Is Insurance For A Tesla Expensive

Thursday, March 9, 2023

Edit

Is Insurance For A Tesla Expensive?

An Overview of Tesla Insurance Costs

Tesla is a popular electric car manufacturer with a variety of models including the Model S, Model 3, Model X, and Model Y. While electric cars have a number of advantages over gasoline-powered vehicles, one of the downsides is the cost of insurance. But how much does it cost to insure a Tesla?

The cost of insurance for a Tesla depends on a variety of factors, including the model of the car, the owner's driving record, the state in which the car is registered, and the coverage level. In general, however, the cost of insuring a Tesla is higher than the average cost of insuring a gasoline-powered vehicle.

Factors That Affect Tesla Insurance Costs

The cost of insuring a Tesla can vary greatly depending upon a number of factors. One of the most important factors is the model of the car. Generally speaking, the more expensive the model, the higher the cost of insurance. Additionally, the cost of insurance can also be affected by the owner's driving record. Drivers with a history of accidents or traffic violations are likely to pay higher premiums than those with a clean driving record.

The state in which the car is registered can also have an effect on the cost of insurance. Certain states may have laws that require higher levels of coverage, which can increase the cost of insurance. Additionally, certain states may have higher insurance rates due to a higher rate of accidents or other factors.

Finally, the coverage level chosen can also affect the cost of insurance. Generally speaking, the more coverage that is chosen, the higher the cost of insurance. Some drivers may opt for higher coverage levels in order to protect their vehicle from any possible losses, while others may opt for a lower level of coverage in order to keep the cost of insurance down.

What Does Tesla Insurance Cover?

Tesla insurance typically covers a variety of losses, including those resulting from collisions, theft, vandalism, and other types of damage. It may also provide coverage for medical expenses in the event of an accident, as well as coverage for towing and rental cars.

In addition to covering the cost of repairs or replacements, Tesla insurance may also cover the cost of the driver's legal fees in the event of a lawsuit. Finally, some insurers may offer additional coverage options, such as roadside assistance, rental car reimbursement, and trip interruption coverage.

Tips for Saving Money on Tesla Insurance

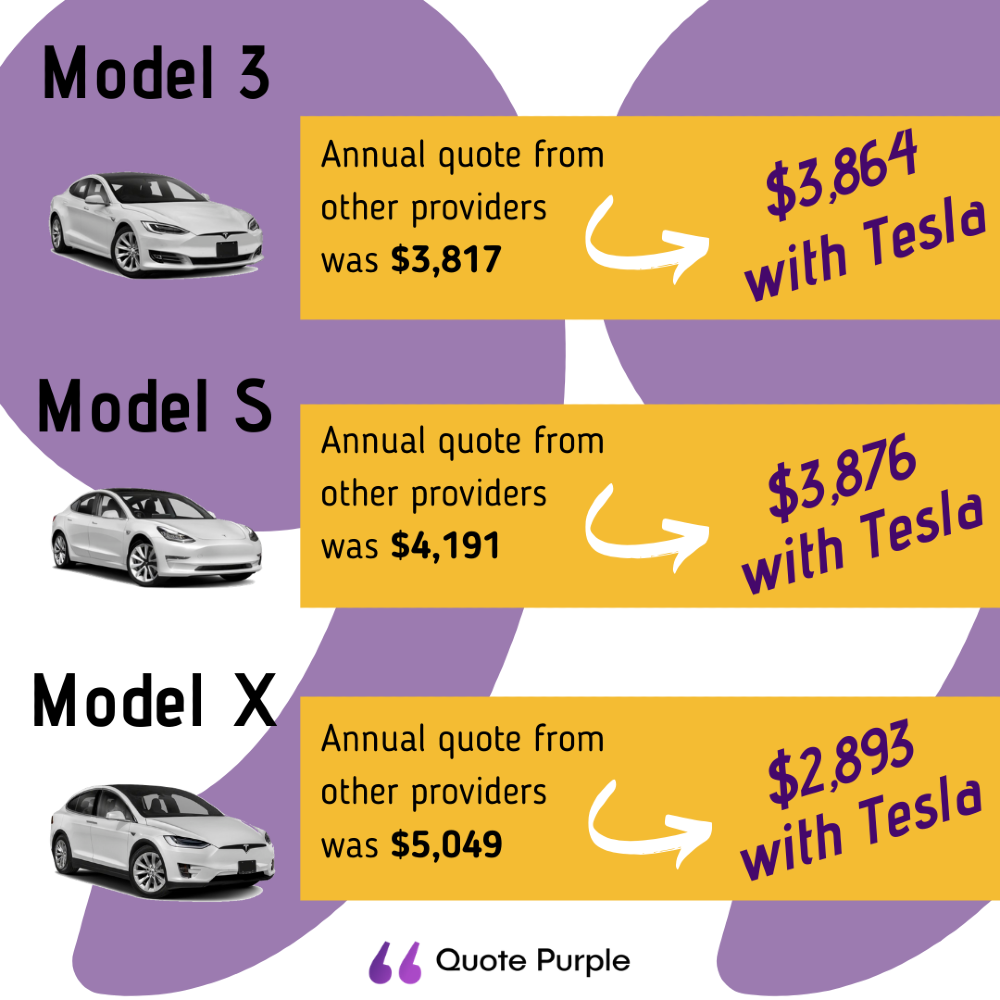

There are a number of ways to save money on Tesla insurance. One of the simplest is to shop around and compare quotes from different insurers. Different insurers may offer different levels of coverage at different prices, so it's important to compare quotes to ensure that you're getting the best deal. Additionally, some insurers may offer discounts for certain drivers, such as those with a clean driving record or those who have taken a defensive driving course.

It's also important to review your coverage level and make sure that you're not paying for more coverage than you need. Some drivers may opt for higher levels of coverage in order to protect their vehicle from any possible losses, while others may opt for a lower level of coverage in order to keep the cost of insurance down. Additionally, some insurers may offer discounts for those who are willing to pay a higher deductible.

Conclusion

In conclusion, the cost of insuring a Tesla depends on a variety of factors, including the model of the car, the owner's driving record, the state in which the car is registered, and the coverage level chosen. Generally speaking, the cost of insuring a Tesla is higher than the average cost of insuring a gasoline-powered vehicle. That said, there are a number of ways to save money on Tesla insurance, such as shopping around and comparing quotes, taking advantage of discounts, and reviewing your coverage level to make sure that you're not paying for more coverage than you need.

Tesla Insurance Cost Breakdown - The Ultimate Guide - EINSURANCE

Tesla Model X Insurance Cost - Tesla Model X Configurator Now Live

Tesla Insurance - How Does it Compare to Normal Insurance?

Tesla Insurance Review - How Is Tesla’s In-House Insurance?

What Is The Most Expensive Tesla Car - CARS NEWS INFO BLOG