Tpl Car Insurance Claim Form

The Benefits of Filling Out a TPL Car Insurance Claim Form

If you’ve been in an accident and need to file a car insurance claim, you’ll likely have to fill out a TPL car insurance claim form. But what is a TPL form and why is it important? TPL stands for third party liability and is a form of car insurance claim. The form is necessary to determine who is responsible for covering the costs of the damage that was caused in the accident. Knowing what this form covers and why it’s important can help you make sure that you’re filing your claim accurately and getting the compensation you deserve.

What is TPL Insurance?

TPL insurance, or third party liability insurance, is a type of car insurance coverage that protects you in the event of an accident. If you’re in an accident and the other driver is at fault, their insurance will cover the costs of the damages, including medical bills, car repairs, and legal costs. TPL insurance is also known as liability insurance, and can be purchased as part of a comprehensive car insurance policy.

What is a TPL Car Insurance Claim Form?

A TPL car insurance claim form is a form that you’ll have to fill out when you’re filing a car insurance claim. The form is necessary to determine who is responsible for covering the costs of the damage that was caused in the accident. It’s important to note that TPL claims forms may vary from insurer to insurer, so it’s important to make sure you’re filling out the form that’s specific to your insurer.

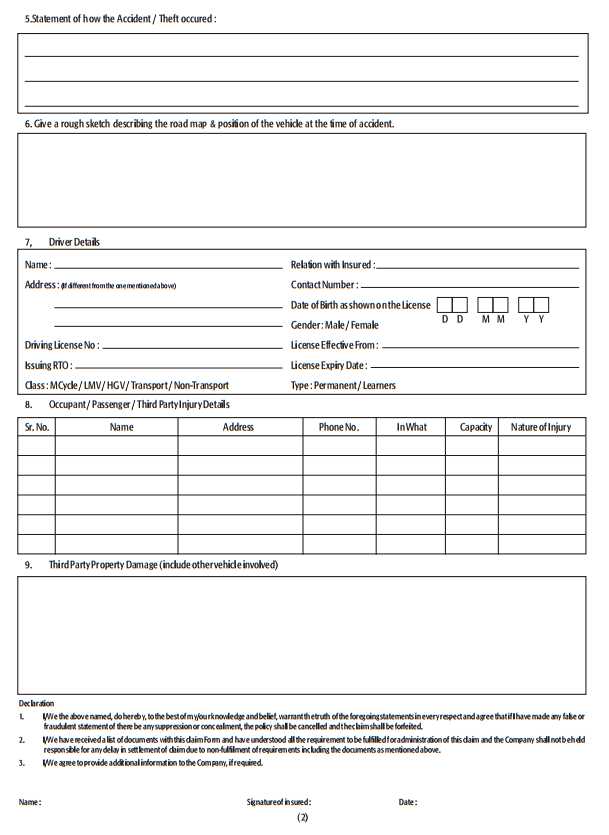

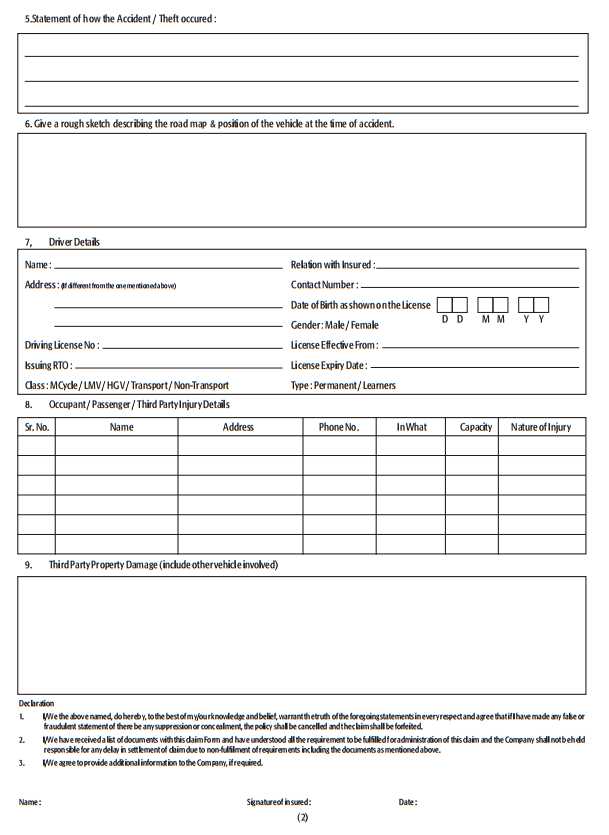

What Information is Needed to Fill Out a TPL Car Insurance Claim Form?

When filling out the TPL car insurance claim form, you’ll need to provide information about yourself, the other driver, and the accident. You’ll need to include your contact information, the date and time of the accident, the location of the accident, and a description of what happened. You’ll also need to include the other driver’s information, including their name, contact information, and insurance information. Finally, you’ll need to provide any additional information such as photos, witness statements, and police reports.

Why is it Important to Fill Out a TPL Car Insurance Claim Form?

It’s important to fill out a TPL car insurance claim form because it’s necessary to determine who is responsible for covering the costs of the damage that was caused in the accident. Filling out the form accurately and completely can help ensure that you’re getting the compensation you deserve. Additionally, it’s important to fill out the form as soon as possible after the accident, as some insurance companies may require you to file within a certain time frame.

What Happens After You Submit a TPL Car Insurance Claim Form?

Once you submit the TPL car insurance claim form, your insurer will review the information and determine whether or not they will cover the costs of the accident. If they do, they will contact you with information on how to proceed. If they don’t, they may contact you with additional information or may deny the claim. If your claim is denied, you will need to contact an attorney to help you appeal the decision.

National Insurance Company Limited Motor Claim Form PDF - 2019 2020

Claim Form | Vehicle Insurance | Government Information

FREE 27 Sample Claim Forms in MS Word

Car Insurance Claim Form High-Res Stock Photo - Getty Images

Motor Insurance: New India Motor Insurance Claim Form