Average Full Coverage Cost For 23 Year Old Car Insurance

Average Full Coverage Cost For 23 Year Old Car Insurance

What is Car Insurance?

Car insurance is a type of insurance policy that provides financial protection against physical damage and/or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Car insurance can be used for a wide range of vehicles, including cars, trucks, and motorcycles. Depending on the type of car you have and the type of coverage you want, the cost of car insurance can vary significantly.

Average Full Coverage Cost For 23 Year Olds

For 23 year old drivers, the average cost of full coverage car insurance can range from around $1,000 to $2,000 per year. This range is based on a variety of factors, including the type of car you drive, where you live, your driving record, and the insurance company you choose. Younger drivers tend to pay higher rates because they are considered higher risk due to their lack of experience. However, if you drive a safe car and maintain a good driving record, you can often get discounts on your car insurance.

How to Reduce Your Car Insurance Costs?

There are a few ways to reduce your car insurance costs as a 23 year old driver. One way is to shop around for different providers and compare prices. Different insurance companies offer different rates, so it pays to compare before you buy. You can also look into discounts that you may qualify for, such as good driver discounts or multi-car discounts. Additionally, you can look into raising your deductible, which is the amount of money you pay out of pocket before your insurance kicks in.

How to Find the Best Car Insurance?

When you’re looking for the best car insurance for a 23 year old, it’s important to take into account your individual needs. Do you need a lot of coverage or just the basics? Are you looking for short-term or long-term coverage? Different companies offer different types of coverage, so you should be sure to compare different policies to find the one that best meets your needs. Additionally, it’s important to consider the customer service reputation of the insurance company you are considering. Make sure you are dealing with a reputable company with good customer service.

What is the Best Way to Buy Car Insurance?

The best way to buy car insurance for a 23 year old is online. Shopping online allows you to compare multiple companies and get the best rate. You can also get quotes from different companies and compare them side by side to find the best deal. Additionally, you can often find discounts and other special offers online that you may not be able to find in a retail store. Shopping online is also a convenient way to buy car insurance and is often much faster than buying in person.

Conclusion

The average full coverage cost for 23 year old car insurance can vary depending on a variety of factors, including the type of car you drive, where you live, your driving record, and the insurance company you choose. You can save money by shopping around for different providers, looking into discounts, and raising your deductible. Additionally, it’s important to find a reputable company with good customer service. Shopping online is the best way to find the best car insurance for a 23 year old.

Average Car Insurance Cost For 23 Year Old Female - Car Retro

Average Cost Of Car Insurane For A 23 Year Old

The average cost of car insurance in the US, from coast to coast

Average Cost of Car Insurance (2019) | Average Cost of Insurance

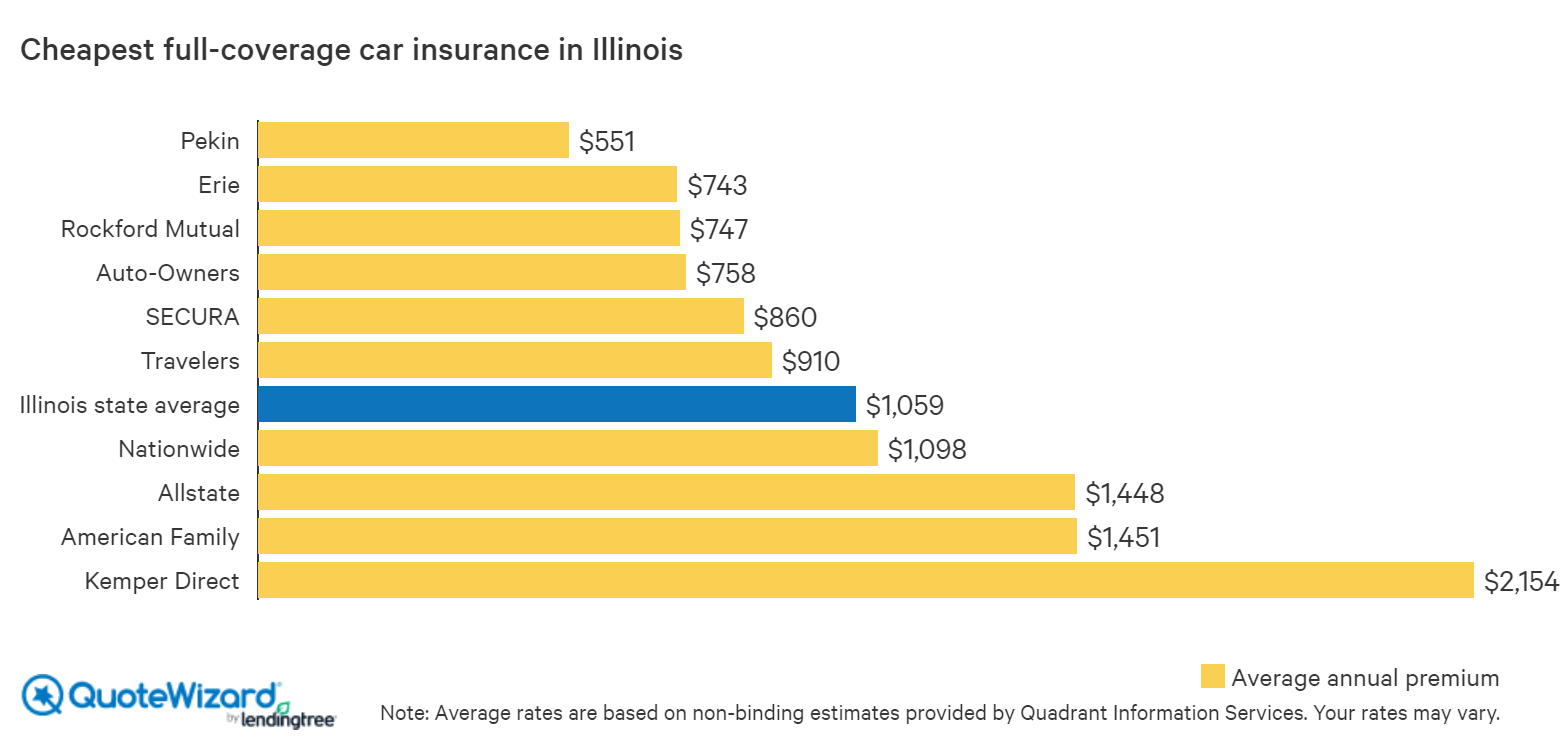

Find Cheap Car Insurance in Illinois | QuoteWizard