Auto Owners Home Insurance Class 5 Means

Monday, April 10, 2023

Edit

Auto Owners Home Insurance Class 5 Means

What is Auto Owners Home Insurance Class 5?

Auto Owners Home Insurance Class 5 is a type of insurance that is offered by Auto Owners Insurance Company, which is one of the largest providers of home insurance in the United States. This type of insurance is specifically designed to protect homeowners from certain risks that are associated with owning a home. It is important to note that this type of insurance is not mandatory, but it is recommended for those who have a large amount of assets and would like to protect them from potential losses.

Auto Owners Home Insurance Class 5 covers a wide range of risks, including fire, theft, vandalism, and more. It also provides coverage for damages caused by natural disasters such as hurricanes and floods. Additionally, this type of insurance also covers expenses associated with medical bills, legal costs, and loss of use of the home.

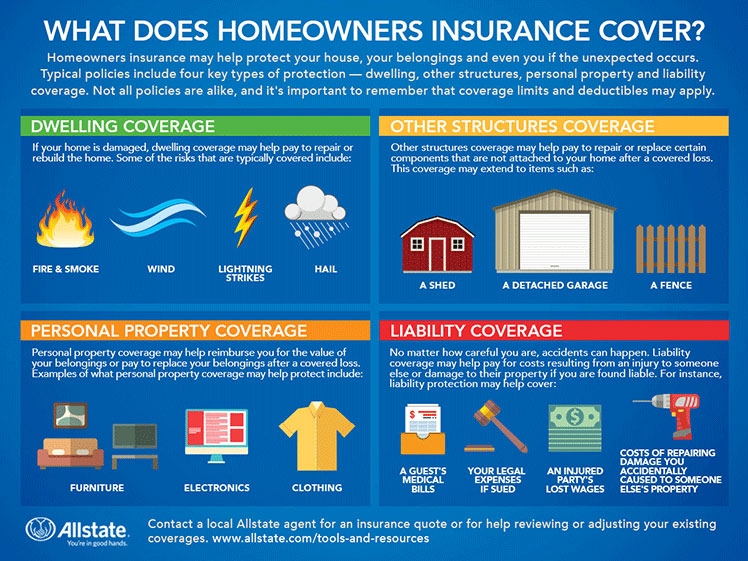

What Does Auto Owners Home Insurance Class 5 Cover?

Auto Owners Home Insurance Class 5 provides a wide range of coverage for your home. This type of insurance covers the cost of repairs to your home in the event that it is damaged by fire, theft, or vandalism. It also covers the cost of replacing any personal belongings that were destroyed or stolen in the event of a fire or other disaster. It also includes coverage for medical bills, legal costs, and loss of use of the home. Additionally, Auto Owners Home Insurance Class 5 also covers the cost of replacing any damaged or destroyed items inside the home, such as furniture, appliances, and electronics.

What Are The Benefits Of Auto Owners Home Insurance Class 5?

The benefits of Auto Owners Home Insurance Class 5 are numerous. One of the most significant benefits is the peace of mind that comes with knowing that your home and your personal possessions are protected from potential financial losses. Additionally, this type of insurance also covers costs associated with medical bills, legal costs, and loss of use of the home. This coverage can help to protect you from the financial hardship that can come with the loss of your home or personal belongings.

Another benefit of this type of insurance is the discounts that can be obtained by having Auto Owners Home Insurance Class 5. Many insurance companies offer discounts to customers who purchase this type of coverage. This can help to reduce the overall cost of your insurance premium. Additionally, Auto Owners Home Insurance Class 5 can also provide discounts on homeowners insurance premiums when purchased together with other types of insurance.

What Are The Risks Associated With Auto Owners Home Insurance Class 5?

While Auto Owners Home Insurance Class 5 can provide a great deal of coverage and protection, there are also certain risks that come with this type of insurance. One of the most significant risks is that of underinsuring your home or personal property. If you do not have enough coverage, you could end up facing financial hardship in the event of a disaster or theft. Additionally, if you are not adequately insured, you may be responsible for paying out of pocket for any damages or losses that occur.

Additionally, it is also important to remember that this type of insurance does not cover all types of risks. For instance, Auto Owners Home Insurance Class 5 does not provide coverage for floods or earthquakes. Additionally, it does not cover any damage caused by an act of God, such as a tornado or hurricane. It is important to be aware of these limitations before purchasing this type of insurance.

Conclusion

Auto Owners Home Insurance Class 5 is a great way to protect your home and personal belongings. This type of insurance covers a wide range of risks, including fire, theft, and vandalism. Additionally, it also provides coverage for medical bills, legal costs, and loss of use of the home. Furthermore, it also offers discounts on homeowners insurance premiums when purchased together with other types of insurance. However, it is important to remember that there are certain risks associated with this type of insurance, and it is important to be aware of these risks before purchasing.

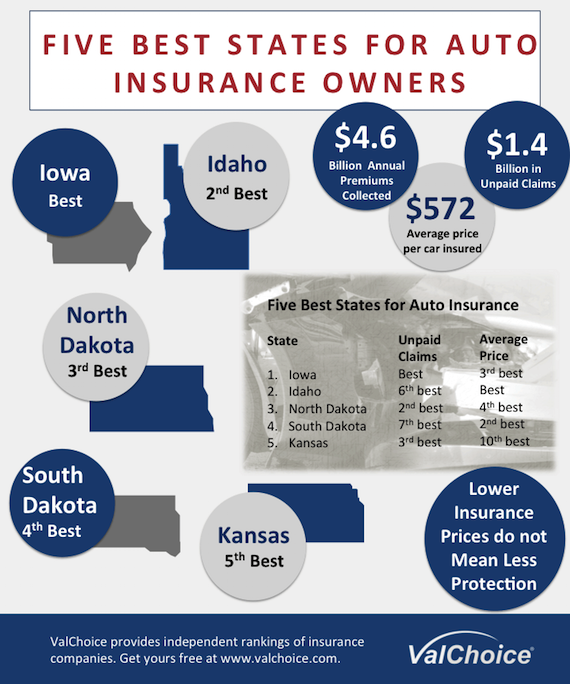

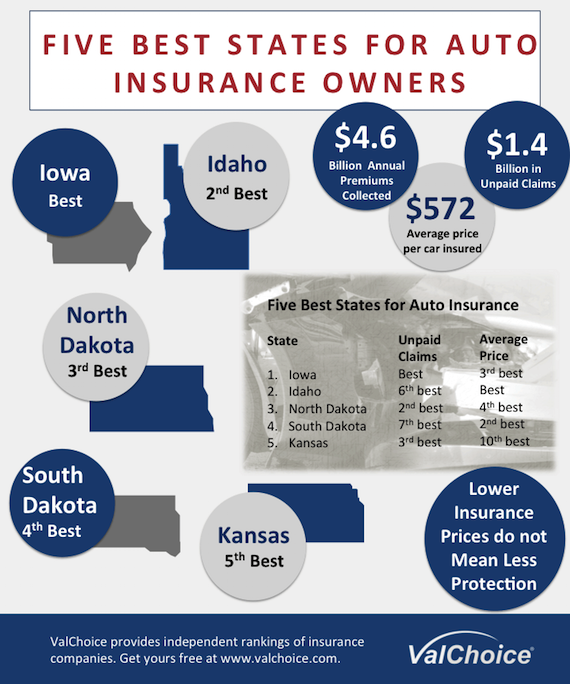

Five Best States for Auto Insurance Owners - ValChoice

Insurance Coverage You Should Have / How Much Homeowners Insurance

What Does Homeowners Insurance Cover? | Allstate

Auto-Owners holds steady in Fortune 500 listing | The Resource Center

Insurance: State Farm Home Owner Insurance Quote