Average Car Insurance Cost Pa Per Month

Monday, November 21, 2022

Edit

Average Car Insurance Cost Per Month in Pennsylvania

Introduction to Car Insurance in Pennsylvania

Car insurance is an important part of owning a vehicle. It protects you and your car in the event of an accident or other unforeseen circumstances. In Pennsylvania, all drivers are required to carry a minimum amount of car insurance. The minimum coverage requirements vary by state, but in Pennsylvania, you must carry at least $15,000 per person and $30,000 per accident in bodily injury liability coverage, as well as $5,000 in property damage liability coverage. You may also be required to carry additional coverage, such as uninsured motorist coverage and personal injury protection.

Average Cost of Car Insurance in Pennsylvania

The cost of car insurance in Pennsylvania varies from driver to driver based on factors such as age, driving record, credit score, and the type of vehicle being insured. According to the Insurance Information Institute, the average cost of car insurance in Pennsylvania for a full coverage policy is $1,630 per year, or about $135 per month. This is slightly lower than the national average, which is $1,671 per year, or about $139 per month.

Factors that Affect Car Insurance Premiums

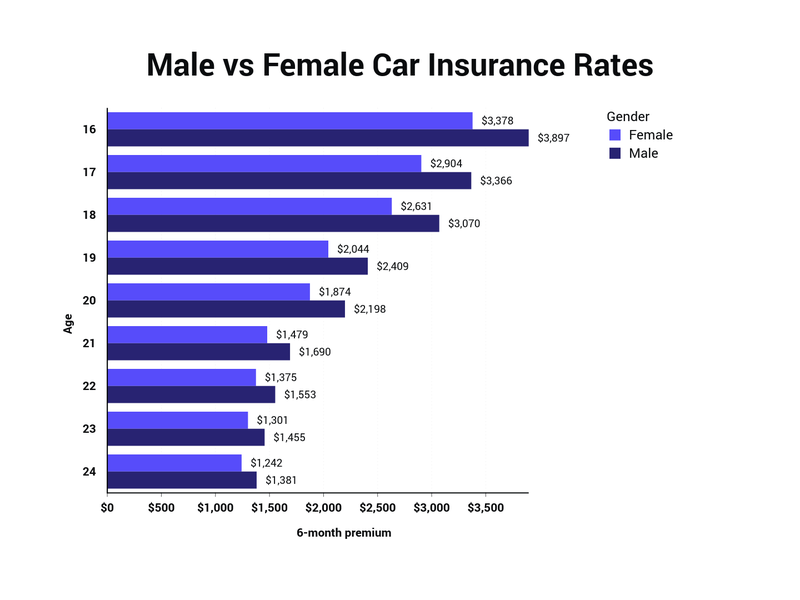

There are several factors that can affect your car insurance premiums in Pennsylvania. The most important factor is your driving record. Drivers with a history of traffic violations or accidents will typically pay more for car insurance than those with a clean driving record. Other factors that can affect your car insurance premiums include your age, sex, credit score, and the type of vehicle you drive. The make and model of the vehicle you drive can also affect your premiums. Cars that are considered high-risk, such as sports cars and luxury vehicles, typically have higher insurance rates than other types of vehicles.

How to Get the Best Car Insurance Rates in Pennsylvania

There are several ways to get the best car insurance rates in Pennsylvania. One of the best ways is to shop around and compare rates from different insurance companies. Many companies offer discounts for good drivers, so it pays to shop around and compare rates. You can also save money on car insurance by taking advantage of discounts for safety features on your vehicle, such as anti-lock brakes and airbags. You can also save money by raising your deductible, which is the amount of money you have to pay before your insurance coverage kicks in.

Conclusion

The cost of car insurance in Pennsylvania can vary significantly from driver to driver. The average cost of car insurance in Pennsylvania is $1,630 per year, or about $135 per month. However, this cost can vary depending on factors such as age, driving record, credit score, and the type of vehicle being insured. To get the best car insurance rates in Pennsylvania, it’s important to compare rates from different insurance companies and take advantage of discounts for safety features and good drivers.

Average Price Of Car Insurance Per Month - designby4d

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami

Average Car Insurance Rates by Age and Gender Per Month

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word

32+ Teenage Car Insurance Average Cost Per Month Pics - Escanciador Sidra