How Much More Is Car Insurance For Business Use

Wednesday, March 29, 2023

Edit

How Much More Is Car Insurance For Business Use?

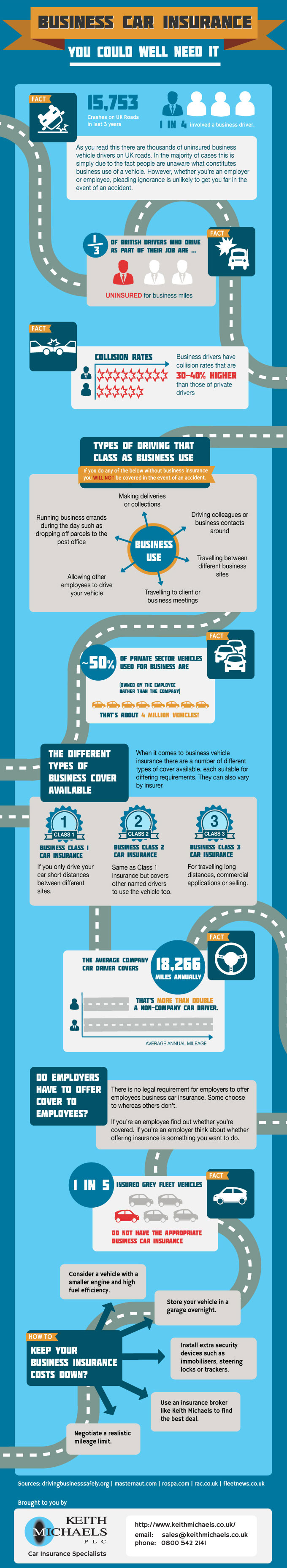

Commercial Car Insurance: What Is It?

If you own a business and you use a car for work, then you need to get commercial car insurance. This type of insurance is designed specifically to cover vehicles used in the course of business operations. It provides the same coverage that personal car insurance does, but it is tailored to the specific needs of businesses. Commercial car insurance typically covers physical damage to the insured vehicle, liability for damages caused by the insured vehicle, and other associated costs.

How Much More Is Commercial Car Insurance?

The cost of commercial car insurance is typically much higher than the cost of personal car insurance. This is because commercial car insurance has to cover more than just the vehicle itself. It also has to cover the liability of the business for any damages caused by the vehicle. In addition, commercial car insurance often covers the cost of rental vehicles and other associated expenses. This means that the cost of commercial car insurance can be quite high.

Factors That Affect The Cost Of Car Insurance For Business Use

The cost of commercial car insurance varies widely depending on the type of business and the type of vehicle. Businesses that use cars for deliveries or transportation of goods are likely to pay more for car insurance than businesses that use cars for sales or marketing. Similarly, businesses that use trucks or vans for business purposes will typically pay more for car insurance than those that only use cars. The age and condition of the vehicle, as well as the driver's driving record, can also affect the cost of car insurance.

What Coverage Does Commercial Car Insurance Provide?

Commercial car insurance typically provides the same coverage as personal car insurance. This includes liability coverage, physical damage coverage, and medical payments coverage. Liability coverage pays for damages caused by the insured vehicle, while physical damage coverage pays for damage to the insured vehicle. Medical payments coverage pays for medical expenses related to an accident involving the insured vehicle.

Do I Need Commercial Car Insurance?

If you own a business and use a car for work, then you need to get commercial car insurance. This type of insurance is designed specifically to provide coverage for vehicles used in business operations. The cost of commercial car insurance is typically much higher than the cost of personal car insurance, but it is necessary to ensure that your business is properly protected.

Conclusion

Commercial car insurance is essential for businesses that use cars for work. The cost of commercial car insurance is typically much higher than the cost of personal car insurance, but it is necessary to ensure that your business is properly protected. Commercial car insurance typically provides the same coverage as personal car insurance, including liability coverage, physical damage coverage, and medical payments coverage.

Does Car Insurance Cost More For Business Use - Business Walls

Looking at the costs of auto insurance in Ontario, and ways motorists

What is Business Car Insurance? | Business Insurance

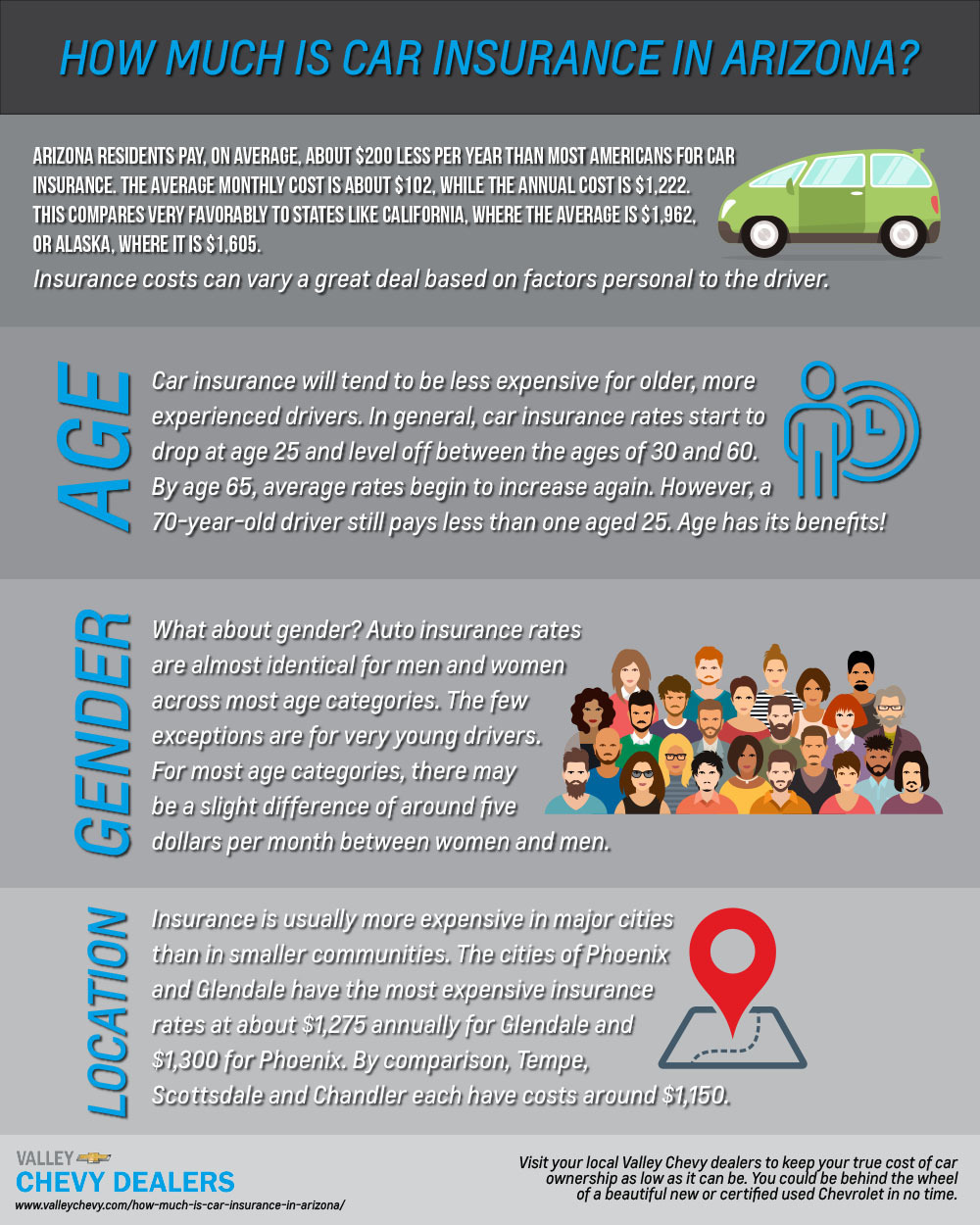

How Much is Car Insurance in Arizona? | Valley Chevy Dealers | Valley Chevy

How much car insurance should I buy?