Car Insurance For Rebuilt Title

Understanding Car Insurance for Rebuilt Title

A rebuilt title can be a tricky thing to manage when it comes to car insurance. Understanding what it means and how it can affect the coverage you get for your car is essential if you want to make sure you get the best coverage for your vehicle. A rebuilt title is one that has been issued to a vehicle that has had significant damage, usually from a crash or other accident. The vehicle has been repaired in a manner that meets the standards of the state where the vehicle is registered, and the title is then issued to indicate that the vehicle is safe to drive.

When it comes to car insurance for vehicles with a rebuilt title, there are a few things to keep in mind. First and foremost, it is important to remember that most insurance companies will not cover a vehicle with a rebuilt title. This is because the vehicle is considered to be a higher risk than one with a clean title, as the damage that was done to the vehicle could have had an effect on its performance or safety. If you are looking for insurance for a vehicle with a rebuilt title, you should expect to pay higher premiums.

Getting Car Insurance for Rebuilt Title

Fortunately, there are some insurance companies that will provide car insurance for vehicles with a rebuilt title. While it is unlikely that you will be able to find a policy that offers the same coverage as a policy for a vehicle with a clean title, you may be able to get a policy that provides some coverage. It is important to shop around and compare quotes from different insurers to find the best deal on car insurance for a vehicle with a rebuilt title.

When shopping for car insurance for a vehicle with a rebuilt title, it is important to keep in mind that the type of coverage you choose will depend on the type of damage that was done to the vehicle. For example, if the vehicle was in a major accident, you may need to consider comprehensive coverage. This type of coverage will provide protection for any damage that may occur to the vehicle, even if it was not caused by an accident. If the vehicle was only slightly damaged, you may be able to get a policy that only provides liability coverage.

Know Your Rights

It is also important to understand your rights when it comes to car insurance for a vehicle with a rebuilt title. If an insurance company denies your claim or refuses to provide coverage for a vehicle with a rebuilt title, you may be able to file a complaint with your state’s insurance department. This will allow you to get the coverage you need and ensure that the insurance company is following the law.

When it comes to car insurance for a vehicle with a rebuilt title, it is important to understand the risks that come with the territory. A vehicle with a rebuilt title is considered to be a higher risk than one with a clean title, so it is important to make sure you are getting the best coverage for your vehicle. Shopping around and comparing quotes from different insurers is the best way to find the right policy for your vehicle.

flowerdesignersnyc: What Is A Rebuilt Car Title

美國加拿大購車注意要點及車輛歷史報告 - 璟上國際有限公司

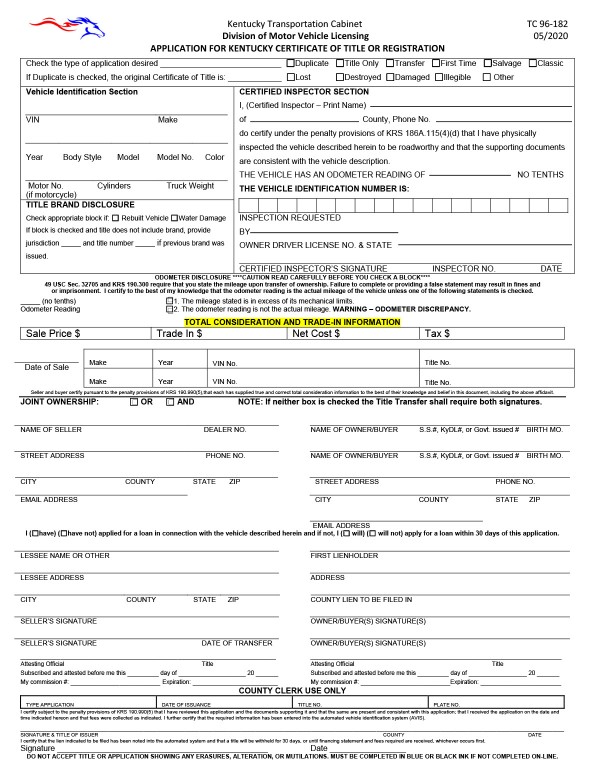

Rebuilt Title Cars For Sale In Ky / Salvage Cars For Sale - For more

Title Information - EasyCare Midwest

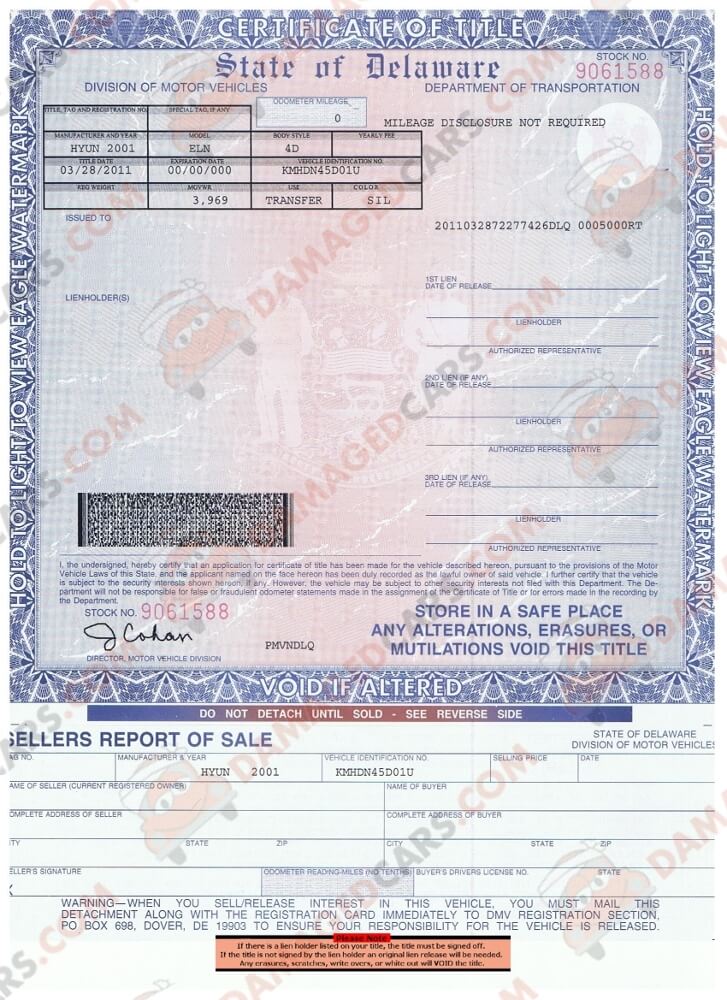

Delaware Car Title - How to transfer a vehicle, rebuilt or lost titles.