What Does Ncb Stand For In Car Insurance

What Does Ncb Stand For In Car Insurance?

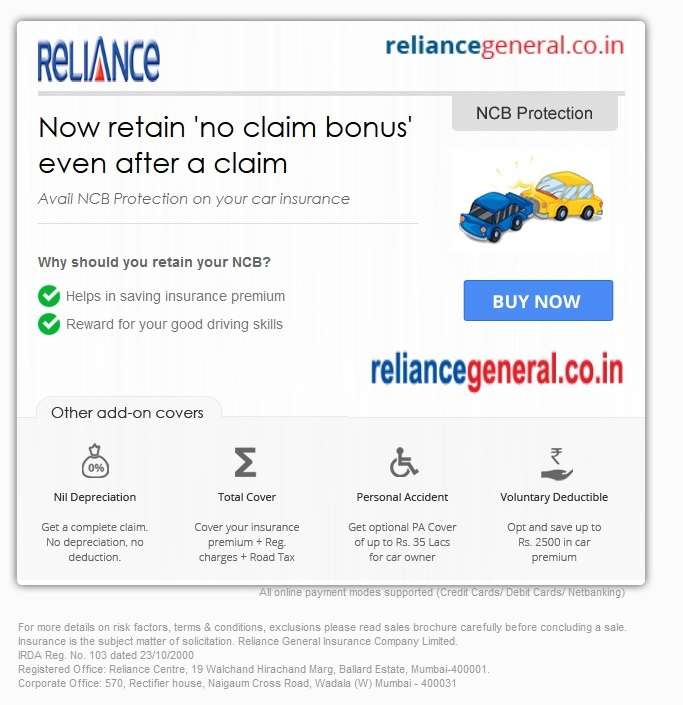

No-Claims Bonus, or NCB, is a type of discount offered to car insurance policyholders who have not made claims on their policy for a certain period of time. Generally, the longer you go without making claims, the more discounts and bonuses you can receive. It is a way of rewarding loyal customers who have been with the same car insurance provider for a long time.

How Does NCB Work?

No-Claims Bonus works by awarding discounts for policyholders who have gone a certain amount of time without making a claim on their car insurance policy. Generally, the longer you go without making a claim, the higher the discount you can receive. For instance, if you have had no claims for 3 years, you may receive a 25% discount. If you have had no claims for 5 years, you may receive a 50% discount.

What Are The Benefits Of NCB?

No-Claims Bonus can offer numerous benefits to car insurance policyholders. Firstly, the longer you go without making a claim, the higher the discount you can receive. This can result in significant savings on your car insurance premiums. Secondly, NCB can also provide peace of mind to policyholders who may worry about making a claim and having their premiums increased. Finally, it can also provide a sense of loyalty between the insurer and policyholder, as the insurer is rewarding the policyholder for their longevity.

What Can Affect My NCB?

There are certain factors that can affect your No-Claims Bonus. Firstly, if you make a claim on your car insurance policy, the amount of discounts you can receive may be reduced. Secondly, if you switch car insurance providers, the amount of discounts you can receive may be reduced. Finally, the amount of discounts you can receive may also be reduced if you have had several minor claims in a short space of time.

How Can I Maximize My NCB?

There are a few steps you can take to maximize your No-Claims Bonus. Firstly, it is important to make sure you have sufficient car insurance coverage for your needs. It is also important to shop around for the best car insurance deal you can find, as this can result in significant savings. Additionally, it is important to be aware of any potential claims you may make, such as a windscreen repair, as some insurers may not count this as a claim. Finally, it is important to stay with the same car insurance provider for as long as possible, as this can result in higher discounts.

Conclusion

No-Claims Bonus can offer numerous benefits to car insurance policyholders, such as significant savings on premiums and peace of mind for policyholders. It is important to be aware of the factors that can affect your No-Claims Bonus, such as making a claim or switching car insurance providers. To maximize your No-Claims Bonus, it is important to shop around for the best deal, be aware of any potential claims you may make, and stay with the same car insurance provider for as long as possible.

Important Things You Need To Know About NCB In Car Insurance

No Claim Bonus/NCB with your Motor Insurance Policy - Reliance General

NCB Protection Cover: A Smart Way to Protect Your Bonuses During Car

What is NCB Certificate? | Insurance Flavor

Car Insurance Ncb Rules - Insurance Reference