Cheap Liability Car Insurance In Pa

Cheap Liability Car Insurance In Pa – The Ultimate Guide

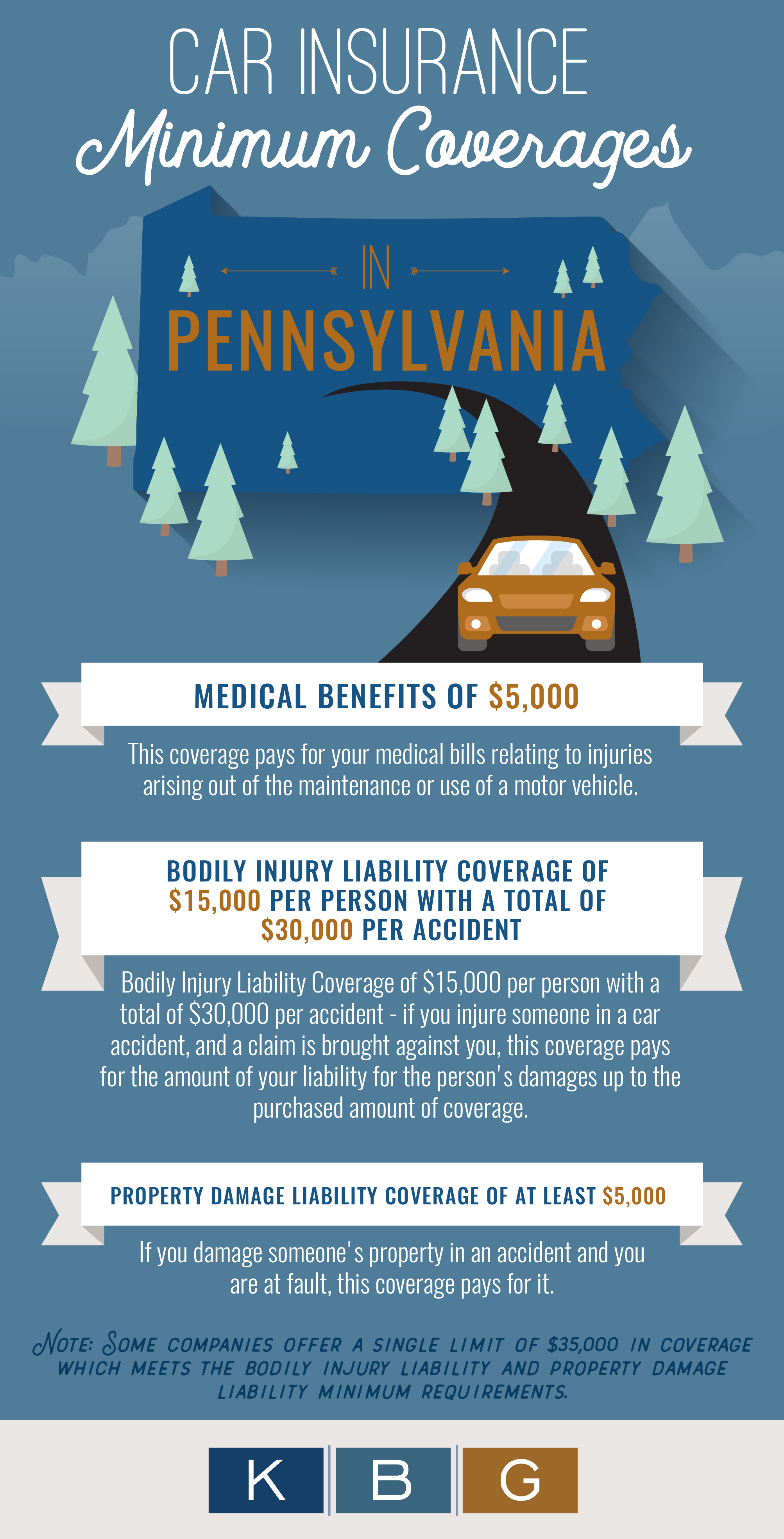

When it comes to finding cheap liability car insurance in Pennsylvania, there are a few things you should know. Liability car insurance is a type of insurance that covers you financially if you are found at fault in an auto accident. It pays for the medical expenses and damage to property of other people in the accident, but not for your own medical expenses or damage to your vehicle. It is important to understand what liability car insurance covers and how much coverage you need, in order to ensure that you get the best deal.

The Benefits of Liability Car Insurance

The primary benefit of liability car insurance is that it can save you money in the long run. If you are found at fault in an accident, the costs of repairs and medical bills can be very expensive. Liability car insurance can help you cover these costs, so you don’t have to take out a loan or use your own money to pay for them. Additionally, liability car insurance can help protect you from other drivers who might not be insured, so you don’t have to foot the bill if they are at fault.

Tips for Finding Cheap Liability Car Insurance in Pa

The first step to finding cheap liability car insurance in Pennsylvania is to shop around. Different insurance companies offer different rates and different levels of coverage, so it’s important to compare prices and coverage levels. Additionally, it’s a good idea to look for discounts. For example, some insurance companies offer discounts to drivers with good driving records, or to drivers who have taken defensive driving courses. Additionally, some insurance companies offer discounts to drivers who purchase multiple types of insurance policies from them.

Consider Your Deductible

Another way to save money on liability car insurance in Pennsylvania is to consider your deductible. A deductible is the amount of money you are willing to pay out of pocket before your insurance kicks in. The higher your deductible, the lower your premium will be. However, it’s important to make sure that you can afford to pay your deductible in the event of an accident. Otherwise, you might end up in financial trouble.

Consider an Umbrella Policy

Finally, you might want to consider an umbrella policy. An umbrella policy provides additional coverage above and beyond what your regular liability car insurance covers. This can be a great way to make sure you are adequately covered in the event of a major accident. However, it’s important to make sure that you understand the terms and conditions of the policy, as well as the coverage limits, before you purchase it.

Finding cheap liability car insurance in Pennsylvania can be a challenge, but it is possible. By shopping around, taking advantage of discounts, and considering an umbrella policy, you can save money on your car insurance and protect yourself financially in the event of an accident.

Cheap Car Insurance Pa - Insurance Reference

Liability Car Insurance Pa - ericrdesign

Cheap Full Coverage Car Insurance Pa - change comin

Page for individual images - QuoteInspector.com

Top 8 Best Car Insurance Philippines 2021 - Classification and Reviews