30 Day Car Insurance In Michigan

30 Day Car Insurance In Michigan: All You Need To Know

What is 30 Day Car Insurance?

30 Day car insurance in Michigan is a type of short-term auto insurance policy. It is designed to provide you with the necessary coverage for your vehicle for a period of 30 days. This type of policy is a great option for those who need a temporary solution or who don’t want to commit to a long-term policy. 30 day car insurance policies in Michigan are offered by many insurance providers and can be purchased online or through an agent.

Benefits of 30 Day Car Insurance

30 day car insurance in Michigan offers many benefits. It provides coverage for a short period of time so you don’t need to commit to a long-term policy. It also offers flexibility, as you can switch providers or cancel your policy at any time. Additionally, it is often cheaper than a traditional long-term policy and can be tailored to your specific needs. Lastly, it is an easy way to get the coverage you need quickly and easily.

Requirements for 30 Day Car Insurance

In Michigan, you must meet certain requirements in order to qualify for 30 day car insurance. These include having a valid driver’s license, a clean driving record, and proof of valid insurance coverage. Additionally, you must provide proof of financial responsibility, such as proof of income, a credit card, or a bank statement. Finally, you must have a valid vehicle registration and proof of ownership.

Types of 30 Day Car Insurance

In Michigan, there are two types of 30 day car insurance policies: comprehensive and liability. Comprehensive coverage provides protection for your vehicle in the case of theft, vandalism, fire, and other losses. Liability coverage, on the other hand, provides protection for damage you may cause to another person or their property. You can mix and match both types of coverage to create a policy that is tailored to your needs.

Cost of 30 Day Car Insurance

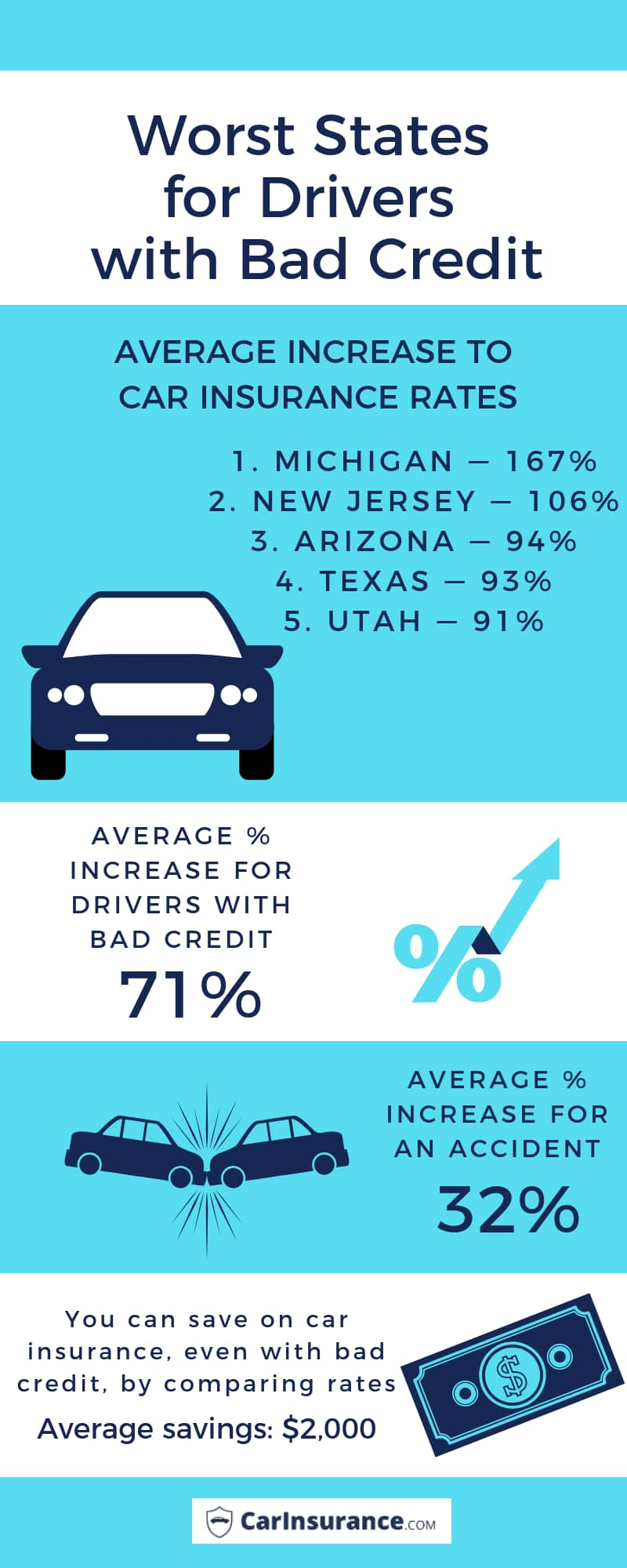

The cost of 30 day car insurance in Michigan will vary depending on the type of coverage you choose and the insurance provider you use. Generally speaking, it is often cheaper than a traditional long-term policy. Additionally, some insurance providers will offer discounts for good driving records, so it is worth shopping around to find the best rate.

How to Get 30 Day Car Insurance in Michigan

You can purchase 30 day car insurance in Michigan online or through an agent. Most insurance providers offer this type of policy and will have an online application process. You will need to provide some basic information such as your driver’s license number, vehicle registration, and proof of financial responsibility. Once you have submitted your application, the provider will review your information and provide you with a quote. Once you have accepted the quote, the insurance policy will be issued and you will be able to start driving with the coverage you need.

30 day car insurance policy

MuskegonPundit: Report: Michigan has most expensive auto insurance in

30 Day Car Insurance with No Deposit to Pay Upfront: Get Instant

How Much Will Michigan Car Insurance Decrease ~ mayoudesign

Car Insurance Michigan - Call 800-998-0662 - YouTube