How Much For Car Insurance Per Month

How Much For Car Insurance Per Month?

Do You Really Need Car Insurance?

It is a well-known fact that having car insurance is an absolute necessity in the modern world. After all, you wouldn’t want to be stuck with a huge financial burden just because you inadvertently caused an accident. But what is the exact amount that you need to pay for car insurance per month?

The truth is that the cost of car insurance per month depends on multiple factors such as the type of car you drive, your age, your driving record, the coverage you choose and even the state in which you live. As such, the exact amount you need to pay for car insurance per month may vary from one person to the next.

How Much Does Car Insurance Cost on Average?

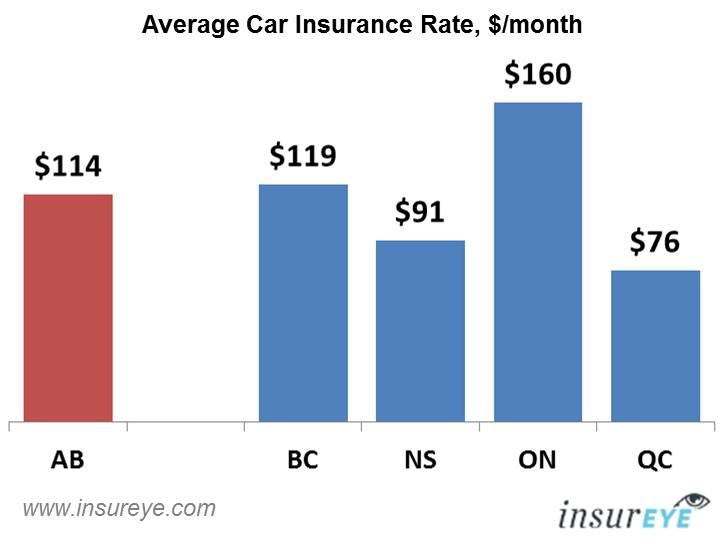

According to the National Association of Insurance Commissioners, the average cost of car insurance per month across the United States is around $135. While this may seem like an excessive amount to pay, it is important to remember that car insurance is designed to protect you from financial losses that may arise from an accident. As such, getting adequate coverage is a must.

Factors that Impact the Cost of Car Insurance Per Month

The cost of car insurance per month may vary based on a variety of factors. For instance, if you drive an expensive car, then you will have to pay more for insurance coverage than someone who drives a regular car. This is because the insurance company has to cover the higher repair costs associated with a more expensive car.

Your age can also impact the cost of car insurance per month. Generally, younger drivers pay more for car insurance because of their inexperience behind the wheel. Additionally, your driving record will also influence the cost of car insurance per month. Drivers with a history of accidents or traffic violations will be charged higher rates than those with a clean record.

Tips to Lower the Cost of Car Insurance Per Month

If you’re looking to lower the cost of car insurance per month, then there are a few simple steps you can take. For instance, you can opt for higher deductibles as this will reduce the amount you have to pay each month for car insurance. Similarly, you can also look into getting discounts from your insurance company for having multiple cars insured with them or for having a good driving record.

In addition, you can also opt for the minimum coverage required by your state. While this may reduce the cost of car insurance per month, it is important to remember that you may be taking on more risk by doing so. As such, it is advisable to get the coverage you need to protect yourself financially.

Conclusion

The cost of car insurance per month can vary significantly based on your driving record, the type of car you drive and the coverage you choose. On average, the cost of car insurance per month across the United States is around $135. However, there are several ways to reduce the cost of car insurance per month such as opting for higher deductibles, getting discounts from your insurance company and opting for the minimum coverage required by your state.

Average Price Of Car Insurance Per Month - designby4d

ALL You Need to Know About the Average Car Insurance Cost

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami

Car Insurance Alberta | Average Rate is $114 per month

Average Monthly Car Insurance Payment / Texas Car Insurance