How Much Does Turo Charge For Insurance

How Much Does Turo Charge For Insurance?

What is Turo?

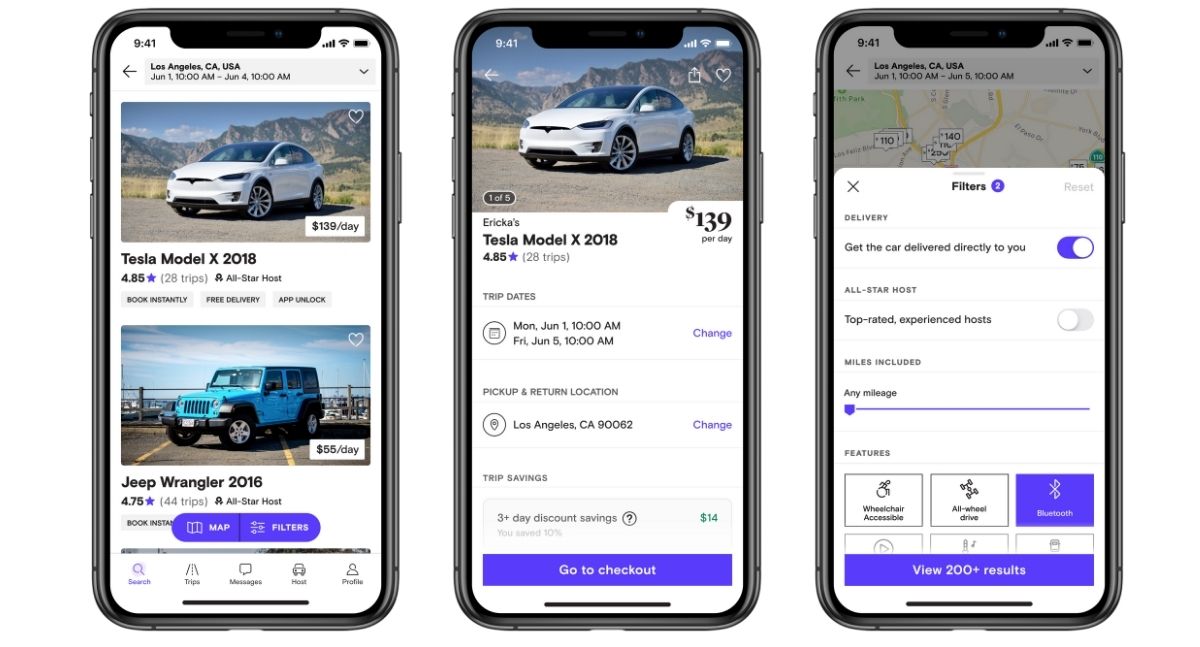

Turo is a peer-to-peer car sharing platform that allows users to rent out their vehicles to other drivers. This service is similar to traditional car rental companies, but with a few key differences. With Turo, customers have more control over the type of car they rent and the rental terms. Turo also has a unique insurance offering that covers users in case of an accident or other damages. In this article, we'll discuss how much Turo charges for insurance and what the coverage includes.

Turo Insurance Coverage

Turo offers two types of insurance coverage: liability and physical damage. Liability coverage helps protect renters from the financial costs associated with third-party property damage and bodily injury. Physical damage coverage helps protect renters from the financial costs associated with damage to the vehicle itself. Liability coverage is required for all renters, but physical damage coverage is optional. If a renter chooses to opt for physical damage coverage, they may be charged an additional fee.

How Much Does Turo Charge For Insurance?

Turo charges a flat fee of $15 per rental for liability coverage. This fee covers up to $1 million in liability for third-party property damage or bodily injury. If a renter chooses to opt for physical damage coverage, they will be charged an additional fee. The exact amount of this fee will vary based on the type of car being rented, the length of the rental, and the amount of coverage purchased.

What Does Turo's Insurance Cover?

Turo's liability coverage covers up to $1 million in third-party property damage or bodily injury. It also includes coverage for legal fees, medical expenses, and other costs associated with an accident. Turo's physical damage coverage covers up to the full value of the vehicle in the event of an accident, theft, fire, or other damages.

Can I Purchase Additional Insurance Coverage?

Yes, Turo offers additional coverage options that can be purchased at an additional cost. These options include roadside assistance, personal property coverage, and liability coverage for rented items. Additionally, Turo offers a damage waiver option that can be purchased to waive the renter's responsibility for any damages to the vehicle.

Conclusion

Turo is a great way to rent a car without having to go through a traditional rental agency. Turo charges a flat fee of $15 per rental for liability coverage, and additional fees may be charged for physical damage coverage. Turo's insurance coverage includes up to $1 million in liability for third-party property damage or bodily injury, and up to the full value of the car for physical damage. Additional coverage options are also available for purchase. With Turo, you can enjoy the convenience and affordability of a car rental without having to worry about the cost of insurance.

does turo charge for under 25 - Low Tone Webzine Picture Show

does turo charge for under 25 - Otto Hutcherson

Everything You Need to Know About Using Turo - Part 2 - ECI Insurance

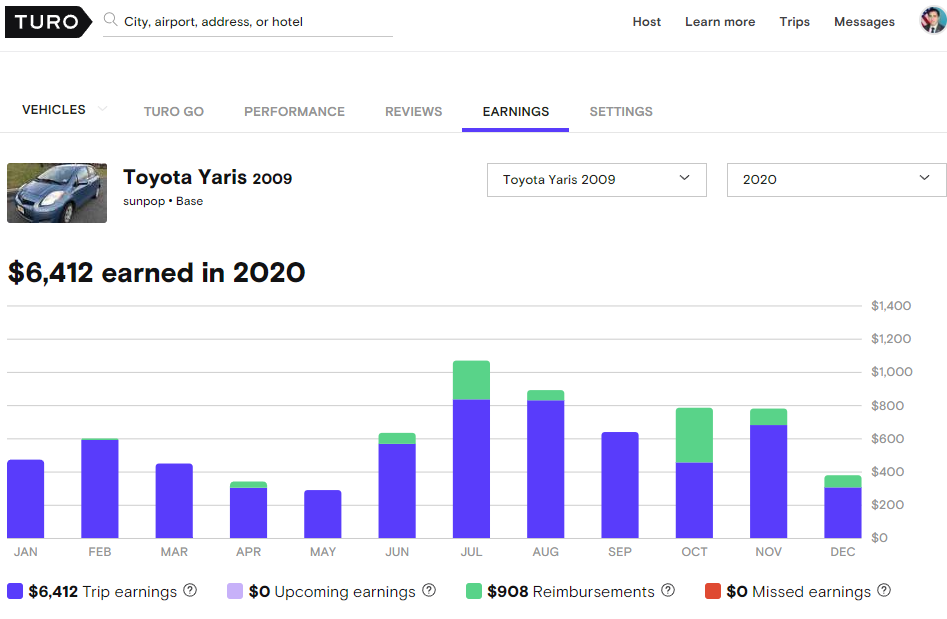

Turo Review: How Renting Out Our Cars on Turo Turned Into a Free Tesla

does turo charge for under 25 - Low Tone Webzine Picture Show