Cost Of Long term Care Insurance At Age 65

Cost Of Long Term Care Insurance At Age 65

What Is Long Term Care Insurance?

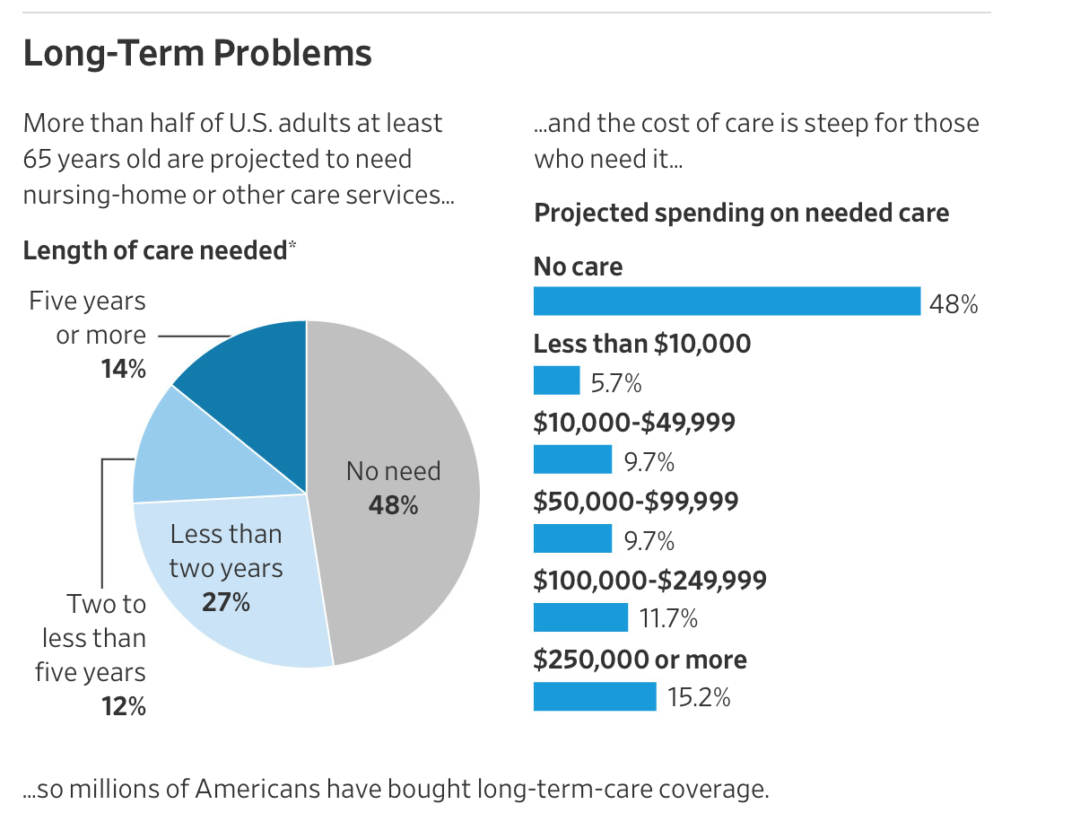

Long term care insurance is a type of insurance policy designed to cover the costs of long-term care services, such as nursing home care, home health care, and other services that are not typically covered by traditional health insurance policies. It is a way to protect yourself from the high costs of long-term care, and to ensure that you are able to maintain your independence and quality of life even if you need assistance with activities of daily living. Long-term care insurance policies provide coverage for a specified period of time, and they vary in terms of the amount of coverage they provide.

What Are the Benefits of Long Term Care Insurance?

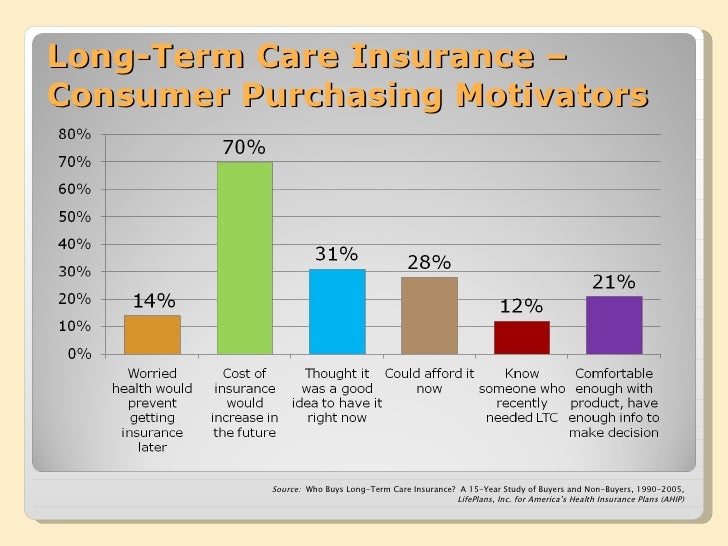

Long term care insurance is a great way to protect your financial security if you are faced with a long-term care situation. With long-term care insurance, you can be sure that you are not putting your savings at risk if you need long-term care services. Long-term care insurance can help you maintain your independence and quality of life, and it can provide you with peace of mind knowing that you will be taken care of if you need long-term care services. Long-term care insurance can also help you to protect your estate, as it can cover the costs of long-term care services that can be quite expensive.

What Is the Cost of Long Term Care Insurance At Age 65?

The cost of long-term care insurance at age 65 varies depending on a variety of factors, including the type of policy you choose, the amount of coverage you need, and the type of care you need. Generally speaking, the cost of long-term care insurance at age 65 is much higher than it is at a younger age, as the risk of needing long-term care services increases with age. It is important to note, however, that the cost of long-term care insurance at age 65 is still much less than the cost of paying for long-term care services out of pocket. It is also important to note that the cost of long-term care insurance can be tax deductible, depending on the type of policy you choose.

What Are the Different Types of Long Term Care Insurance?

There are several different types of long-term care insurance policies, including traditional policies, hybrid policies, and short-term policies. Traditional long-term care insurance policies are designed to cover the costs of long-term care services, such as nursing home care, home health care, and other services that are not typically covered by traditional health insurance policies. Hybrid policies are a combination of traditional long-term care insurance and life insurance, and they provide coverage for long-term care services as well as death benefits. Short-term policies provide coverage for a specified period of time, and they are generally less expensive than traditional policies.

Conclusion

Long-term care insurance is an important way to protect your financial security if you are faced with a long-term care situation. The cost of long-term care insurance at age 65 is much higher than it is at a younger age, but it is still much less than the cost of paying for long-term care services out of pocket. There are several different types of long-term care insurance policies, so it is important to research your options and find the policy that best meets your needs. With the right long-term care insurance policy, you can be sure that you are covered if you ever need long-term care services.

Health Insurance For Retirees Under 65 : The Retirement Café: February

Cost Of Long Term Care Insurance Calculator / Best Long Term Care

Average Long Term Care Costs in Arizona | ALTCS Planning.net

Long Term Care Insurance || the Compassionate Advisor | Rocky Mountain