The Purpose Of Managed Care Health Insurance Plans Is To

What is Managed Care Health Insurance Plan?

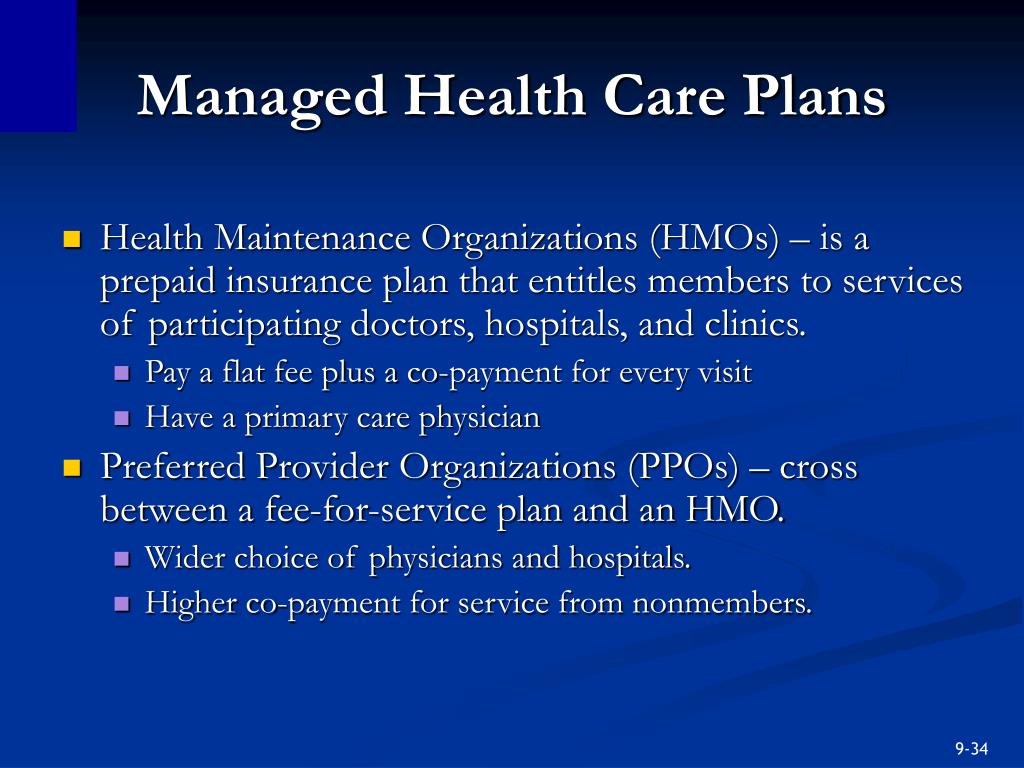

Managed care health insurance plans are designed to provide comprehensive coverage for medical services and treatment. They are typically offered by employers and other health insurance providers, and usually consist of a variety of services including preventive care, hospitalization, specialist visits, and prescription drugs. Managed care plans are designed to provide more comprehensive coverage than traditional health insurance plans, while also helping to control costs.

What is the Purpose of Managed Care Health Insurance?

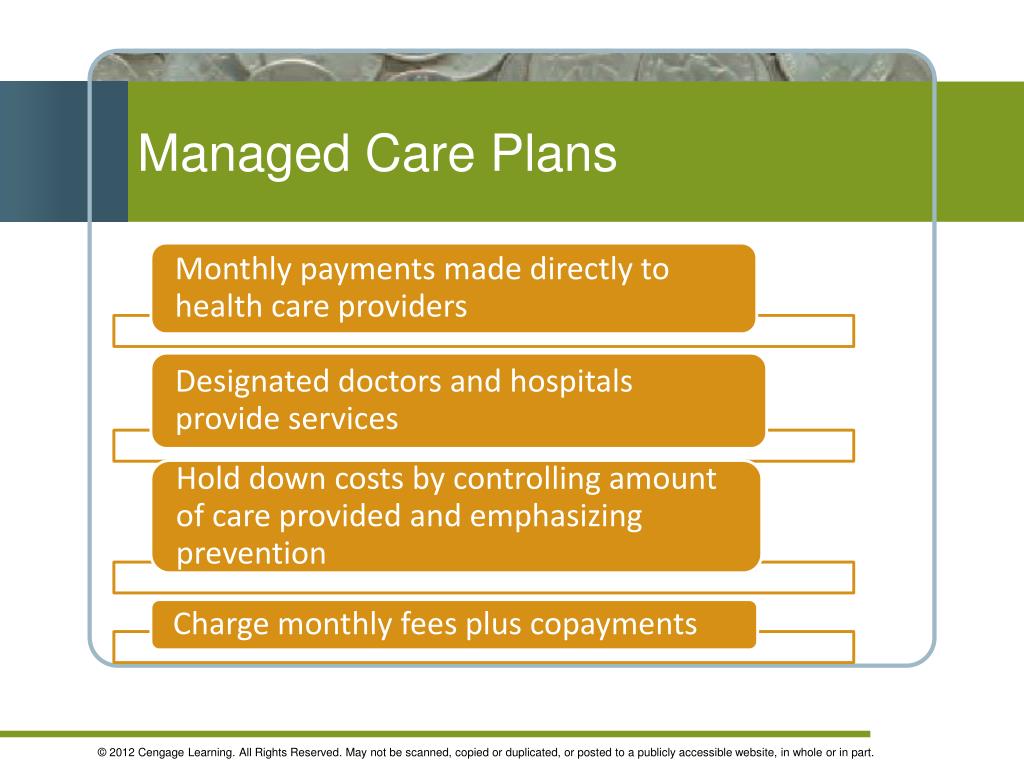

The purpose of managed care health insurance is to provide comprehensive coverage for medical services and treatments while also controlling costs. This can be accomplished by providing preventative care, such as regular check-ups and screenings, as well as hospitalization, specialist visits, and prescription drugs. By providing these services, managed care health insurance plans can help to reduce the overall cost of medical care.

How Does Managed Care Health Insurance Work?

Managed care health insurance plans work by providing comprehensive coverage for medical services and treatments while also controlling costs. This is accomplished by providing preventative care, such as regular check-ups and screenings, as well as hospitalization, specialist visits, and prescription drugs. Depending on the type of plan, the patient may be required to choose their own doctor and/or hospital, or they may have a network of providers that they must use. In some cases, the patient may be required to pay for services out of pocket, but in most cases, the insurance plan will cover the cost.

What Benefits Does Managed Care Health Insurance Provide?

Managed care health insurance plans provide a variety of benefits, including comprehensive coverage for medical services and treatments. They also provide preventive care, such as regular check-ups and screenings, as well as hospitalization, specialist visits, and prescription drugs. Another benefit of managed care plans is that they can help to control costs, as they often have lower premiums than traditional health insurance plans. Additionally, managed care plans may provide discounts on services and treatments, such as lab tests, imaging, and physical therapy.

What Are the Downsides of Managed Care Health Insurance?

The downsides of managed care health insurance plans are that they may limit the choice of doctors and hospitals, and may require the patient to pay for services out of pocket. Additionally, managed care plans may require the patient to get prior authorization for certain services and treatments, which can be time consuming and frustrating. Finally, managed care plans may have higher co-pays and deductibles than traditional health insurance plans.

Conclusion

Managed care health insurance plans can provide comprehensive coverage for medical services and treatments while also helping to control costs. However, they may limit the choice of doctors and hospitals and require the patient to pay for services out of pocket. Additionally, managed care plans may have higher co-pays and deductibles than traditional health insurance plans. Therefore, it is important to consider all of these factors when deciding whether or not to enroll in a managed care plan.

PPT - 7.01: Classify types of health and life insurance and features of

PPT - Chapter 9 PowerPoint Presentation, free download - ID:454787

PPT - Insuring Your Health PowerPoint Presentation, free download - ID

PPT - Indirect Compensation: Benefits PowerPoint Presentation, free

PPT - Managed Care: Defragmenting Health Care? PowerPoint Presentation