Insurance Cost For Tesla Model Y

Insurance Cost For Tesla Model Y

What is Tesla Model Y?

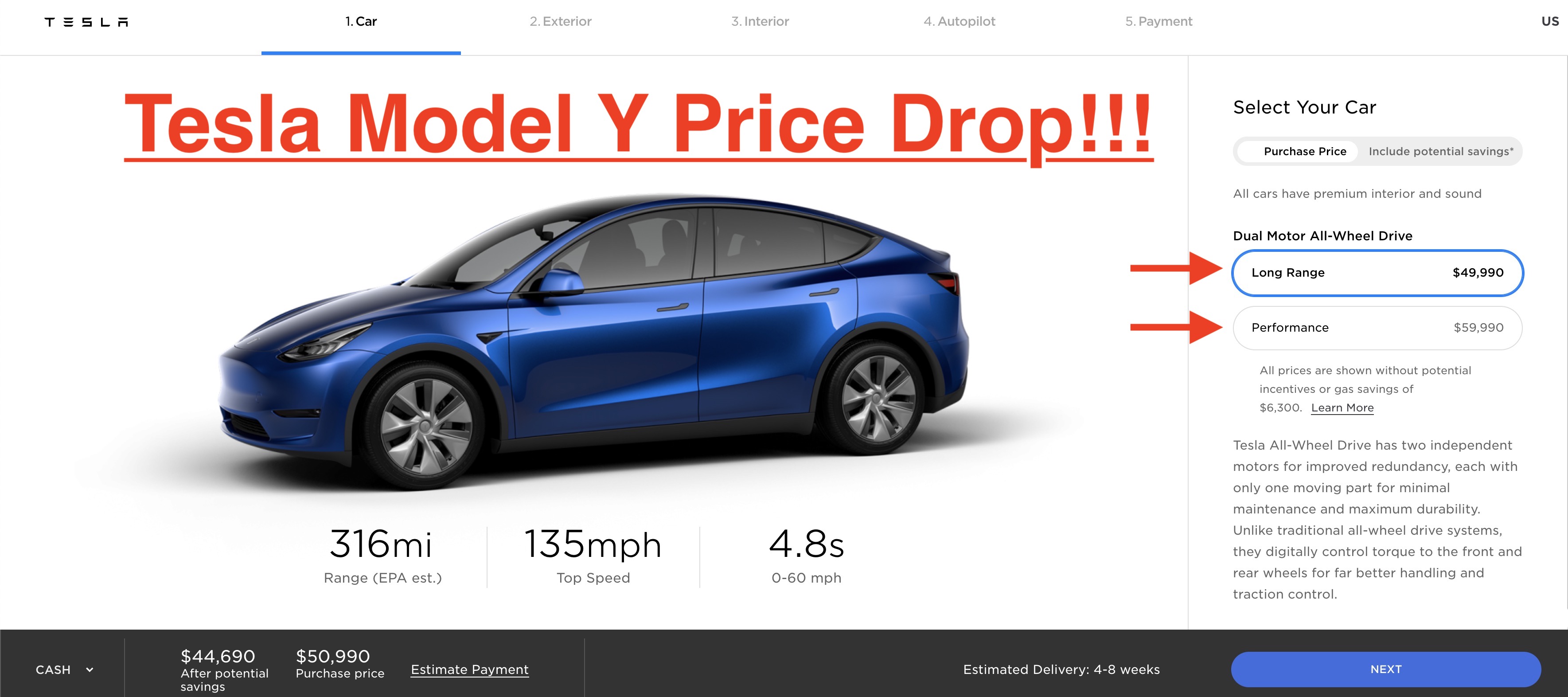

Tesla Model Y is the mid-size electric SUV that is manufactured by Tesla. It is available in two versions, the Long Range and Performance. The Long Range version has an estimated range of 316 miles, while the Performance version has an estimated range of 300 miles. It has a top speed of 150 mph and can accelerate from 0-60 mph in 3.5 seconds. It is a five-seater vehicle and has a roomy interior with plenty of space for all passengers.

What is Insurance?

Insurance is a contract between a policyholder and an insurer. It is designed to protect the policyholder from financial losses due to an accident, illness, or another event. Insurance premiums are usually paid on a monthly or yearly basis, and the amount of the premium is based on the type of coverage and the risk associated with the policyholder.

What is the Insurance Cost for Tesla Model Y?

The cost of insurance for a Tesla Model Y can vary depending on the coverage and the risk associated with the driver. Generally, insurance rates for electric vehicles are lower than for conventional vehicles due to the fact that electric vehicles are less likely to be involved in an accident. The cost of insurance for the Tesla Model Y can be anywhere from a few hundred to a few thousand dollars per year, depending on the coverage and the risk associated with the driver.

What Factors Affect the Cost of Insurance?

There are several factors that can affect the cost of insurance for a Tesla Model Y, including the make and model of the vehicle, the age of the driver, the driving record, and the type of coverage selected. Generally, older drivers with more experience and a good driving record will pay less for insurance than younger, inexperienced drivers. Additionally, the type of coverage selected can also affect the cost of insurance.

How to Get the Best Insurance Rates for Tesla Model Y?

To get the best insurance rates for a Tesla Model Y, it is important to shop around and compare rates from different insurers. It is also important to maintain a good driving record to ensure that insurance rates remain low. Additionally, drivers should consider adding additional coverage such as gap insurance, which can protect against financial losses in the event of an accident or theft.

Conclusion

Insurance costs for a Tesla Model Y can vary depending on the coverage and the risk associated with the driver. Shopping around for different insurers and adding additional coverage such as gap insurance can help to ensure that the costs remain low. Additionally, maintaining a good driving record is important to ensure that insurance rates remain low.

Insurance Cost For Tesla Model Y

What is Tesla Model Y?

Tesla Model Y is the mid-size electric SUV that is manufactured by Tesla. It is available in two versions, the Long Range and Performance. The Long Range version has an estimated range of 316 miles, while the Performance version has an estimated range of 300 miles. It has a top speed of 150 mph and can accelerate from 0-60 mph in 3.5 seconds. It is a five-seater vehicle and has a roomy interior with plenty of space for all passengers.

What is Insurance?

Insurance is a contract between a policyholder and an insurer. It is designed to protect the policyholder from financial losses due to an accident, illness, or another event. Insurance premiums are usually paid on a monthly or yearly basis, and the amount of the premium is based on the type of coverage and the risk associated with the policyholder.

What is the Insurance Cost for Tesla Model Y?

The cost of insurance for a Tesla Model Y can vary depending on the coverage and the risk associated with the driver. Generally, insurance rates for electric vehicles are lower than for conventional vehicles due to the fact that electric vehicles are less likely to be involved in an accident. The cost of insurance for the Tesla Model Y can be anywhere from a few hundred to a few thousand dollars per year, depending on the coverage and the risk associated with the driver.

What Factors Affect the Cost of Insurance?

There are several factors that can affect the cost of insurance for a Tesla Model Y, including the make and model of the vehicle, the age of the driver, the driving record, and the type of coverage selected. Generally, older drivers with more experience and a good driving record will pay less for insurance than younger, inexperienced drivers. Additionally, the type of coverage selected can also affect the cost of insurance.

How to Get the Best Insurance Rates for Tesla Model Y?

To get the best insurance rates for a Tesla Model Y, it is important to shop around and compare rates from different insurers. It is also important to maintain a good driving record to ensure that insurance rates remain low. Additionally, drivers should consider adding additional coverage such as gap insurance, which can protect against financial losses in the event of an accident or theft.

Conclusion

Insurance costs for a Tesla Model Y can vary depending on the coverage and the risk associated with the driver. Shopping around for different insurers and adding additional coverage such as gap insurance can help to ensure that the costs remain low. Additionally, maintaining a good driving record is important to ensure that insurance rates remain low.

True Monthly cost of a Tesla Model Y - Is it worth it? Insurance

Tesla reduces Model Y prices, now starts below $50,000 - Electrek

Tesla Model Y True Cost Calculator - Teslanomics

China grants Tesla permission to sell Shanghai made Model Y cars in the

How Much Is Tesla Y Insurance - KHOWM