How Many No Fault Insurance States Are There

Thursday, December 15, 2022

Edit

No Fault Insurance States: How Many Are There?

No Fault Insurance is a type of insurance that covers medical bills and other financial losses regardless of who is found to be at fault in an accident. It is an insurance system that was introduced to the US in the 1970s and is currently adopted in 12 states across the country. But what is it exactly, and what states have No Fault Insurance? In this article, we will answer those questions and provide an overview of No Fault Insurance in the US.

What Is No Fault Insurance?

No Fault Insurance is a type of liability insurance that pays for the medical bills and other losses of the policyholder regardless of who was at fault in an accident. This type of insurance is designed to prevent the filing of lawsuits and reduce the costs and delays associated with litigation. It is also intended to reduce the cost of insurance premiums and ensure that all drivers are covered in the event of an accident.

No Fault Insurance is available in two forms: personal injury protection (PIP) and medical payments coverage (MPC). PIP covers medical costs, lost wages, and other expenses associated with an accident, while MPC provides coverage for medical bills, regardless of fault.

What States Have No Fault Insurance?

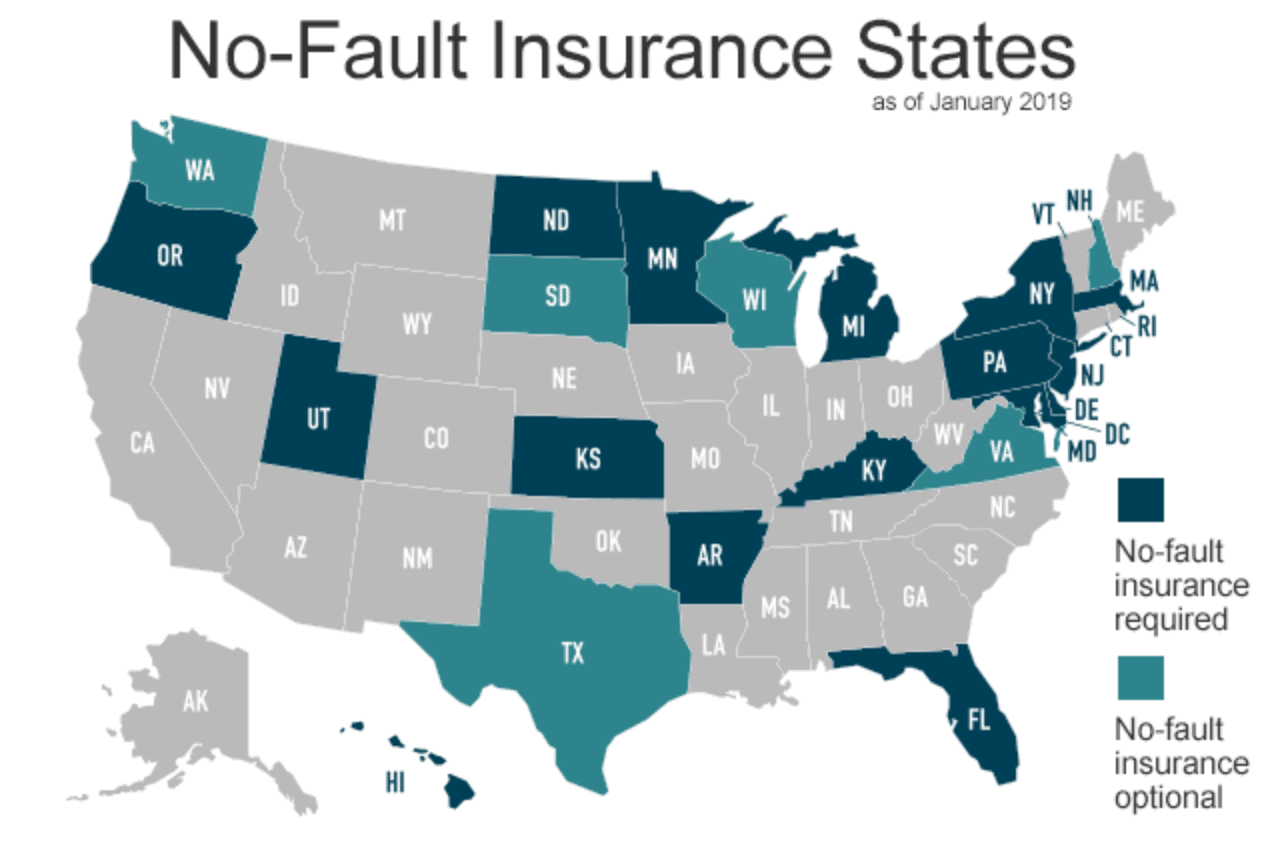

Currently, 12 states across the US have adopted some form of No Fault Insurance. These states include Florida, Michigan, New York, New Jersey, Pennsylvania, Hawaii, Kansas, Kentucky, Massachusetts, Minnesota, North Dakota, and Utah.

In these No Fault Insurance states, drivers must carry PIP and MPC coverage. The minimum required PIP coverage varies from state to state, but the minimum MPC coverage is typically $5,000.

Pros and Cons of No Fault Insurance

No Fault Insurance has both advantages and disadvantages. The main benefit of this type of insurance is that it prevents the filing of lawsuits, which can be expensive and time-consuming. It also reduces the cost of insurance premiums, as drivers do not have to worry about being sued or paying out-of-pocket for medical bills.

However, there are also some drawbacks to No Fault Insurance. First, drivers may not be fully compensated for their losses in some states. Additionally, No Fault Insurance does not cover damage to property, and drivers may still be responsible for paying out-of-pocket for repairs.

Alternatives to No Fault Insurance

If you live in a state that does not have No Fault Insurance, there are still other options available for protecting yourself financially in the event of an accident. Traditional liability insurance is the most common type of coverage, and it covers medical bills and other losses of the other party in an accident. Additionally, uninsured/underinsured motorist coverage can help protect you from drivers who don’t have adequate insurance.

Conclusion

No Fault Insurance is a type of insurance that was introduced in the 1970s and is currently adopted in 12 states across the US. This type of insurance is designed to reduce the costs and delays associated with litigation and ensure that all drivers are covered in the event of an accident. However, there are also some drawbacks to No Fault Insurance, and there are alternatives available for those who live in states without it.

Ultimate Guide to No-Fault Auto Insurance

Out of State Visitors Hurt in Car Accidents in Florida (Settlements)

States With No-Fault Auto Insurance | Reviews.com - Infogram

No Fault States: A Guide to Auto Insurance Regulations

What is No-Fault Insurance and How Does it Work? | QuoteWizard