Iffco Tokio Car Insurance Claim Ratio

Iffco Tokio Insurance Claim Ratio

Overview

Iffco Tokio is one of the leading general insurance companies in India and has been in the business since 2000. It is a joint venture of the Indian Farmers Fertiliser Co-operative (IFFCO) and Tokio Marine & Nichido Fire Group, Japan. The company offers an extensive range of insurance products, ranging from motor insurance to health insurance and travel insurance. The company has been consistently growing in the market and currently holds a market share of 9%.

One of the key metrics to measure the performance of an insurance company is the claim ratio. It is the ratio of the claims paid to the total premium collected by the insurer in a year. It is an important indicator of a company's performance and efficiency. A high claim ratio means that the company is prompt in paying claims and is reliable.

Iffco Tokio's Claim Ratio

Iffco Tokio has been performing very well in terms of its claim ratio over the years. The company's claim ratio in the financial year 2018-19 was 93.86%, which is higher than the industry average of 92.09%. This indicates that the company is highly efficient in settling claims and is reliable in doing so. In fact, the company has been consistently performing better than the industry average in terms of its claim ratio.

The company's claim ratio in the motor insurance category was 95.55%, which is higher than the industry average of 94.32%. This indicates that the company pays its motor insurance claims promptly and is reliable in doing so.

Reasons for Iffco Tokio's High Claim Ratio

The company's high claim ratio can be attributed to its efficient claims processing system. The company has a dedicated team of professionals who are responsible for the processing of claims. The team ensures that all claims are processed in a timely and efficient manner. The company also has a wide network of third-party service providers across the country, which helps in the speedy settlement of claims. Furthermore, the company has a comprehensive customer service system in place, which helps customers get their claims settled quickly and easily.

The company also has a robust fraud detection system in place. This system helps the company detect and prevent fraudulent claims from being settled. This, in turn, helps the company keep its claim ratio high.

Conclusion

Iffco Tokio is one of the leading general insurance companies in India. The company has been performing very well in terms of its claim ratio. It has a claim ratio of 93.86%, which is higher than the industry average. The company's high claim ratio can be attributed to its efficient claims processing system, wide network of third-party service providers, and robust fraud detection system.

Iffco Tokio Car Insurance - Renewal, Reviews & Premium Calculator

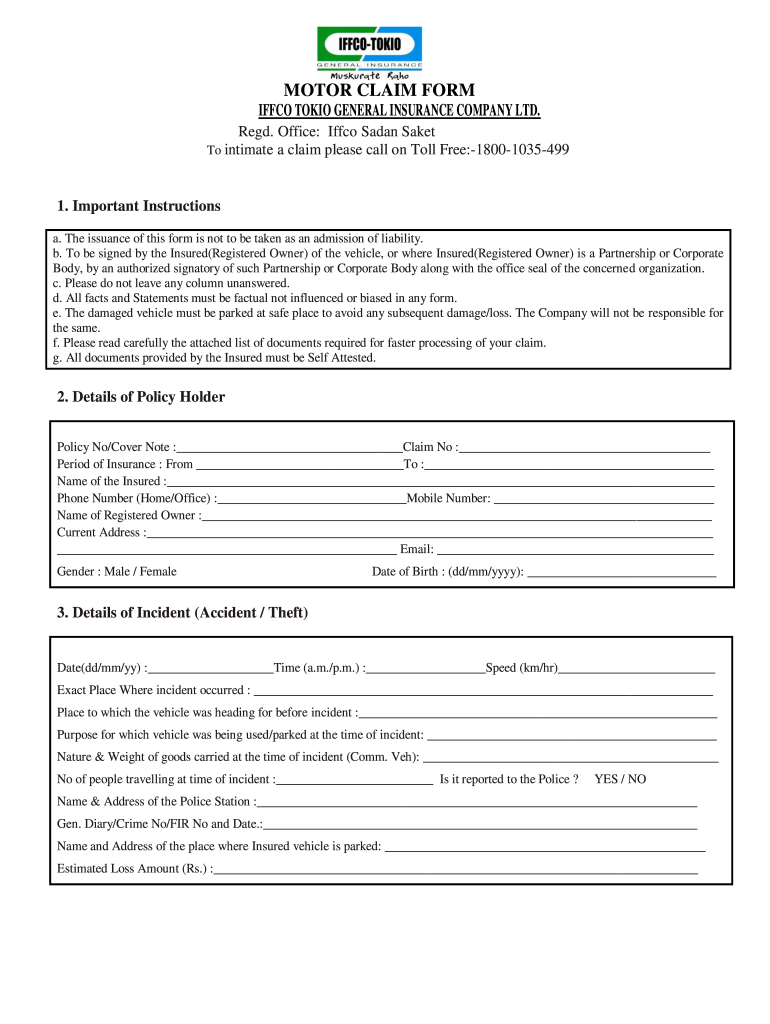

Iffco Tokio Claim Form - Fill Online, Printable, Fillable, Blank

Iffco Tokio Car Insurance Pdf

[PDF] IFFCO-Tokio Health Claim Form PDF Download in English – InstaPDF

![Iffco Tokio Car Insurance Claim Ratio [PDF] IFFCO-Tokio Health Claim Form PDF Download in English – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/iffco-tokio-health-claim-form-1442.jpg)

Iffco Tokio General Insurance Claim Form - Fadia Arsadila 2022