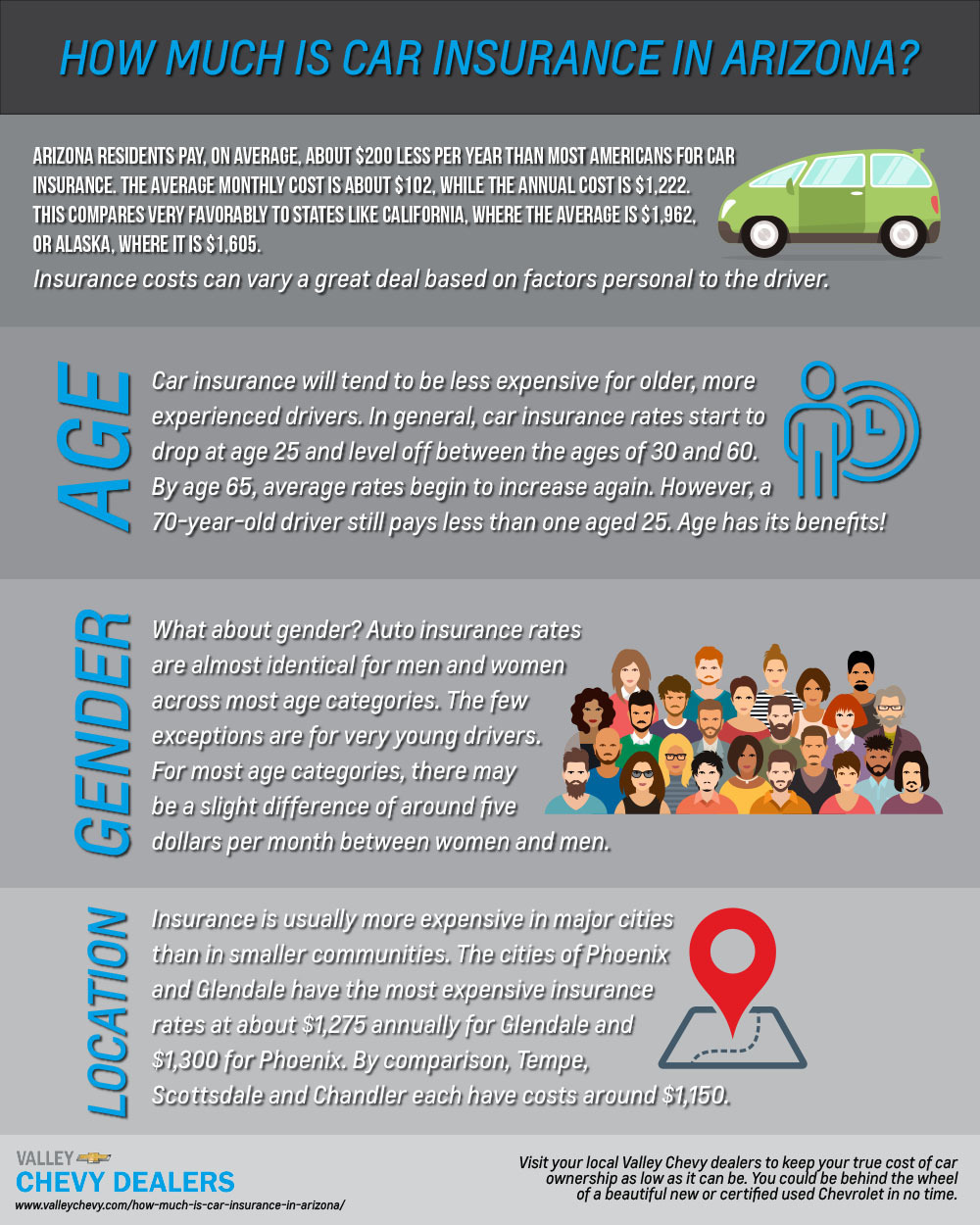

There are many factors that can increase or decrease the cost of car insurance for a second vehicle. Insurance companies consider the age, make, and model of the car, as well as the driver’s age, driving record, and credit score. The type of coverage you choose also plays a role in the cost of your premiums. Liability coverage is usually the cheapest option, while comprehensive coverage is usually more expensive.

How Much Does Car Insurance Cost for a Second Vehicle?

The exact cost of car insurance for a second vehicle will vary depending on the factors mentioned above. Generally speaking, though, most drivers can expect to pay anywhere from 10-25% more for car insurance on a second vehicle than they do for their primary vehicle. This is because secondary vehicles are usually used less frequently, so they are considered a higher risk.

It’s also important to note that some insurance companies offer discounts for bundling policies. If you have more than one vehicle, you may be able to get a discount on your car insurance premiums by purchasing all of your policies from the same insurer.

Tips For Lowering the Cost of Car Insurance for a Second Vehicle

There are a few ways you can lower the cost of car insurance for a second vehicle. First, consider raising your deductible. A higher deductible means you’ll pay more out-of-pocket for repairs in the event of an accident, but it also means your premiums will be lower.

You may also be able to qualify for discounts based on your driving record or credit score. Some insurance companies offer discounts for customers who have a clean driving record or a good credit score. Make sure to ask your insurer about any available discounts before you purchase a policy.

Finally, shop around. Different insurers offer different rates, so it’s important to compare prices before you purchase a policy. You can use an online comparison tool to quickly compare rates from multiple insurers.

Purchasing car insurance for a second vehicle can be a bit more expensive than insurance for a primary vehicle, but there are a few ways you can save. Make sure to shop around, compare rates, and ask your insurer about any available discounts. With a little research, you can find a policy that will fit your budget.

Cheap Car Insurance for Teens Infographic | Cheap Car Insurance | Car

Do You Still Need To Get Insurance For Second Hand Cars?

How Much Car Insurance Do You Need? | Car Insurance Guidebook

How Much is Car Insurance in Arizona? | Valley Chevy Dealers | Valley Chevy

How Much Car Insurance Do I Need Canada / How Much Auto Insurance