Buying A Car Gap Insurance

Buying A Car Gap Insurance - What You Need to Know

What is Gap Insurance?

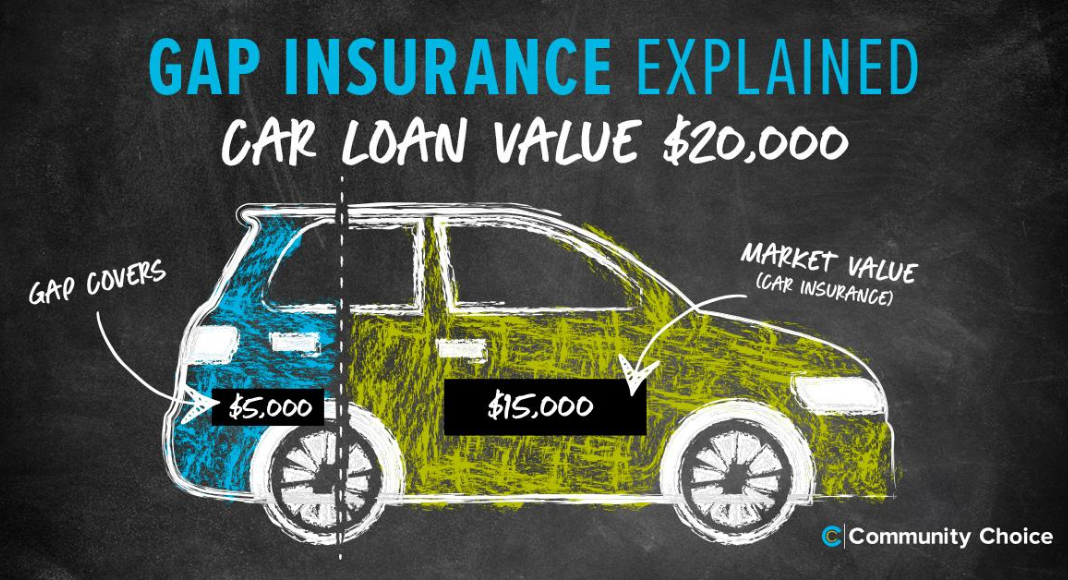

Gap insurance, also known as loan/lease gap coverage, is a type of insurance that covers the difference between the amount of money you owe on a vehicle loan or lease and the amount that your car insurance would cover if the vehicle were to be totaled or stolen. Gap insurance is most commonly purchased when a person takes out a loan or lease on a vehicle. In the event of an accident or theft, gap insurance helps to bridge the gap between what you owe on the vehicle and the amount that the insurance company pays out on the claim.

When is Gap Insurance Necessary?

Gap insurance is necessary when the amount that you owe on the vehicle is more than the actual cash value (ACV) of the vehicle. The ACV is the market value of the vehicle at the time of the loss or theft and is determined by the insurance company. If the ACV is less than what you owe on the vehicle, then you would be responsible for the remaining balance of the loan or lease after the insurance company pays out. Gap insurance helps bridge this gap by paying the difference.

What Does Gap Insurance Cover?

Gap insurance typically covers the difference between the amount of money you owe on a vehicle loan or lease and the amount that your car insurance would cover if the vehicle were to be totaled or stolen. This coverage may also include other expenses such as a down payment, taxes and fees, the cost of an extended warranty, and other items that may be included in the loan or lease agreement.

What Does Gap Insurance Not Cover?

Gap insurance does not cover any damage to the vehicle caused by an accident. It also does not cover any personal items that may have been in the vehicle at the time of the accident or theft. Gap insurance also does not cover any late payments or penalties associated with the loan or lease agreement.

How Much Does Gap Insurance Cost?

The cost of gap insurance depends on the amount of coverage you purchase and the type of vehicle you own. Gap insurance can cost anywhere from a few hundred dollars to a few thousand dollars, depending on the amount of coverage you purchase. Most lenders require you to purchase gap insurance when you finance a vehicle. However, it is important to shop around to get the best deal on gap insurance.

Should You Buy Gap Insurance?

Whether or not you should buy gap insurance depends on your individual situation. If you have a loan or lease on a vehicle, it is likely that you will need to purchase gap insurance. If you are purchasing a new car or a car with a high value, it is also a good idea to purchase gap insurance. Gap insurance can help you protect yourself from financial loss in the event of an accident or theft, so it is important to consider purchasing gap insurance if you are financing a vehicle.

Gap Insurance For Cars Is It Worth It - Is Car GAP Insurance Worth It

What to Consider When You Buy a Car from Community Choice

What is gap insurance and do I need it for my car? | Atlanta Insurance

Buying a Car: When Should You Buy GAP Insurance? - Autotrader

Buying a new car? Then read about the benefits of GAP insurance