First And Third Party Cyber Insurance

What is First and Third Party Cyber Insurance?

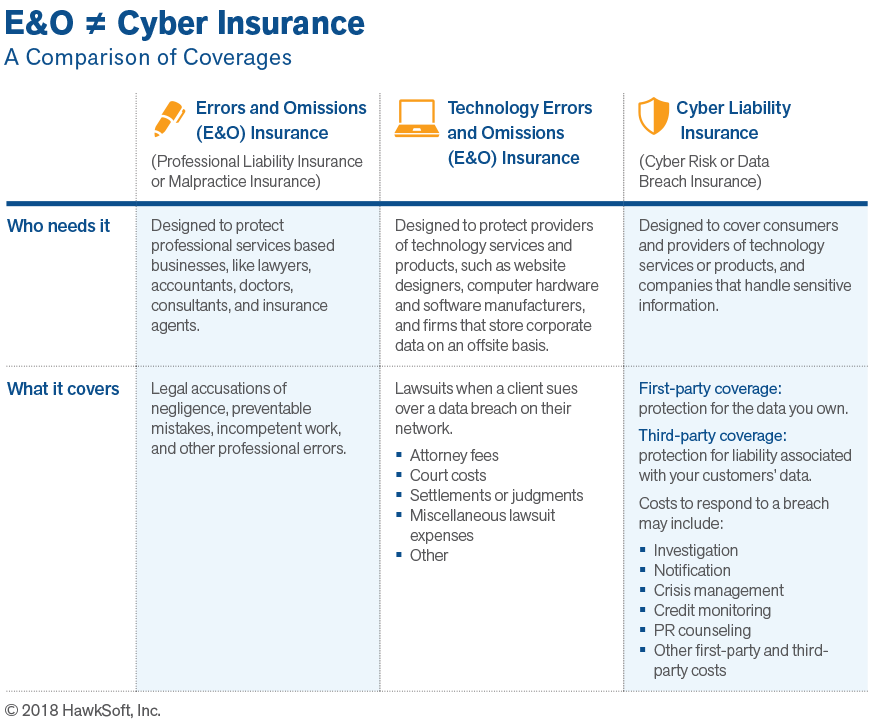

In recent years, cyber security has become a major concern for businesses, large and small. With the prevalence of digital devices and services, the risk of cyber crime has increased, leading to the need for cyber insurance. First and third party cyber insurance are two types of cyber insurance that can help protect businesses from the financial consequences of cyber crime.

First Party Cyber Insurance

First party cyber insurance is a type of insurance that covers the costs associated with a business's own data loss or damage due to a cyber attack. This includes the cost of restoring lost data, notification services, and other costs associated with a data breach. It may also cover the cost of legal fees, if the business is taken to court for negligence in protecting its data.

Third Party Cyber Insurance

Third party cyber insurance is a type of insurance that covers the costs associated with a third-party's data loss or damage due to a cyber attack. This can include the cost of restoring lost data, notification services, and other costs associated with a data breach. It may also cover the cost of legal fees, if the third party is taken to court for negligence in protecting its data.

Difference Between First and Third Party Cyber Insurance

The primary difference between first and third party cyber insurance is the entity that is covered. First party insurance covers the costs associated with a business's own data loss or damage, while third party insurance covers the costs associated with a third-party's data loss or damage. Additionally, first party insurance typically covers the cost of restoring lost data, whereas third party insurance may cover only the cost of notification services.

Benefits of First and Third Party Cyber Insurance

The primary benefit of first and third party cyber insurance is that it can help protect businesses from the financial consequences of cyber crime. This can include the cost of restoring lost data, notification services, and other costs associated with a data breach. Additionally, it may cover the cost of legal fees, if the business or third party is taken to court for negligence in protecting its data.

Conclusion

First and third party cyber insurance can help protect businesses from the financial consequences of cyber crime. First party insurance covers the costs associated with a business's own data loss or damage, while third party insurance covers the costs associated with a third-party's data loss or damage. Additionally, first party insurance typically covers the cost of restoring lost data, whereas third party insurance may cover only the cost of notification services. Overall, first and third party cyber insurance can help businesses protect their data and minimize the financial costs associated with cyber crime.

First-Party vs Third-Party Coverage in Cyber Insurance – Telegraph

First-Party vs Third-Party Cyber Insurance:… | SecurityScorecard

3 things agents should learn about cyber insurance and 4 steps to

First Party और Third Party insurance क्या होता है, दोनों में अंतर तथा लाभ?

All You Should Know About Cybersecurity Insurance