Car Insurance Requirements For Uber

Monday, January 2, 2023

Edit

Uber Drivers: What Car Insurance Requirements Do You Need?

Ridesharing is becoming increasingly popular, and with it comes a new set of rules and regulations. If you’re an Uber driver, you need to make sure you have the right car insurance coverage in place before you start taking on rides.

What Does Uber Require?

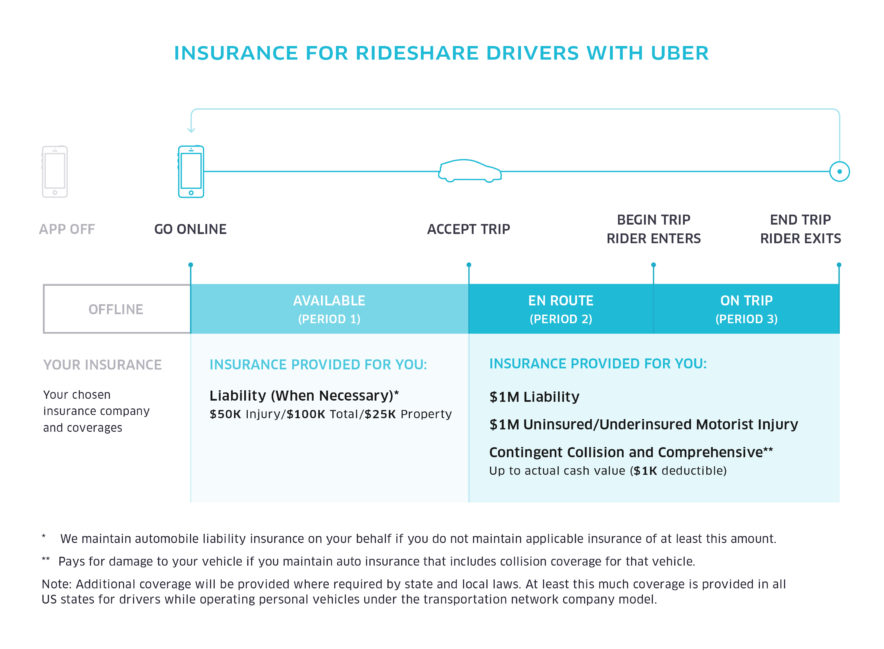

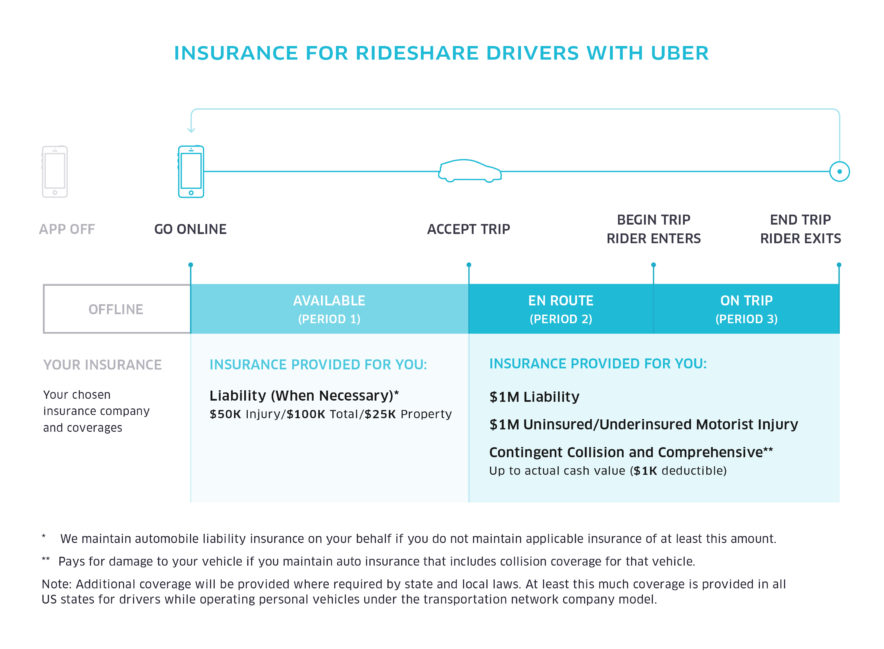

Uber requires all its drivers to have a certain amount of insurance coverage, regardless of the state they’re operating in. This insurance policy must provide coverage for any bodily injury or property damage caused by an accident while the driver is logged into the Uber app. The minimum requirements are:

- Bodily Injury Liability Coverage: $50,000 per person/$100,000 per accident

- Property Damage Liability Coverage: $25,000 per accident

- Uninsured/Underinsured Motorist Coverage: $50,000 per person/$100,000 per accident

- Contingent Comprehensive and Collision Coverage: With a $1,000 deductible

These requirements are the same whether you’re an UberX driver or an UberXL driver. UberXL drivers may need additional coverage, however, depending on the state they’re in.

What If I Already Have Insurance?

If you already have car insurance, you may be able to add a ridesharing endorsement to your policy. This endorsement will provide the coverage you need to comply with Uber’s requirements while you’re logged into the app. However, not all insurance companies offer this endorsement, so you may need to shop around to find one that does.

What If I Don’t Have Insurance?

If you don’t already have car insurance, you’ll need to purchase a policy that meets Uber’s requirements. You may be able to find a policy that’s specifically designed for ridesharing drivers, or you may be able to get a policy with a ridesharing endorsement. Either way, make sure the policy offers the coverage you need to comply with Uber’s requirements.

Do I Need Additional Coverage?

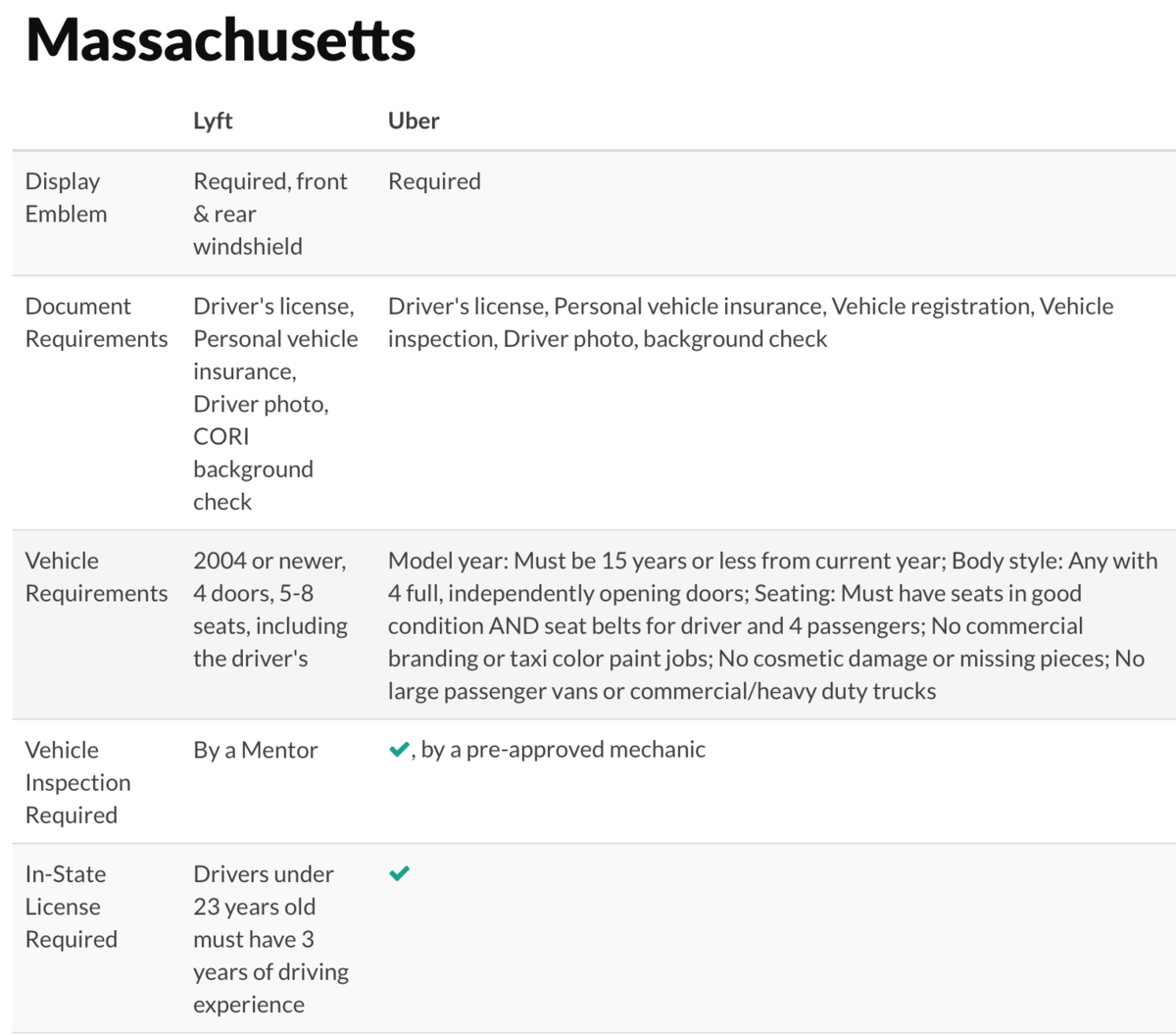

In some states, Uber requires drivers to have additional coverage beyond the minimum requirements. This could include coverage for personal injury protection, medical payments, and more. Be sure to check your state’s requirements before you start driving for Uber.

Conclusion

If you’re planning to become an Uber driver, it’s important to make sure you have the right car insurance coverage in place. Uber requires all its drivers to have a certain amount of coverage, and in some states, additional coverage may be required. If you already have insurance, you may be able to add a ridesharing endorsement. If not, you’ll need to purchase a new policy that meets Uber’s requirements.

Insurance for Ridesharing with Uber, Do you know what coverage you

Uber And Lyft Requirements in Massachusetts: Drivers, Vehicles, And

Uber Insurance Policy Requirements - blog.pricespin.net

48+ Car Insurance Full Coverage Florida - Hutomo Sungkar

What are the Uber Vehicle Requirements? | Uber car, Uber driving, Uber