Can You Insure Your Home For More Than It 39

Tuesday, November 15, 2022

Edit

Can You Insure Your Home For More Than It 39?

What Is Home Insurance?

Home insurance is a type of insurance that provides coverage for your home and its contents. It helps to protect you from unexpected financial losses due to damage to your home and its contents caused by accidents, natural disasters, theft, and other covered events. It also provides liability coverage if you or your family members are found to be responsible for any damage to another person or property. Home insurance typically includes coverage for the structure of your home, personal property, liability, and additional living expenses if you are forced to leave your home due to a covered event.

Can You Insure Your Home For More Than It 39?

The answer is yes, you can insure your home for more than it is worth. This is known as “guaranteed replacement cost” coverage. This type of coverage pays to repair or rebuild your home to its current market value, regardless of the replacement cost. It is important to note that this coverage is typically more expensive than the standard replacement cost coverage, but it is an important form of protection for homeowners.

What Are the Benefits of Guaranteed Replacement Cost Coverage?

Replacement cost coverage is a great way to ensure that your home is fully protected in the event of a covered loss. It guarantees that you will receive the full cost of replacing your home and its contents, regardless of the current market value. This type of coverage also provides peace of mind, knowing that you are fully protected in the event of a disaster.

What Are the Downsides of Guaranteed Replacement Cost Coverage?

The primary downside of guaranteed replacement cost coverage is the higher cost. This type of coverage is typically more expensive than the standard replacement cost coverage, so it is important to weigh the pros and cons before deciding on which type of coverage is best for you. In addition, it is important to make sure that you are adequately insured to cover the full cost of replacing your home and its contents.

What Should I Do if I Want to Get Guaranteed Replacement Cost Coverage?

If you are interested in getting guaranteed replacement cost coverage, it is important to speak to your insurance agent. They will be able to explain the coverage in detail, as well as help you determine how much coverage you need to adequately protect your home and its contents. It is also important to shop around and compare quotes to ensure that you are getting the best coverage at the best price.

Conclusion

Guaranteed replacement cost coverage is a great way to ensure that your home and its contents are fully protected in the event of a covered loss. It is typically more expensive than the standard replacement cost coverage, so it is important to weigh the pros and cons before deciding on which type of coverage is best for you. It is also important to speak to your insurance agent and shop around to ensure that you are getting the best coverage at the best price.

How Can You Insure My Home For More Than It's Worth

Can you over insure your home? | Insurance MD & DE

Can You Insure An Unoccupied Home - WOPROFERTY

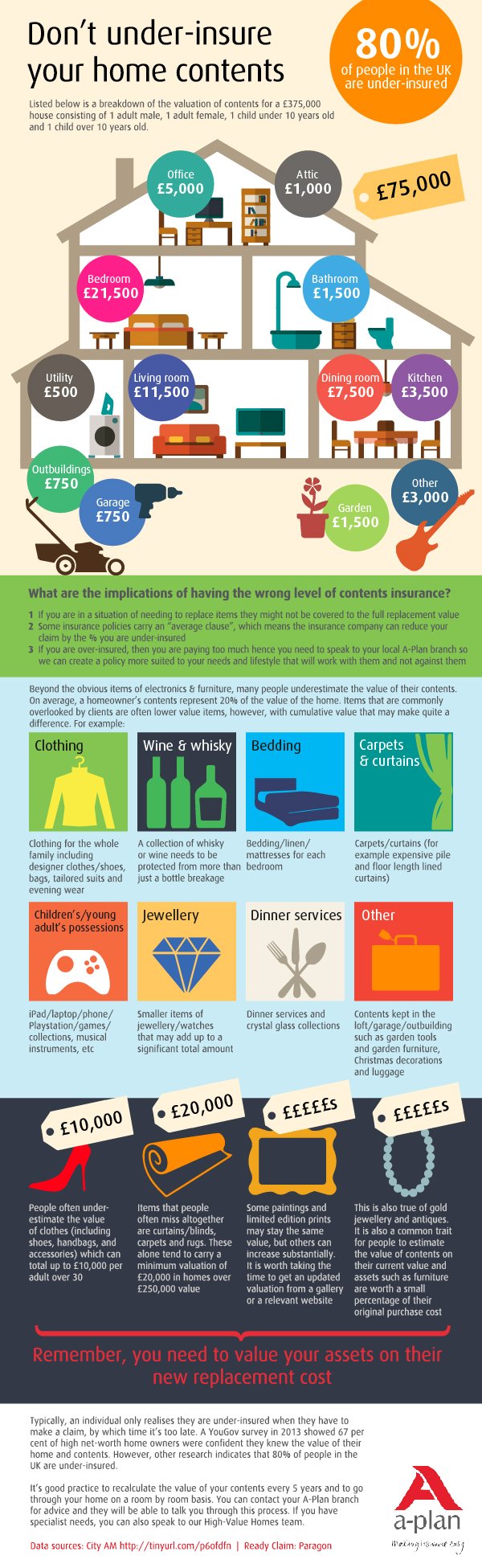

Infographic: Don’t under-insure your home contents - A-Plan Insurance

Does Aaa Insure Homes - jb4designs