Long Term Care Insurance Cost

Monday, February 20, 2023

Edit

What Is Long-term Care Insurance and How Much Does It Cost?

What Is Long-term Care Insurance?

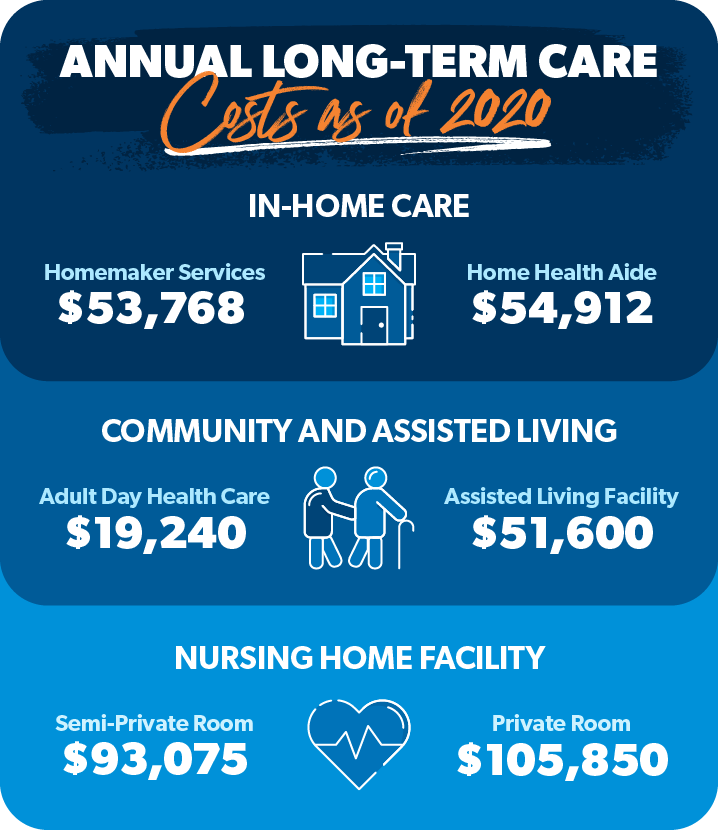

Long-term care insurance is an insurance policy that helps cover the costs of long-term care services, such as in-home care or nursing home care, for those who have difficulty performing activities of daily living due to a chronic illness or disability. Long-term care insurance can be purchased through an insurance provider or as part of an employer-sponsored plan.

Long-term care insurance can help cover the costs of care that Medicare and health insurance do not typically cover, such as daily assistance with activities such as dressing and bathing, or help with managing medications. It can also help to cover the costs of care in a nursing home or assisted living facility.

How Much Does Long-term Care Insurance Cost?

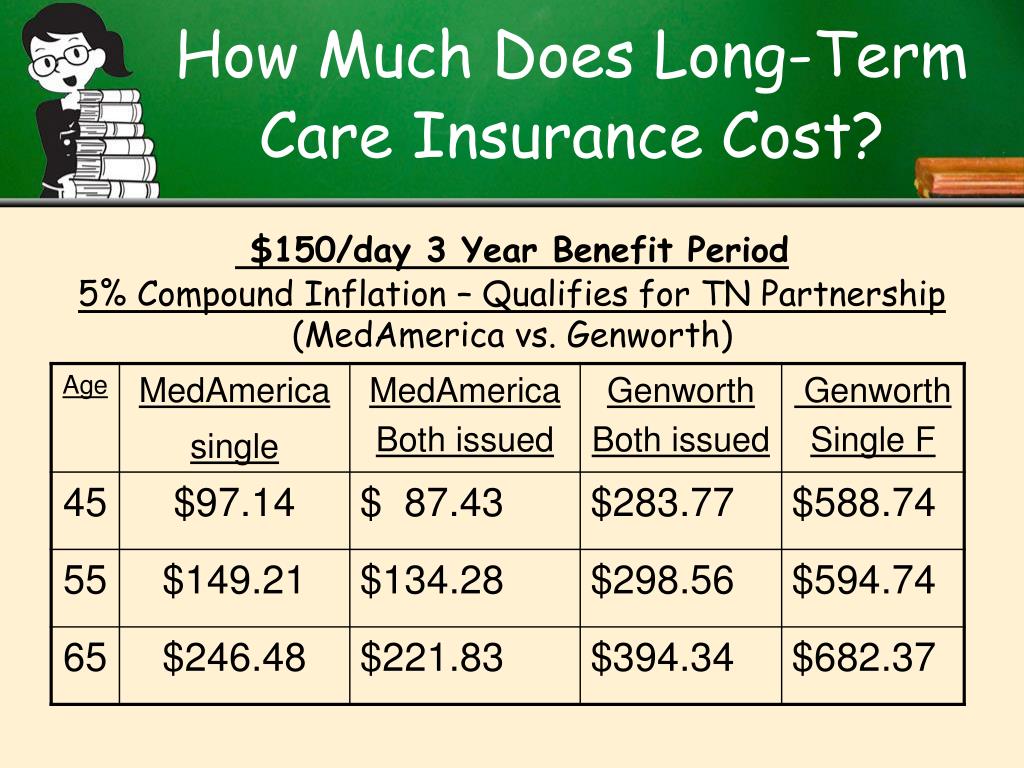

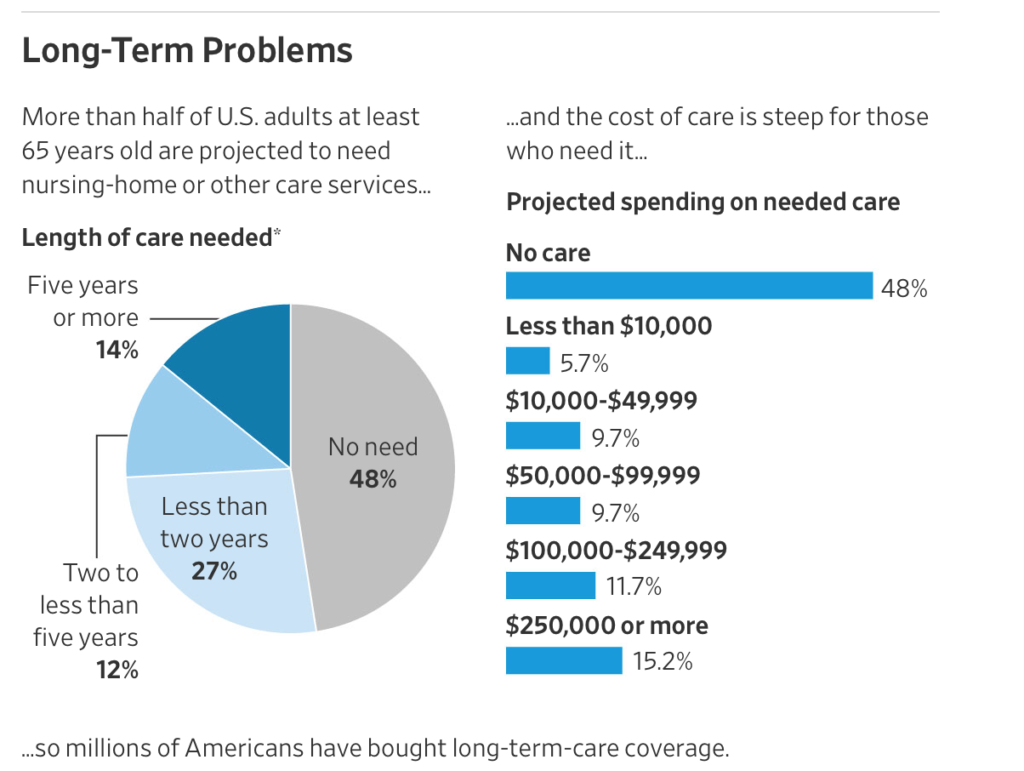

The cost of long-term care insurance can vary greatly depending on the type of policy you choose and the amount of coverage you need. Generally, the cost of long-term care insurance is based on your age when you purchase the policy, your health status, the type of care you need, the length of time you need care, and the amount of coverage you choose.

The average cost of long-term care insurance in the United States is approximately $2,000 per year for an individual policy, though the cost can vary significantly from state to state or from one insurance provider to another. The cost of a long-term care insurance policy also increases as you age, so it is important to purchase a policy as soon as possible.

What Factors Affect the Cost of Long-term Care Insurance?

The cost of long-term care insurance can vary depending on a number of factors. Some of the factors that can affect the cost of long-term care insurance include your age, health status, the type of coverage you choose, and the length of time you need care.

Your age is an important factor when it comes to the cost of long-term care insurance. Generally, the younger you are when you purchase a policy, the less expensive it will be.

Your health status is also an important factor when it comes to the cost of long-term care insurance. Insurance providers may consider certain health conditions, such as chronic illnesses or disabilities, when determining the cost of a policy.

The type of coverage you choose can also affect the cost of long-term care insurance. Policies can vary greatly in terms of the amount of coverage they provide, so it is important to compare different policies to find the one that best meets your needs.

Finally, the length of time you need care can also affect the cost of long-term care insurance. Generally, the longer you need care, the more expensive the policy will be.

Are There Alternatives to Long-term Care Insurance?

In addition to long-term care insurance, there are other options available to help cover the costs of long-term care services. These options include Medicaid, veterans' benefits, and reverse mortgages.

Medicaid is a government program that provides medical and financial assistance to those who meet certain income and asset requirements. To qualify for Medicaid, you must meet certain eligibility criteria, such as having a specific type of disability or being low-income.

Veterans' benefits can also be used to help cover the costs of long-term care services. Veterans and their families may be eligible for a range of benefits, including in-home health care and nursing home care.

Finally, reverse mortgages are also an option for those who need help covering the costs of long-term care services. A reverse mortgage is a loan that is secured by the equity in your home. The loan is repaid when the home is sold or the borrower dies.

What Should I Consider Before Purchasing Long-term Care Insurance?

Before purchasing long-term care insurance, it is important to consider a number of factors, such as your age, health status, and the type of coverage you need. It is also important to compare different policies to find the one that best meets your needs.

In addition, it is important to consider the costs associated with long-term care insurance. The cost of long-term care insurance can vary greatly depending on factors such as your age and health status, so it is important to compare different policies to make sure you are getting the best value for your money.

Finally, it is also important to consider other options available to help cover the costs of long-term care services, such as Medicaid, veterans' benefits, and reverse mortgages.

Long-term care insurance can be a valuable tool for those who need help covering the costs of long-term care services, but it is important to carefully consider all of your options before making a decision.

The Real Cost of Long-Term Care (INFOGRAPHIC) | HuffPost

How Much Does Long-Term Care Insurance Cost? | RamseySolutions.com

Cost of Long-Term Care Insurance | Boomer Money... and More

Long Term Care Insurance || the Compassionate Advisor | Rocky Mountain

PPT - Offering Long Term Care Insurance to Your Employees is as easy as