Bodily Injury And Property Damage Liability

What is Bodily Injury and Property Damage Liability Insurance?

Bodily Injury and Property Damage Liability (BI/PD) insurance is a type of insurance coverage that provides protection against claims resulting from injuries or damage to a third-party's property. It is a type of liability insurance that is often required by law. BI/PD coverage pays out when an insured person is legally liable for physical injuries or property damage caused to another person. It will also pay for the cost of defending a lawsuit brought by the injured party.

What Does Bodily Injury and Property Damage Liability Insurance Cover?

Bodily Injury and Property Damage Liability Insurance covers the cost of damages and/or injuries that may be caused by the negligence of an insured person. This includes medical bills and lost wages for the injured person, as well as repairs and replacement of damaged property. BI/PD insurance also pays for the cost of defending a lawsuit against the insured person.

Who Needs Bodily Injury and Property Damage Liability Insurance?

Bodily Injury and Property Damage Liability Insurance is typically required by law for individuals or businesses that engage in activities that pose a risk of injury or property damage to others. For example, a business that uses heavy equipment that could cause property damage or injury to a third party may be required to carry BI/PD insurance. It is also important for individuals who own or operate motor vehicles to carry this type of insurance in case of an accident.

What Does Bodily Injury and Property Damage Liability Insurance Not Cover?

BI/PD insurance does not cover damages or injuries that are intentionally caused by the insured person. It also does not cover the cost of repairing or replacing property that is owned by the insured person. Additionally, BI/PD insurance does not cover any legal fees that may be incurred by the insured person in defending against a lawsuit.

How Much Does Bodily Injury and Property Damage Liability Insurance Cost?

The cost of BI/PD insurance varies depending on the type of coverage and the risk associated with the activity for which it is being purchased. Generally, the higher the risk, the higher the cost of the insurance. Additionally, the cost of BI/PD insurance can vary from one insurer to another.

Conclusion

Bodily Injury and Property Damage Liability Insurance is an important type of insurance that provides protection against claims resulting from injuries or damage to a third-party's property. It pays for medical bills, lost wages, repairs and replacement of damaged property, and defense costs in a lawsuit. BI/PD insurance is typically required by law for individuals or businesses that engage in activities that pose a risk of injury or property damage to others. The cost of BI/PD insurance varies depending on the type of coverage and the risk associated with the activity for which it is being purchased.

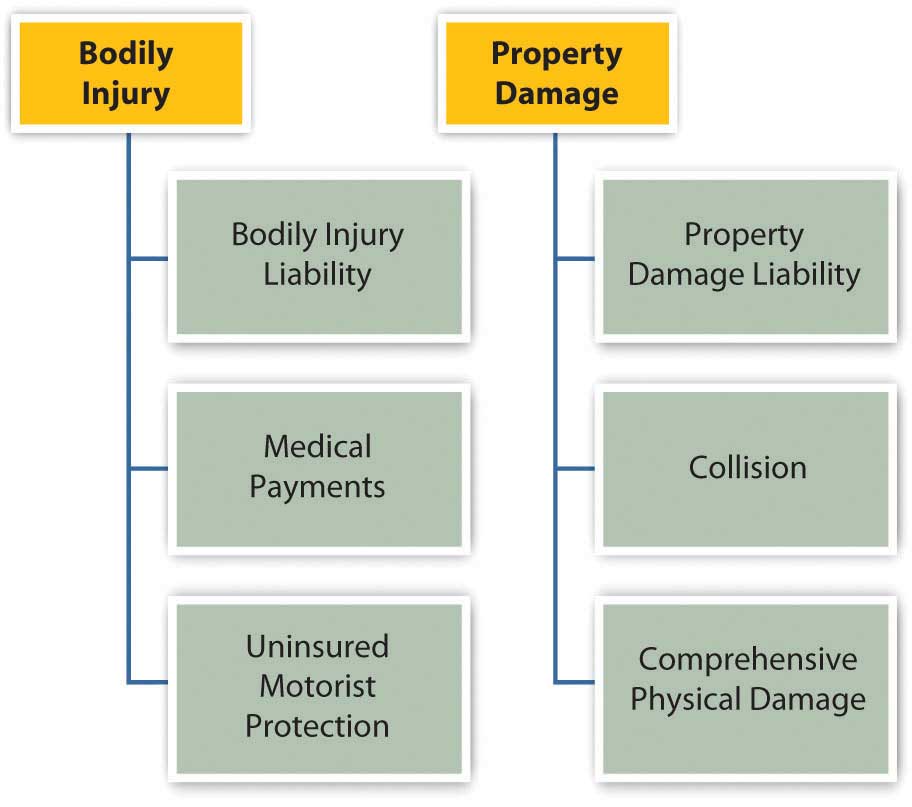

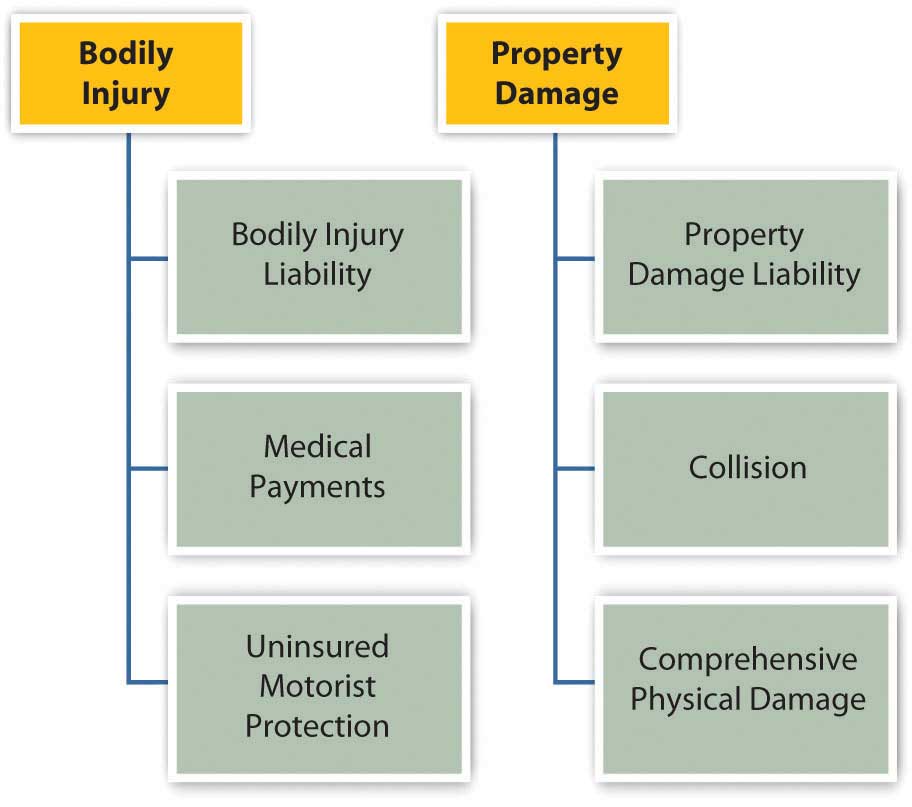

Personal Risk Management: Insurance

Bodily Injury Liability [What does it Cover?] | Ogletree Financial

![Bodily Injury And Property Damage Liability Bodily Injury Liability [What does it Cover?] | Ogletree Financial](https://insurancequotes2day.com/wp-content/uploads/2019/09/liability-limits-by-state.jpg)

Auto insurance final presentation

Bodily Injury & Property Damage Liability - RAELST

There are two main components to Auto Liability: Bodily Injury and