Auto Insurance For Seniors Rates

Auto Insurance Rates for Seniors

What is Auto Insurance For Seniors?

Auto insurance for seniors is a type of insurance policy designed specifically for older drivers. It provides coverage for medical expenses, property damage, and liability that can occur in the event of an accident. Many insurance companies offer special discounts and incentives to seniors who choose to purchase a policy. It is important to understand the different types of coverage available and how they can affect your overall premium rate.

Why Do Seniors Need Auto Insurance?

As we age, we become more susceptible to accidents and injuries. As such, auto insurance is a necessary tool for seniors to protect themselves and their belongings in the event of an accident. Aside from providing financial protection, auto insurance can also help to reduce the cost of medical bills and other expenses related to an accident. Additionally, auto insurance can help to reduce the risk of legal action against you in the event of an accident.

Factors That Impact Auto Insurance For Seniors

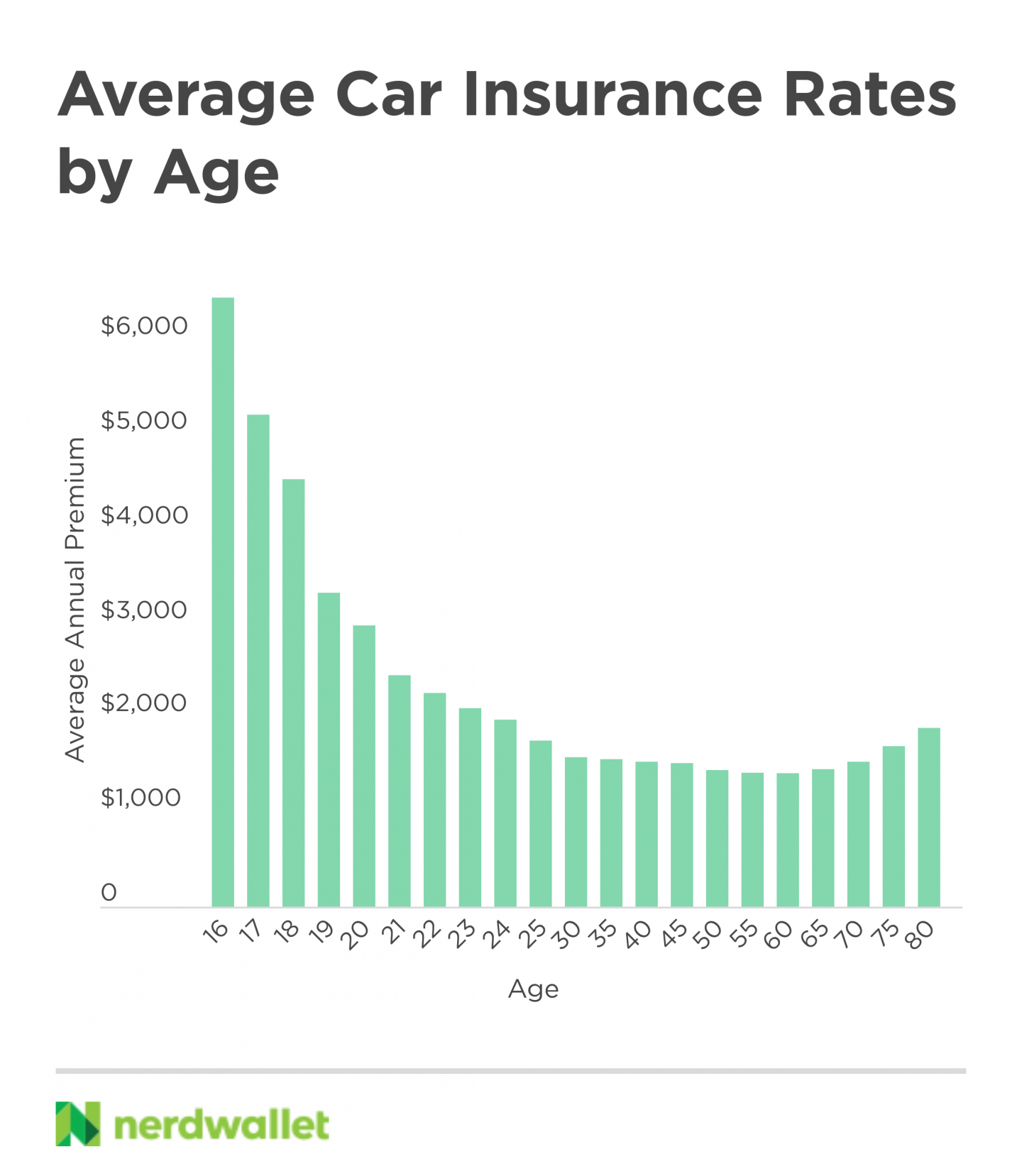

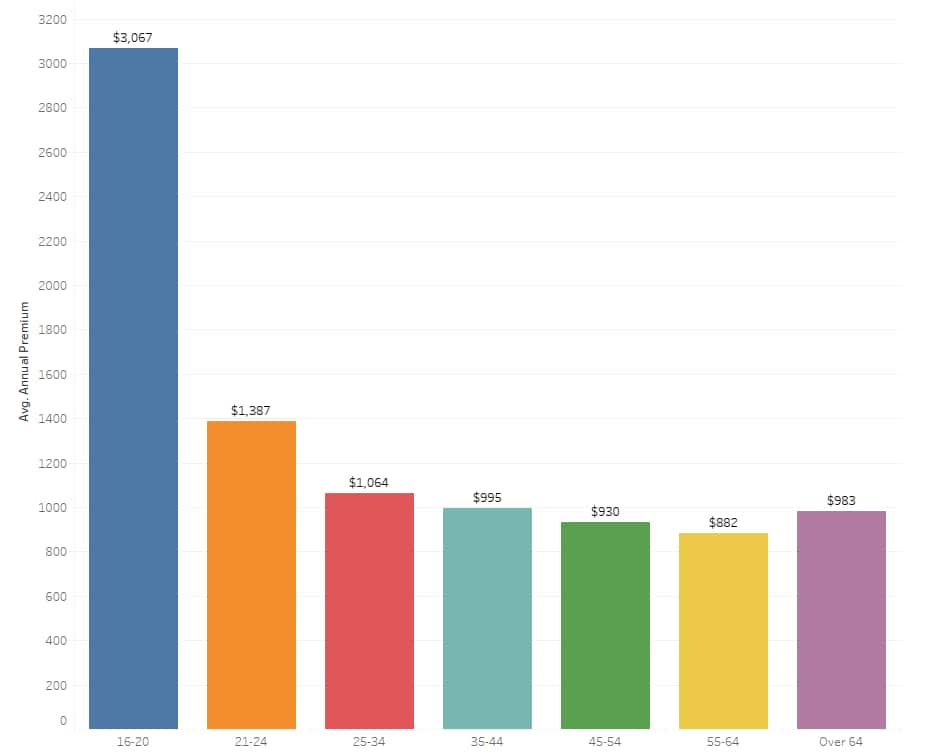

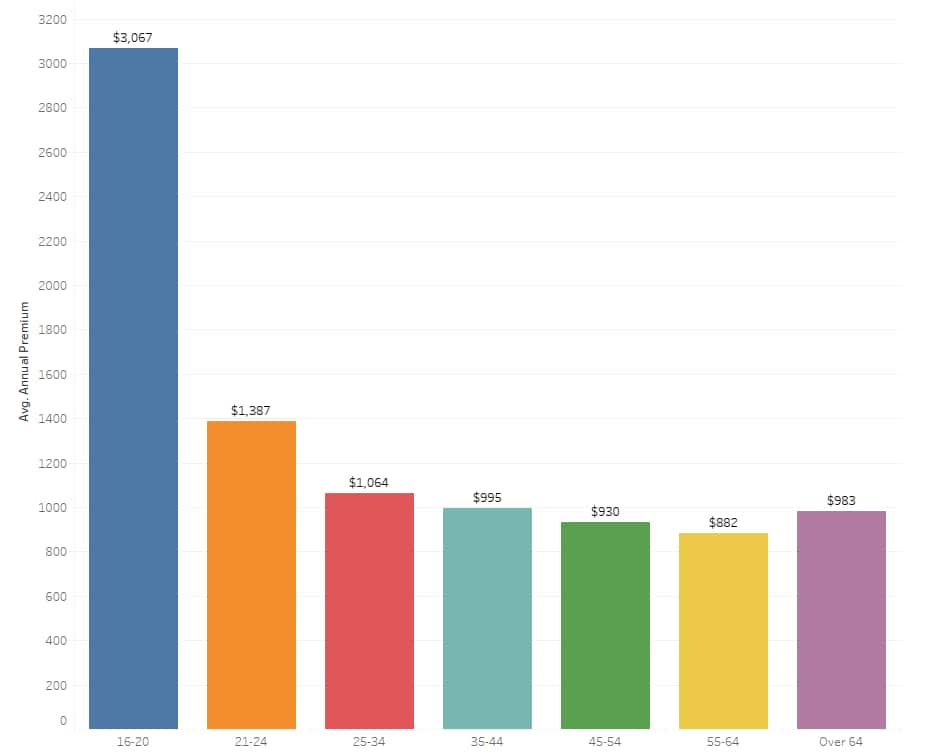

When it comes to auto insurance for seniors, there are a few key factors that will influence the premium rate. These include age, driving history, type of vehicle, and the number of miles driven. Age is the most important factor, as older drivers are seen as a higher risk for insurers. Additionally, a history of safe driving is essential for keeping premiums low. Other factors, such as the type of vehicle you drive and the number of miles you drive, will also impact the cost of your policy.

How To Get The Most Affordable Rate For Seniors

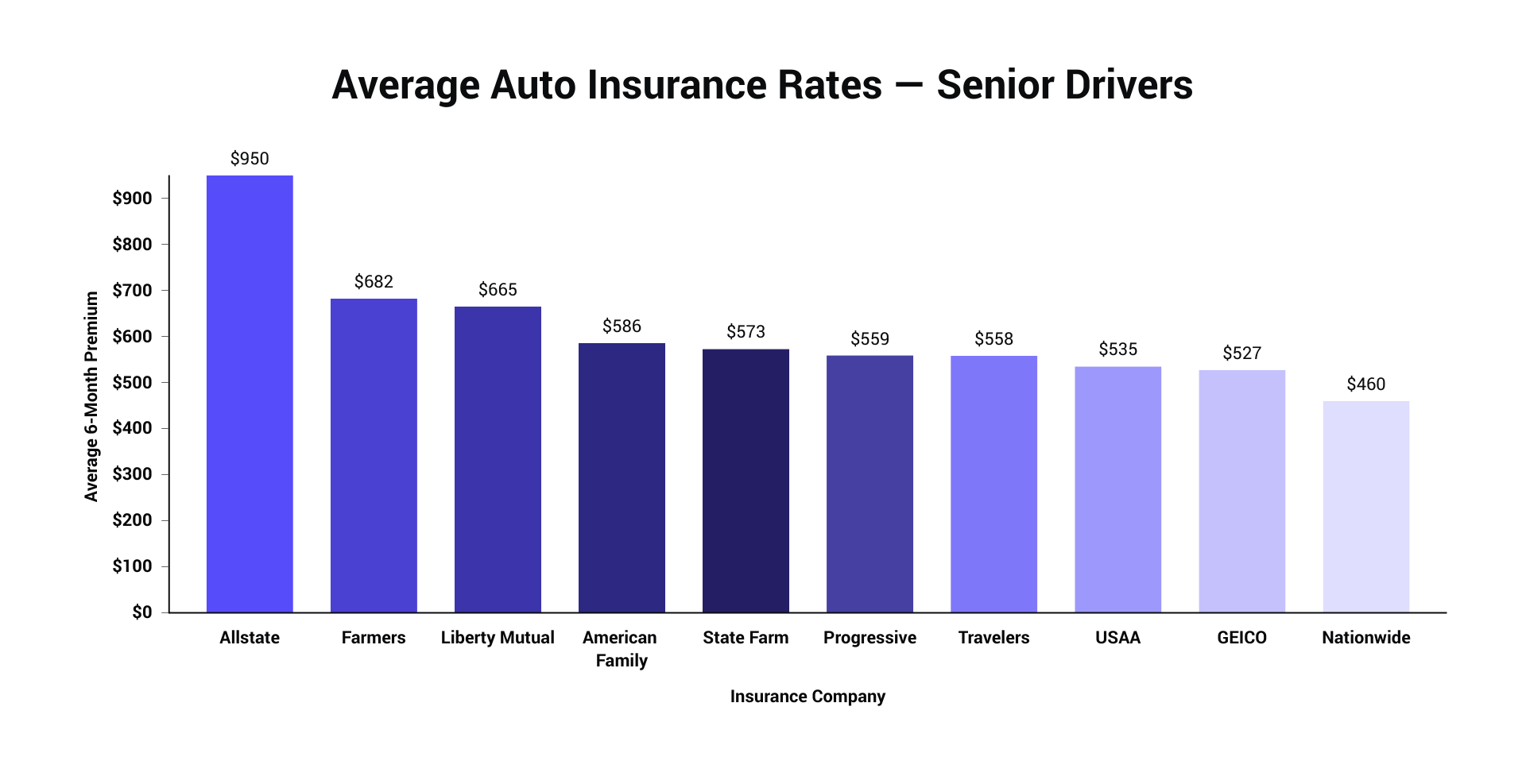

When shopping for auto insurance for seniors, it is important to compare rates from multiple insurers. This will ensure that you get the most affordable rate for your particular needs. Additionally, many insurance companies offer discounts for seniors who take defensive driving courses or maintain good grades in school. Additionally, you can save money on your premium by raising your deductible or taking advantage of any credits offered by your insurer.

What To Look For In A Senior Auto Insurance Policy

When choosing an auto insurance policy for seniors, it is important to understand the key features included in the policy. Look for coverage that includes liability protection, medical payments, and property damage coverage. Additionally, look for a policy that provides adequate coverage for personal belongings and other items that may be damaged or lost in the event of an accident. Finally, make sure that the policy includes a variety of discounts and incentives, as this can help to reduce the overall cost of the policy.

Conclusion

Auto insurance for seniors is a necessary tool for protecting yourself and your belongings in the event of an accident. While the cost of an auto insurance policy for seniors can vary depending on a variety of factors, there are ways to get the most affordable rate. It is important to compare rates from multiple insurers and look for policies that offer discounts and incentives. Additionally, make sure that the policy provides adequate coverage for medical expenses, property damage, and liability.

Auto insurance for seniors: Discounts and tips for saving| Insurance.com

Compare 2021 Car Insurance Rates Side-by-Side | The Zebra

Common Automobile Insurance coverage Charges by Age and Gender

What Is The Cheapest Car Insurance For Seniors - Auto Insurance For

Average Car Insurance Rates by Age and Gender | Urban Wealth Report