Can I Add Home Rental Insurance To My Geico Quote

Can I Add Home Rental Insurance To My Geico Quote?

When you rent a home, one of the most important decisions you need to make is whether or not to purchase renters insurance. Although renting a home comes with some built-in protection, it doesn’t always provide enough coverage to protect your possessions. That’s why many renters choose to add a rental insurance policy to their Geico quote. But is it really worth the extra expense?

What Does Home Rental Insurance Cover?

A home rental insurance policy is designed to provide protection for all of the possessions inside your rented home. This includes furniture, electronics, jewelry, clothing, and any other items of value. In addition, most policies also provide liability protection in case someone is injured while visiting your home. This means that if someone trips and falls on your property and is injured, you won’t have to worry about footing the bill for their medical expenses.

Do I Really Need Home Rental Insurance?

It’s not always necessary to purchase a home rental insurance policy. However, if you’re renting an expensive home in an area prone to natural disasters, you may want to consider adding this type of coverage to your Geico quote. This is because your landlord’s insurance policy is unlikely to cover natural disasters such as floods and earthquakes. So if you live in a flood zone or an area prone to earthquakes, it’s definitely a good idea to purchase a home rental insurance policy.

Can I Add Home Rental Insurance To My Geico Quote?

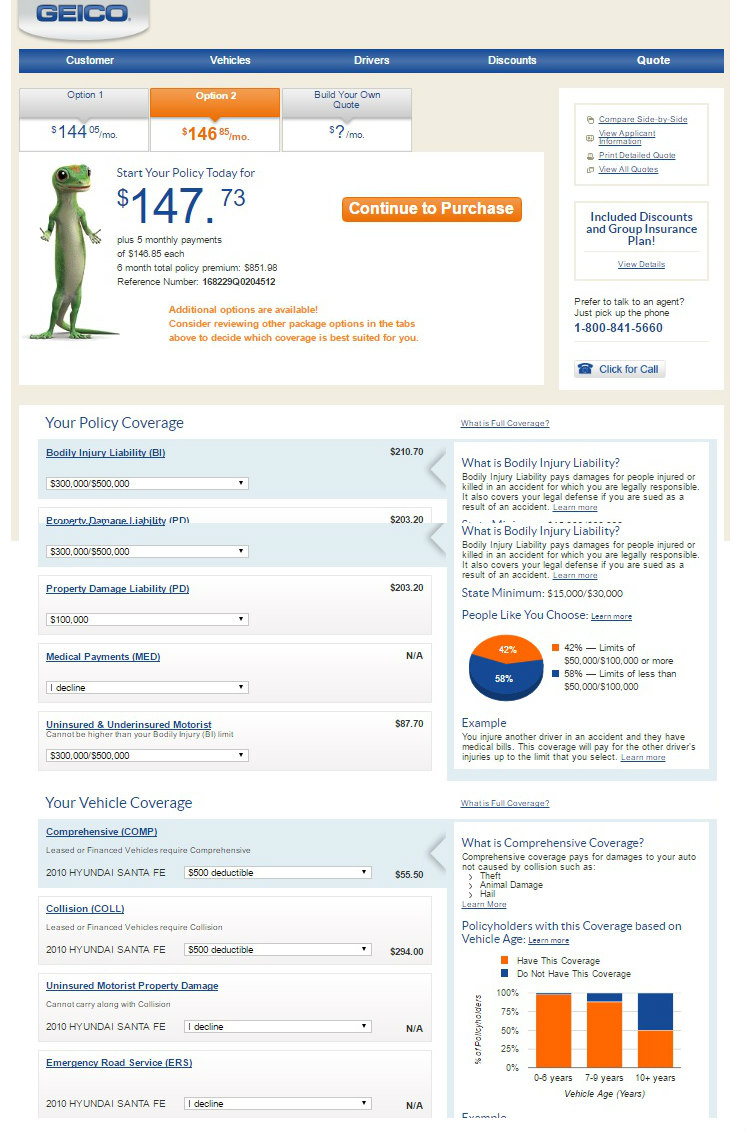

Yes, you can add home rental insurance to your Geico quote. Geico offers a variety of rental insurance policies, so you can choose the one that best suits your needs. These policies are usually very affordable, so you won’t have to worry about breaking the bank to protect your possessions. Plus, Geico offers discounts for bundling rental insurance with your auto insurance policy, so you may even be able to save a little money in the process.

How Much Does Home Rental Insurance Cost?

The cost of home rental insurance varies depending on a number of factors, such as the value of your possessions, the area you live in, and the amount of coverage you choose. Generally speaking, you can expect to pay anywhere from $10 to $30 per month for a basic policy. However, if you need more coverage, you may have to pay a bit more. It’s important to make sure you get enough coverage to protect all of your possessions, so make sure you get several quotes before making a decision.

Conclusion

Renters insurance is an important component of any rental agreement. It provides you with the peace of mind that comes with knowing your possessions are safe, even in the event of a natural disaster or other unexpected event. Fortunately, Geico makes it easy to add rental insurance to your quote. All you have to do is contact a Geico representative to discuss your coverage options and get a quote for a home rental insurance policy.

Geico Quote - How to Access Geico Auto Insurance Quote - Kikguru

geico home insurance review 2020 beware before you buy in 2020 | Home

Fast and Free Geico Vacant Home Insurance Quotes Online

Geico Insurance Quote View And Compare Geico,insurance,co On Yahoo Finance.

Car Insurance Quotes | Lowest Auto Insurance Rates | Cheapest Policy