How Much Does Full Coverage Car Insurance Cost Typically

How Much Does Full Coverage Car Insurance Cost Typically?

When it comes to driving, full coverage car insurance is one of the most important pieces of protection you can have. While it can be one of the more expensive types of insurance, it provides a lot of peace of mind and can save you from a lot of financial trouble if you're ever in an accident.

What Does Full Coverage Car Insurance Include?

Full coverage car insurance typically includes liability coverage, comprehensive coverage, and collision coverage. Liability coverage is the minimum amount of coverage required in most states, and it pays out when you're at fault in an accident. Comprehensive coverage pays out if your car is damaged due to something other than an accident, such as a natural disaster or theft. Collision coverage pays out if your car is damaged in an accident, regardless of who is at fault.

How Much Does Full Coverage Car Insurance Cost?

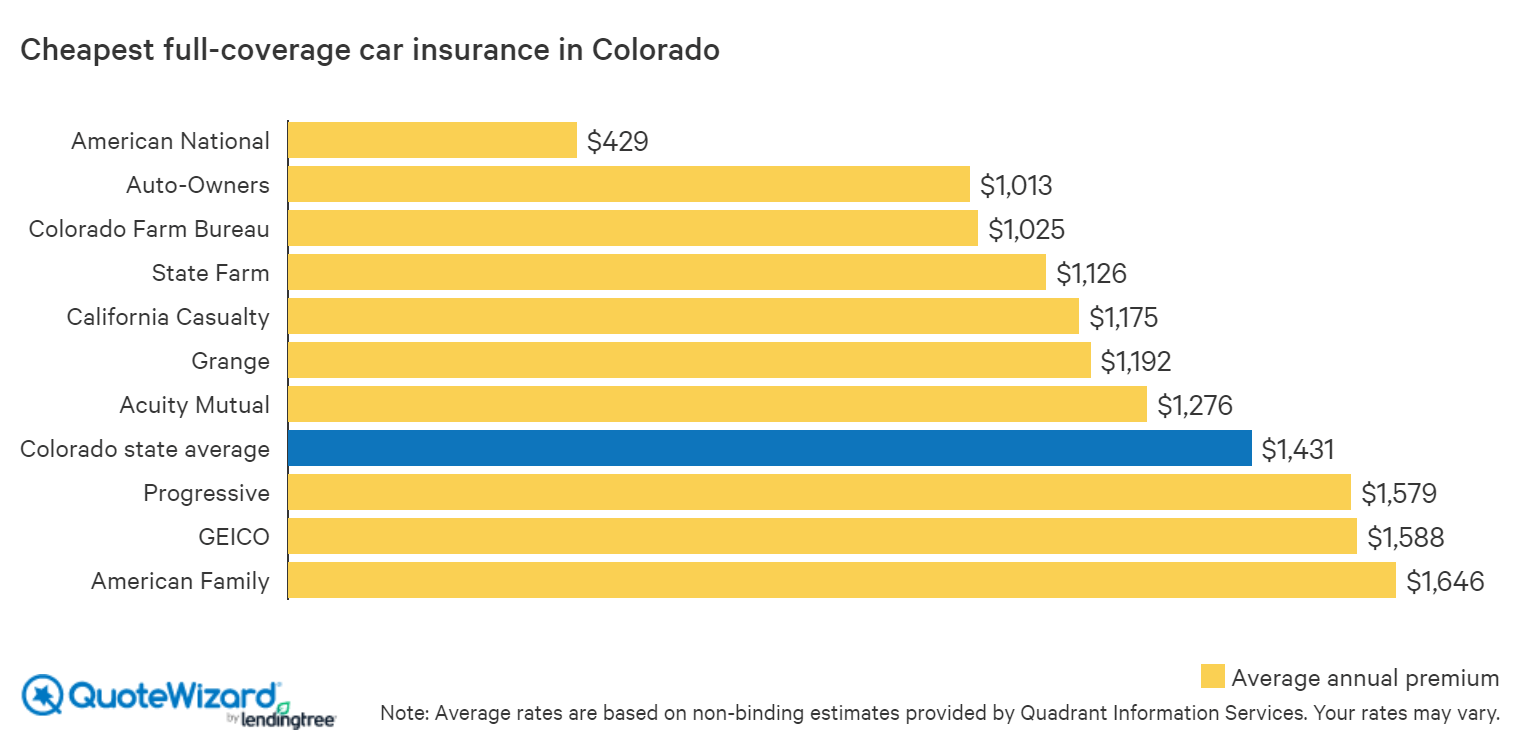

The cost of full coverage car insurance can vary greatly depending on a number of factors, such as your age, driving record, and the type of car you drive. Generally, the average cost of full coverage car insurance is between $1,000 and $2,000 a year, though it can be much higher or lower depending on your individual circumstances. It's important to shop around and compare rates from different insurers to get the best deal.

What Factors Affect the Cost of Full Coverage Car Insurance?

There are a number of factors that can affect the cost of full coverage car insurance, such as your age, driving record, credit score, where you live, and the type of car you drive. Younger drivers, drivers with poor driving records, and drivers with low credit scores typically pay more for full coverage car insurance. The type of car you drive can also have a significant impact on your rates, as some cars are more expensive to insure than others.

How Can I Save Money on Full Coverage Car Insurance?

There are a few ways you can save money on full coverage car insurance, such as by shopping around and comparing rates from different insurers, raising your deductible, and taking advantage of discounts. Many insurers offer discounts for drivers who have good driving records, take defensive driving courses, or install safety devices in their vehicles. Additionally, some insurers offer discounts for members of certain organizations or for drivers who insure multiple vehicles.

Conclusion

Full coverage car insurance is an important form of protection for drivers, and it can be quite expensive. The cost of full coverage car insurance depends on a number of factors, such as your age, driving record, and the type of car you drive. Shopping around and taking advantage of discounts can help you save money on full coverage car insurance.

The average cost of car insurance in the US, from coast to coast

Cheap Car Insurance in North Carolina | QuoteWizard

What is No-Fault Insurance and How Does it Work? | QuoteWizard

What Is The Average Price Of Full Coverage Car Insurance

Tips On Finding The Cheapest Place To Buy Full Coverage Car Insurance