Adding Vehicle To Insurance Policy

Sunday, March 19, 2023

Edit

Adding a Vehicle to Your Insurance Policy

What to Know Before Adding a Vehicle

When you're adding a vehicle to your insurance policy, there are a few things you should consider. First, you need to make sure that the vehicle you're adding is actually covered by your policy. Some policies only cover certain types of vehicles, so you'll want to double-check that the vehicle you're adding is covered. You should also be aware that adding a vehicle to your policy may increase your premiums, so it's important to weigh the cost before you make any decisions.

What Information Do You Need?

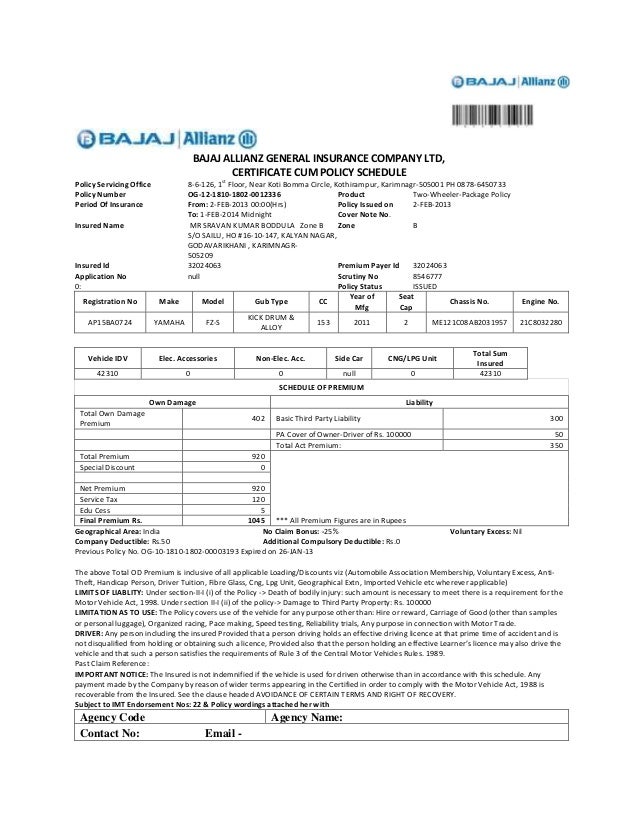

When you're adding a vehicle to your policy, you'll need to provide some basic information. This includes the make and model of the vehicle, the year it was made, and the vehicle's identification number (VIN). You'll also need to provide information about the vehicle's owner, such as their name, address, and driver's license number. You may also need to provide information about any additional drivers who will be regularly operating the vehicle.

What Does the Coverage Include?

When you're adding a vehicle to your insurance policy, you'll need to decide what type of coverage you want. Most policies include liability coverage, which covers damages to other people or property caused by the driver. You may also want to add comprehensive coverage, which covers damages to the vehicle itself, or collision coverage, which covers damages caused by an accident. Depending on your provider, you may also be able to add additional coverage, such as medical payments coverage or personal injury protection.

What Are the Benefits of Adding a Vehicle?

Adding a vehicle to your policy can offer a number of benefits. For one, it can help you save money on your premiums. In most cases, adding a vehicle to your policy will lower your premiums because it will spread the risk across multiple vehicles. Additionally, it can provide you with additional protection in the event of an accident. If you have multiple vehicles on your policy, you'll have additional coverage in the event of an accident with one of the vehicles.

What Are the Disadvantages of Adding a Vehicle?

Adding a vehicle to your policy can also come with some disadvantages. As mentioned, it can increase your premiums, so you'll need to weigh the cost before you make any decisions. Additionally, it can create overlap in coverage. For example, if you have multiple vehicles on the same policy, you may have to pay for repairs twice if both vehicles are damaged in the same accident.

Do You Need to Add a Vehicle?

Whether or not you need to add a vehicle to your policy depends on your individual circumstances. If you already have coverage for the vehicle, you may not need to add it. However, if you're looking for additional coverage or want to save money on your premiums, adding a vehicle to your policy may be a good option. It's important to weigh the cost and benefits before you make any decisions.

Duplicate Car Insurance Policy ~ ytdesignwork

Is Your Insurance Coverage Protecting You and Your Family?

Car Insurance Policy: Car Insurance Policy Sample Pdf

How to Choose Car Insurance Policy – Key factors and Riders