Auto Insurance Rates For Senior Citizens

Auto Insurance Rates For Senior Citizens

Auto Insurance Rates for Senior Citizens: A Guide

Auto insurance rates for senior citizens can be expensive, but they don't have to be. With a few simple steps, seniors can save money on their car insurance while still getting the coverage they need. In this guide, we'll look at what factors can affect auto insurance rates for seniors, some tips to lower those rates, and other ways to save on car insurance.

Factors That Affect Auto Insurance Rates for Senior Citizens

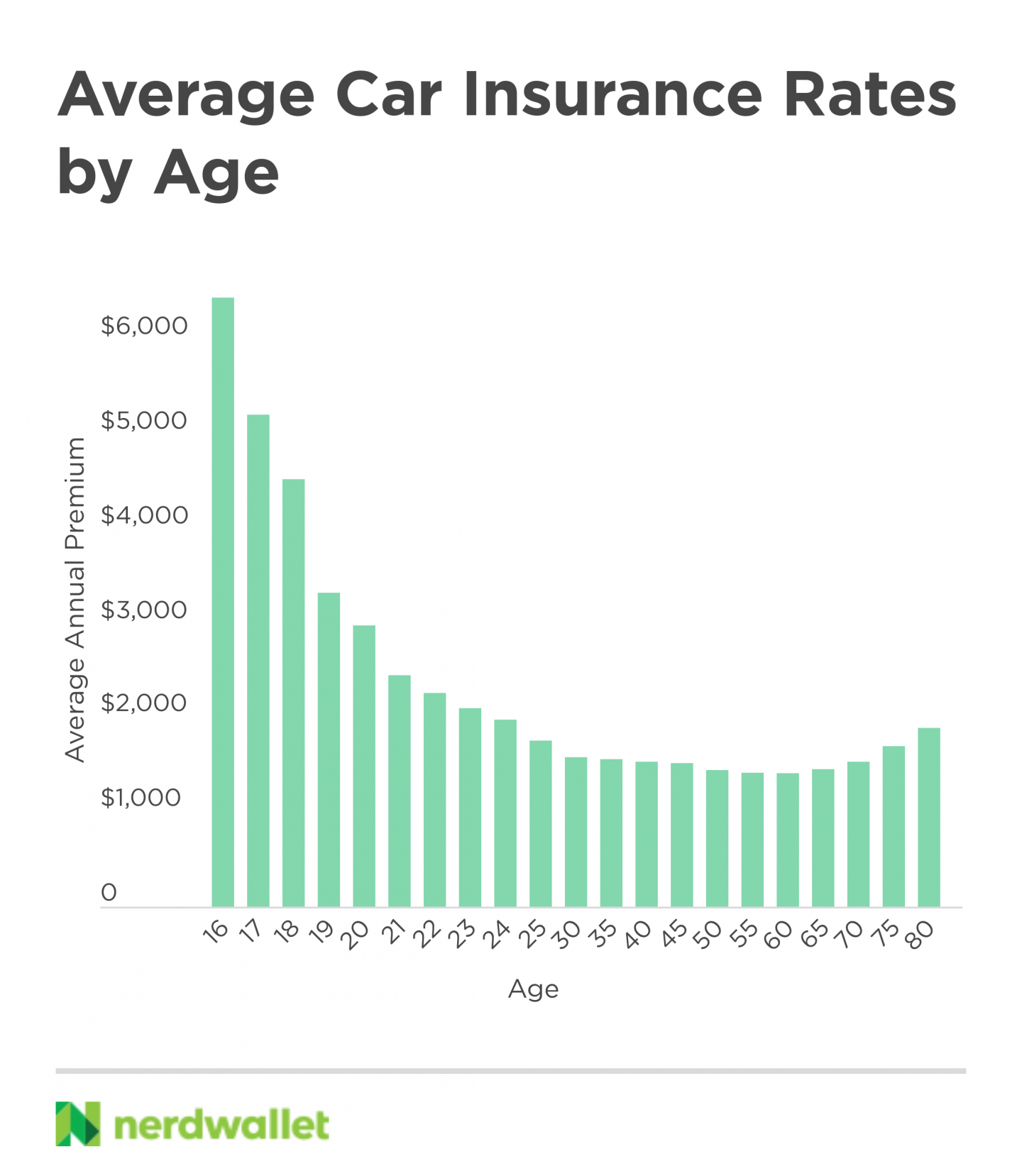

There are a number of factors that can affect auto insurance rates for senior citizens. Age is the most obvious factor, as older drivers tend to be seen as more of a risk by insurers. Additionally, insurers may look at a senior's driving record, credit score, and the type of car they drive. All these factors can affect the cost of auto insurance for seniors.

Age

Age is one of the most significant factors that affects auto insurance rates for senior citizens. As drivers get older, their risk of getting into an accident increases, and their reaction time may not be as fast as younger drivers. This means that insurers may charge higher rates for seniors. However, there are still ways for seniors to keep their rates low.

Driving Record

Insurers look at driving records to determine rates, and this is especially true for senior citizens. If a senior has a good driving record, they may be eligible for discounts or lower rates. On the other hand, if they have a poor driving record, they may be charged higher rates. It's important for seniors to keep their driving record clean in order to get the best rates.

Credit Score

Insurers also look at a senior's credit score when setting rates. A higher credit score can mean lower rates, as it shows that the senior is financially responsible. On the other hand, a lower credit score can lead to higher rates. It's important for seniors to keep their credit score in check in order to get the best rates.

Type of Car

The type of car a senior drives can also affect their auto insurance rates. Generally, luxury or sports cars will have higher rates, while smaller, more fuel efficient cars will have lower rates. It's important for seniors to consider the type of car they drive when shopping for auto insurance.

Tips to Lower Auto Insurance Rates for Senior Citizens

There are a few tips seniors can use to lower their auto insurance rates. One of the most effective is to shop around and compare rates from different insurers. Comparing rates can help seniors find the best deal and get the coverage they need for the lowest possible price. Additionally, seniors should look for discounts that may be available, such as a good driver discount or a multi-policy discount.

Seniors should also consider raising their deductible. A higher deductible means that the senior will have to pay more out of pocket in the event of an accident, but it will also lead to lower rates. It's important to make sure that the senior can afford the higher deductible in the event of an accident.

Other Ways to Save on Auto Insurance for Senior Citizens

In addition to lowering rates, there are other ways seniors can save money on auto insurance. One way is to drop certain coverages, such as collision or comprehensive coverage, if they are not needed. This can help to lower rates, although it may not be a good idea for seniors who are on a tight budget or who drive an expensive car. Additionally, seniors should consider increasing their liability coverage, as this can help to protect them financially in the event of an accident.

Finally, seniors should take advantage of any discounts that may be available. Many insurers offer discounts for seniors, such as a good driver discount or a multi-policy discount. Taking advantage of these discounts can help to lower rates and save money.

Auto insurance rates for senior citizens can be expensive, but they don't have to be. By following the tips outlined in this guide, seniors can save money on their car insurance while still getting the coverage they need.

Best Auto Insurance Rates For Seniors : Best Cheap Ohio State Minimum

Average Car Insurance Rates by Age and Gender | Urban Wealth Report

Cheap Auto Insurance For Senior Citizens -- Guaranteed Full Policy With

Florida Auto Insurance [Rates + Cheap Coverage Guide]

![Auto Insurance Rates For Senior Citizens Florida Auto Insurance [Rates + Cheap Coverage Guide]](https://www.carinsurancecompanies.com/wp-content/uploads/dw/average-monthly-car-insurance-rates-by-age-amp-gender-in-florida-E6lL8.png)

Average Car Insurance Rates by Age and Gender Per Month