Tesla Model 3 Insurance Price

Tuesday, February 10, 2026

Edit

Tesla Model 3 Insurance: What You Need to Know

The Cost of Tesla Model 3 Insurance

Tesla Model 3 insurance rates are lower than average when compared to other cars of similar class and size. On average, a Tesla Model 3 owner can expect to pay around $1,400 a year for full coverage. While this is higher than the national average, it is still lower than the cost of insuring many other mid-size sedans. The cost of Tesla Model 3 insurance can vary depending on factors such as your driving record, location and other factors.

Factors that Impact Tesla Model 3 Insurance Rates

Insurance companies use a variety of factors to determine the cost of insuring a Tesla Model 3. Some of the most common factors include your age, driving record, location, type of coverage and the type of vehicle you drive.

Your age is an important factor, as younger drivers tend to pay higher insurance premiums. Your driving record is also important, as those with a clean record tend to pay lower rates than those with multiple violations or accidents.

Location is another factor, as those in urban areas tend to pay more for insurance than those in rural areas. The type of coverage you choose also affects your insurance rate. If you opt for comprehensive coverage, your premiums will be higher than if you only choose liability coverage.

Finally, the type of vehicle you drive will affect your insurance premiums. The Tesla Model 3 is considered a luxury vehicle, so it is likely to cost more to insure than a non-luxury sedan.

Tips to Save on Tesla Model 3 Insurance

There are several ways to save money on Tesla Model 3 insurance. One way is to compare quotes from several different insurance companies. Comparing quotes can help you find the best rates available.

Another way to save money is to take advantage of discounts. Many insurance companies offer discounts for a variety of reasons, such as having a clean driving record, being a good student or having a safe vehicle.

It is also important to maintain a good credit score. Insurance companies use credit-based insurance scores to determine the cost of premiums, so a good credit score can help lower your rates.

Finally, take steps to reduce the risk of filing a claim. This can include taking a defensive driving course, avoiding distractions while driving and avoiding driving in hazardous conditions.

What's Included in Tesla Model 3 Insurance?

Tesla Model 3 insurance typically includes liability coverage, which covers damages caused by you to another person or their property. It also includes physical damage coverage, which covers damage to your vehicle due to a collision or other event.

Comprehensive coverage is also typically included, which covers damage to your vehicle caused by something other than a collision, such as theft or vandalism. This coverage also includes glass repair and rental car coverage.

Finally, some insurance companies offer gap insurance, which covers the difference between the balance owed on the loan and the actual cash value of the vehicle if it is totaled.

Conclusion

Tesla Model 3 insurance rates are typically lower than average, but they can vary depending on a variety of factors. To get the best rates, it is important to compare quotes from multiple insurers and take advantage of any available discounts. It is also important to maintain a good credit score and take steps to reduce the risk of filing a claim.

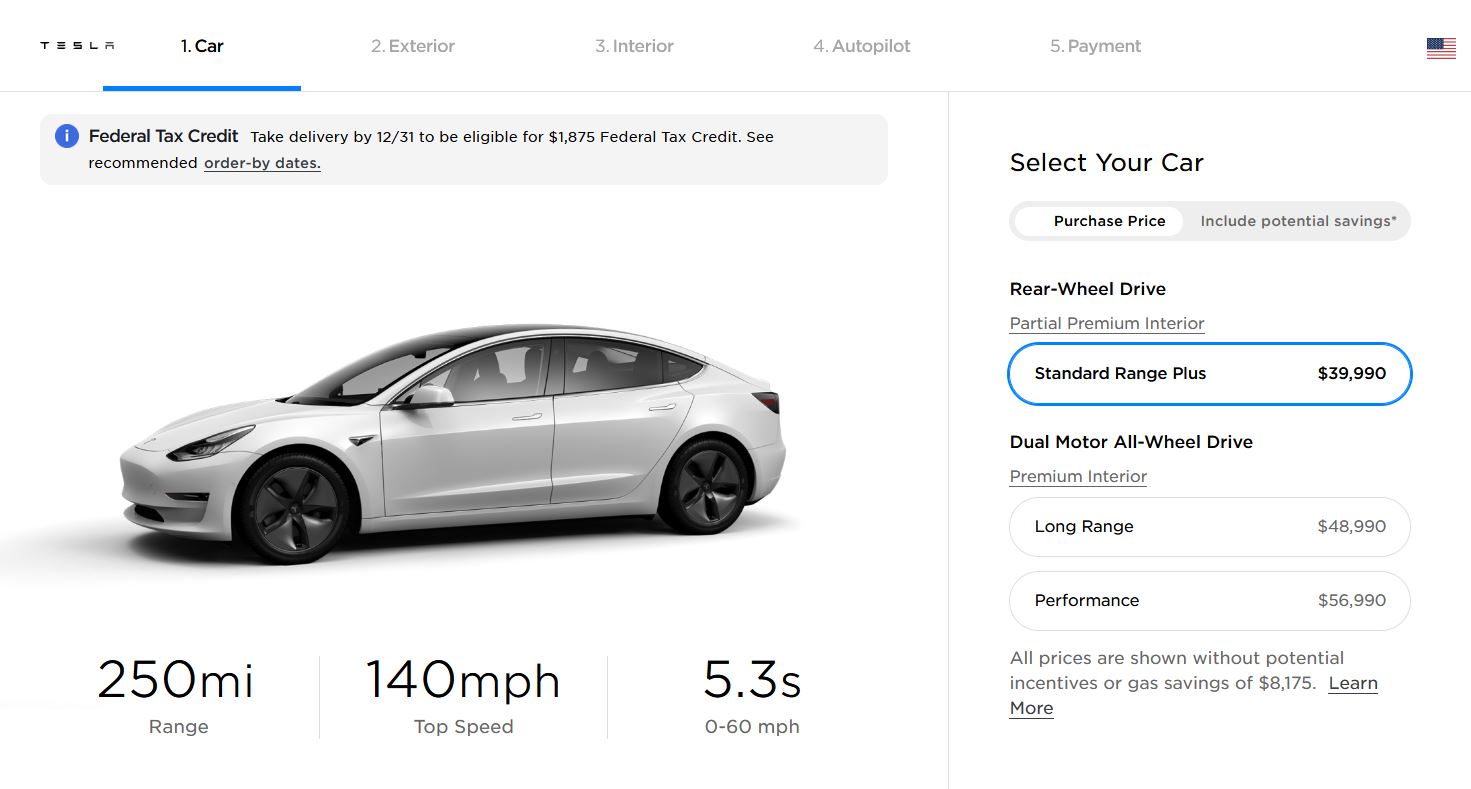

Tesla Model 3 price and specifications - EV Database

Tesla Price - Tesla Model 3 Price Drops By $3,300-3,700 In Norway : Fri

Tesla Model 3 Insurance Cost 2022 | FRugally

How Much Is Insurance For A Tesla Model 3 In California - SWOHM

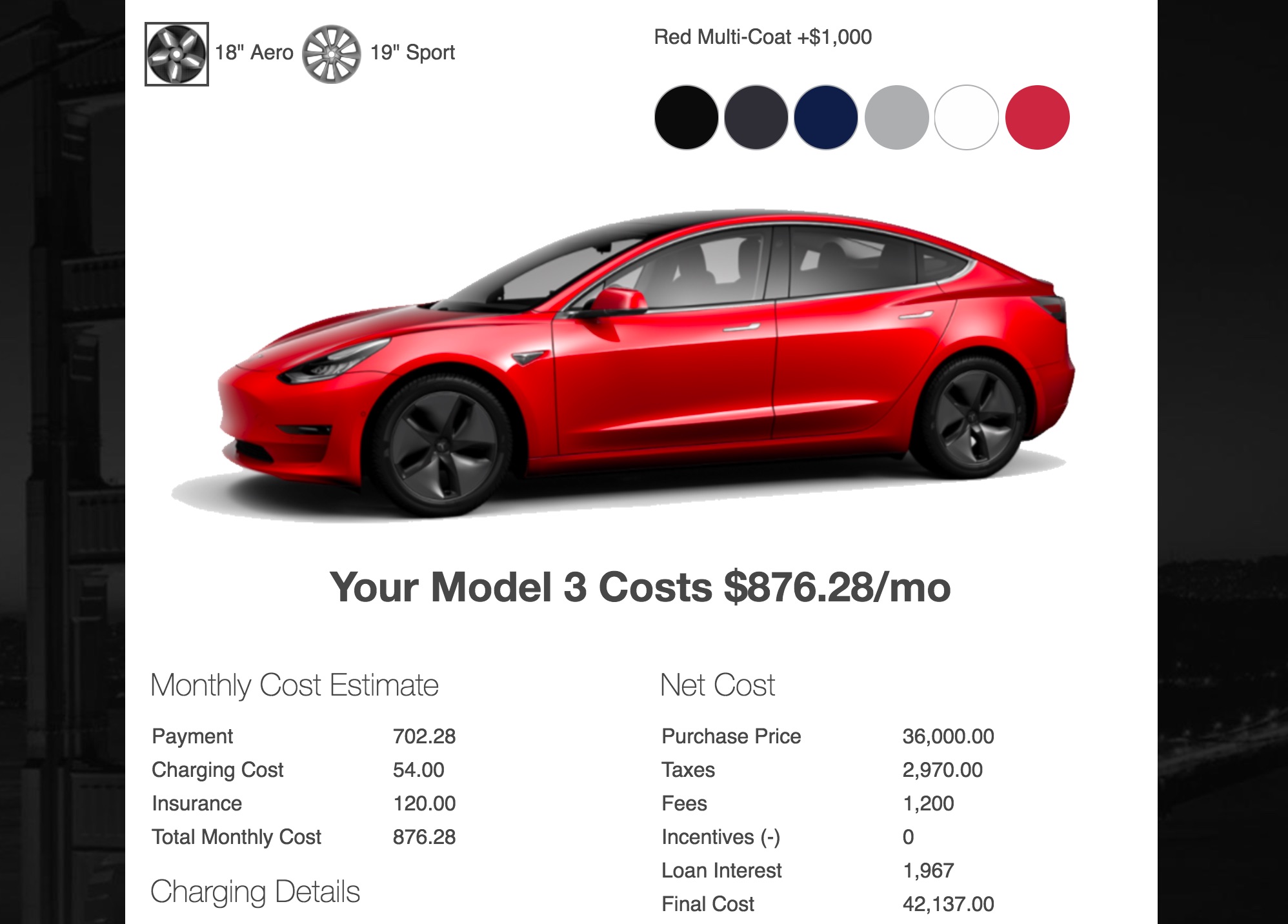

tesla-model-3-monthly-cost-calculator - TESLARATI