Is Sr 22 Insurance Cheaper

Monday, March 6, 2023

Edit

Is SR 22 Insurance Cheaper?

What is SR 22 Insurance?

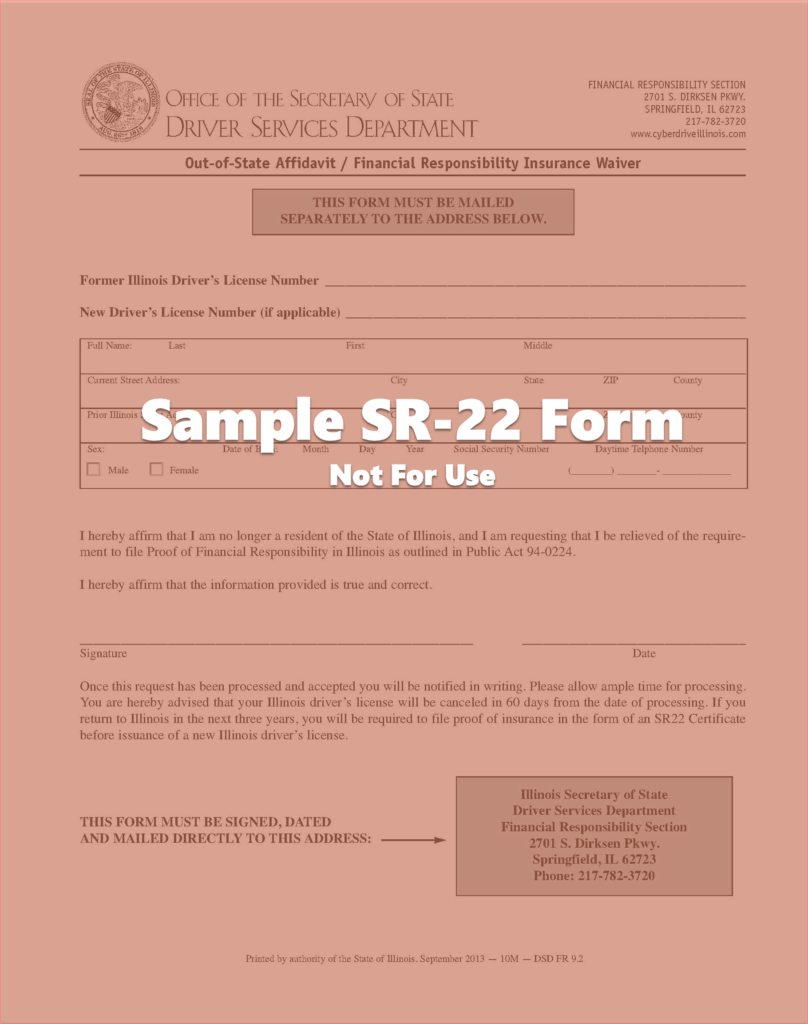

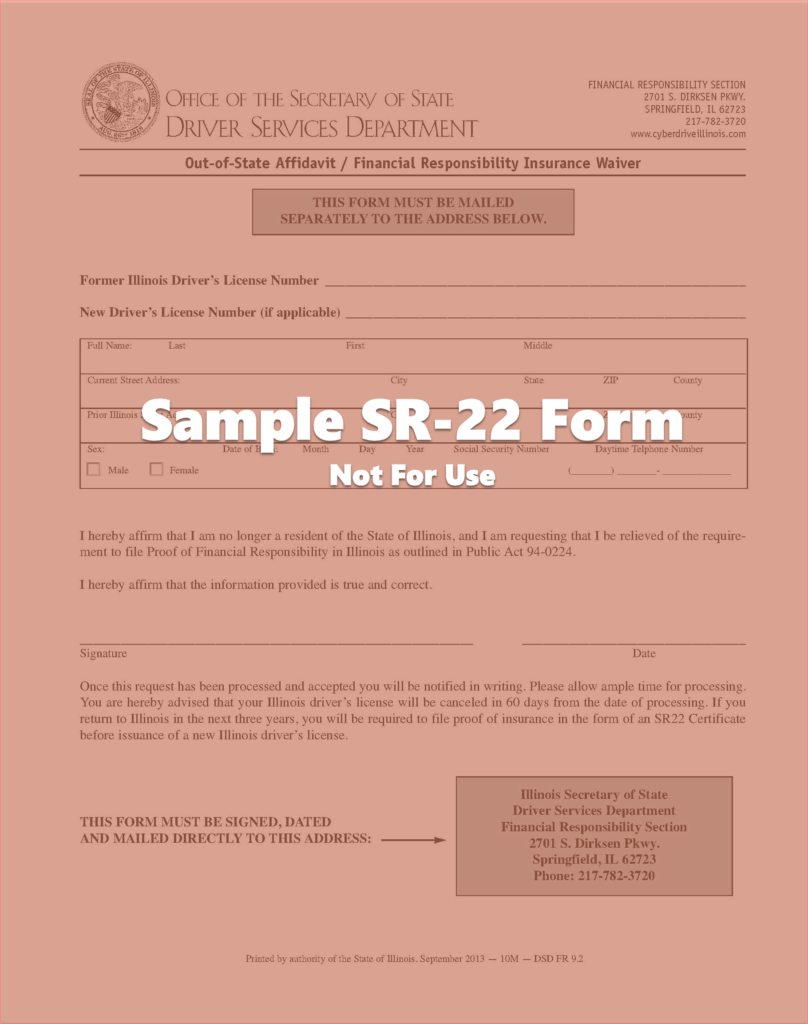

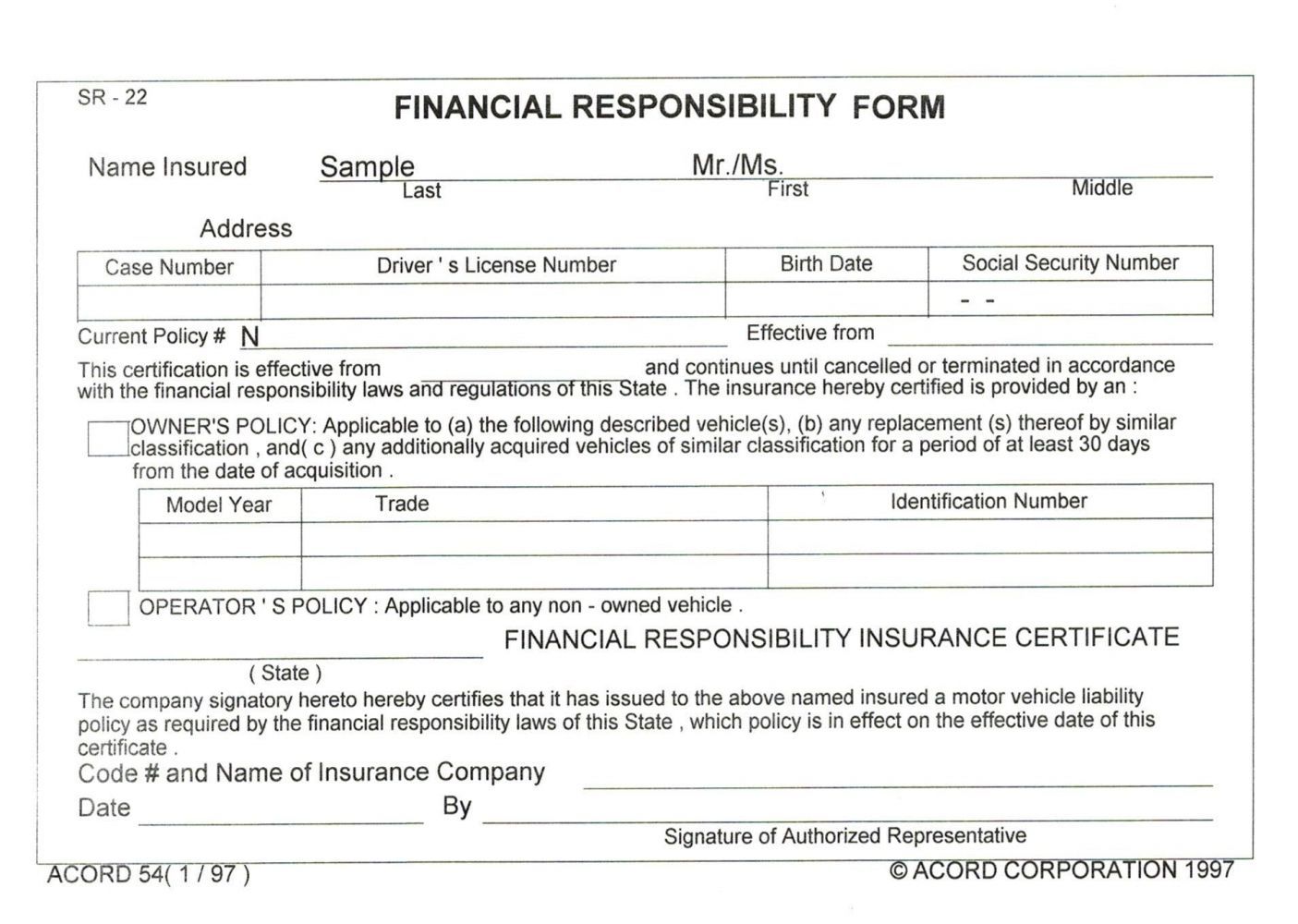

SR 22 insurance is a special type of insurance required for people who have been convicted of certain traffic violations. It is usually required for drivers who have been convicted of driving without insurance, driving under the influence (DUI), or other serious traffic violations. SR 22 insurance provides proof that the driver has the required minimum amount of liability insurance coverage. SR 22 insurance is typically more expensive than regular auto insurance and is usually required for three years after the conviction.

Is SR 22 Insurance Cheaper?

SR 22 insurance is usually more expensive than regular auto insurance. The cost of SR 22 insurance varies from state to state, and the amount of coverage needed can also affect the price. Generally, the cost of SR 22 insurance is higher than regular auto insurance because of the risk associated with drivers who have been convicted of certain traffic violations. Additionally, the cost of SR 22 insurance may be higher if the driver needs additional coverage, such as uninsured/underinsured motorist coverage.

What Factors Affect the Cost of SR 22 Insurance?

The cost of SR 22 insurance is affected by a variety of factors, including the driver's age, driving record, and coverage needs. Additionally, the cost of SR 22 insurance can be affected by the insurance company, the type of vehicle being insured, and the state in which the vehicle is registered. The cost of SR 22 insurance may be higher for younger drivers, those with a poor driving record, or those who need additional coverage.

How Can I Get the Lowest Price for SR 22 Insurance?

The best way to get the lowest price for SR 22 insurance is to shop around and compare rates from different insurance companies. It is also important to make sure that the coverage meets the state's minimum requirements. Additionally, it is important to make sure that the insurance company offers the coverage needed, such as uninsured/underinsured motorist coverage. Finally, it is important to make sure that the policy is up to date, as SR 22 insurance policies must be renewed every three years.

What Should I Do If I Can't Afford SR 22 Insurance?

If you cannot afford SR 22 insurance, there are a few options available. One option is to look for an insurance company that offers lower rates or discounts for drivers with a poor driving record. Additionally, some states offer low-cost auto insurance programs. Finally, you may be eligible for a payment plan or a reduced rate if you are able to provide proof of financial hardship.

Conclusion

SR 22 insurance is typically more expensive than regular auto insurance due to the risk associated with drivers who have been convicted of certain traffic violations. The cost of SR 22 insurance can vary from state to state and is affected by a variety of factors, such as the driver's age, driving record, and coverage needs. To get the lowest price for SR 22 insurance, it is important to shop around and compare rates from different insurance companies. Additionally, if you cannot afford SR 22 insurance, there are a variety of options available, such as looking for an insurance company that offers lower rates or discounts, or looking into low-cost auto insurance programs.

Cheap SR22 Insurance Illinois & Chicago | American Auto Insurance

SR-22 Fairfield OH: Get Insured Fast! Call us Today

Help With Finding SR-22 Insurance

Anatomy of an SR22 Insurance Filing – mckennainsurance.com

What Is SR22 Insurance and How Do You Get it? – Car News