Best Car Insurance For The Money

Best Car Insurance For The Money

Choosing the Right Coverage

When it comes to choosing car insurance, it is important to find the best coverage for the money. It can be difficult to determine which policy will give you the most protection and the greatest value. There are a few different factors to consider when choosing the right coverage. It is important to research the various companies and policies available, as well as to understand the various types of coverage. You should also pay attention to the cost of premiums and make sure that you are getting the best value for your money.

Factors to Consider

When deciding on car insurance, the first thing to consider is the type of coverage you need. Liability coverage is usually required by law and can help cover expenses if you are at fault in an accident. Comprehensive coverage protects against damage to your vehicle from theft, vandalism, and other perils. Collision coverage helps to repair or replace your vehicle if it is damaged in a collision. Uninsured and underinsured motorist coverage can help protect you from losses incurred from drivers who are uninsured or underinsured.

Comparing Rates

Once you have determined the type of coverage you need, it is important to compare the rates of different providers. Many providers offer discounts, such as for having a clean driving record, or for having multiple policies with the same company. It is important to shop around and compare rates to ensure that you are getting the best coverage for the lowest cost. You can use online comparison tools to quickly and easily compare rates from different providers.

Checking Reviews

It is also important to read reviews of different car insurance companies before making a purchase. Look at customer reviews to see how satisfied people are with their coverage and customer service. This can give you an idea of which companies offer the best value for the money. You should also check the Better Business Bureau for any complaints that have been filed against the company.

Getting Discounts

Car insurance companies often offer discounts for drivers who take certain safety courses or adopt safe driving habits. It is important to ask about any discounts that you may be eligible for. Many providers offer discounts for having multiple policies with the same company, or for having a clean driving record. Additionally, many companies offer discounts for installing safety features in your vehicle, such as airbags and anti-lock brakes.

Conclusion

Finding the best car insurance for the money is not always easy. It is important to research the various policies and providers available and to compare rates to ensure that you are getting the most protection for the lowest cost. Additionally, it is important to check reviews and ask about any discounts that you may be eligible for. By taking the time to shop around, you can ensure that you are getting the best value for your money.

Best Way To Save Money on Your Car Insurance

7 Things You Need to Know About Car Insurance | The Summit Express

25 Best Car Insurance Companies of 2020 (Ranked and Reviewed) | Wealth

Moneymax Car Insurance Review: How Much I Pay for Car Insurance - The

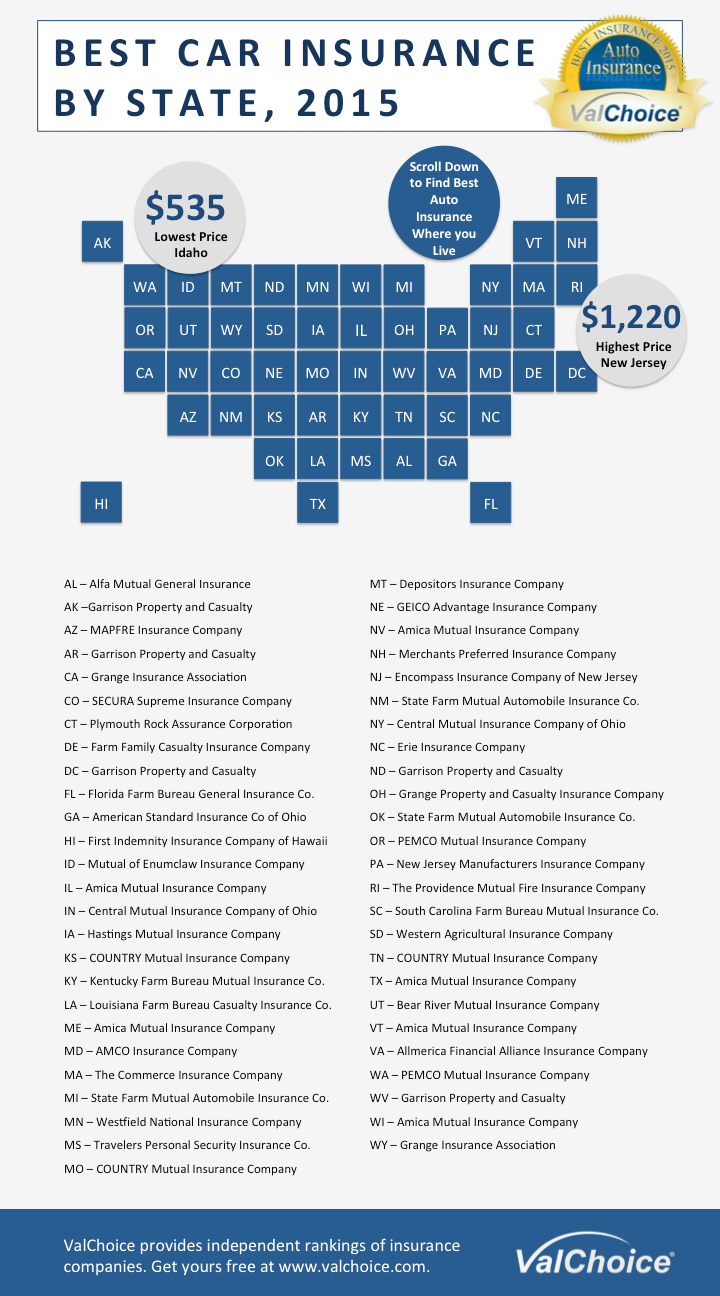

Best Car Insurance Companies by State - ValChoice