Long Term Care Insurance Costs

Understanding Long Term Care Insurance Costs

What is Long Term Care Insurance?

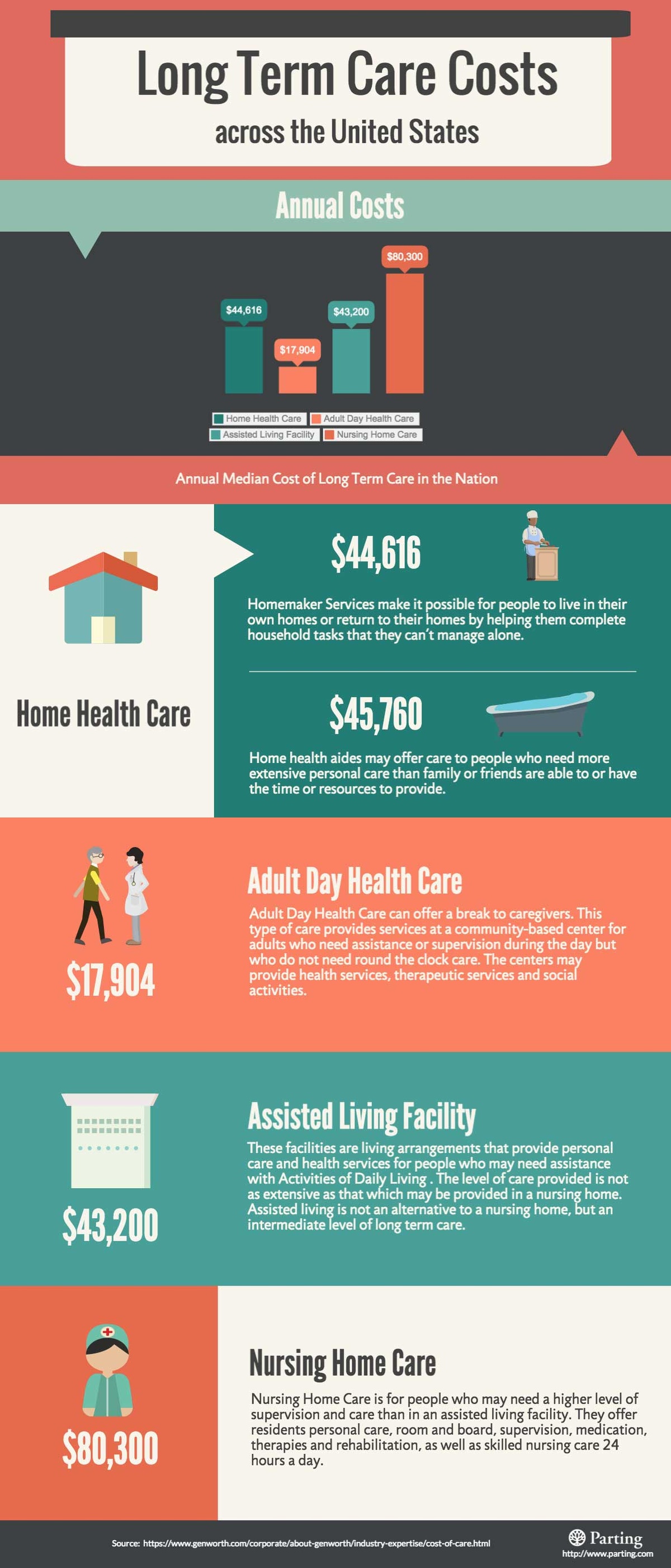

Long Term Care Insurance (LTCI) is a form of health insurance that covers the cost of long term care services for people over the age of 65. It can be used to cover the cost of in-home care, assisted living, nursing home care and other services. It is important to understand the cost of LTCI before making a decision to purchase it.

What Factors Affect Long Term Care Insurance Costs?

The cost of LTCI can vary widely depending on a number of factors. These include the type of coverage you choose, the benefits, your age, and the amount of coverage you need. Your health and lifestyle can also affect the cost of your policy. The cost of LTCI can also vary depending on the provider and the state you live in.

How Much Does Long Term Care Insurance Cost?

The average cost of LTCI can range from a few hundred dollars per month to several thousand dollars per year, depending on the coverage you choose and the benefits you receive. Generally speaking, the younger you are when you purchase LTCI, the lower your premiums will be. However, the cost of LTCI can vary widely from state to state and from provider to provider.

How Can I Save Money on Long Term Care Insurance?

There are a few ways to save money on LTCI. Shopping around for the best rates is the most effective way to save. Comparing quotes from multiple providers can help you find the best deal. You can also consider raising your deductible, which can reduce your premiums. Additionally, you can look into discounts offered by certain providers, such as loyalty or family discounts.

What Are the Benefits of Long Term Care Insurance?

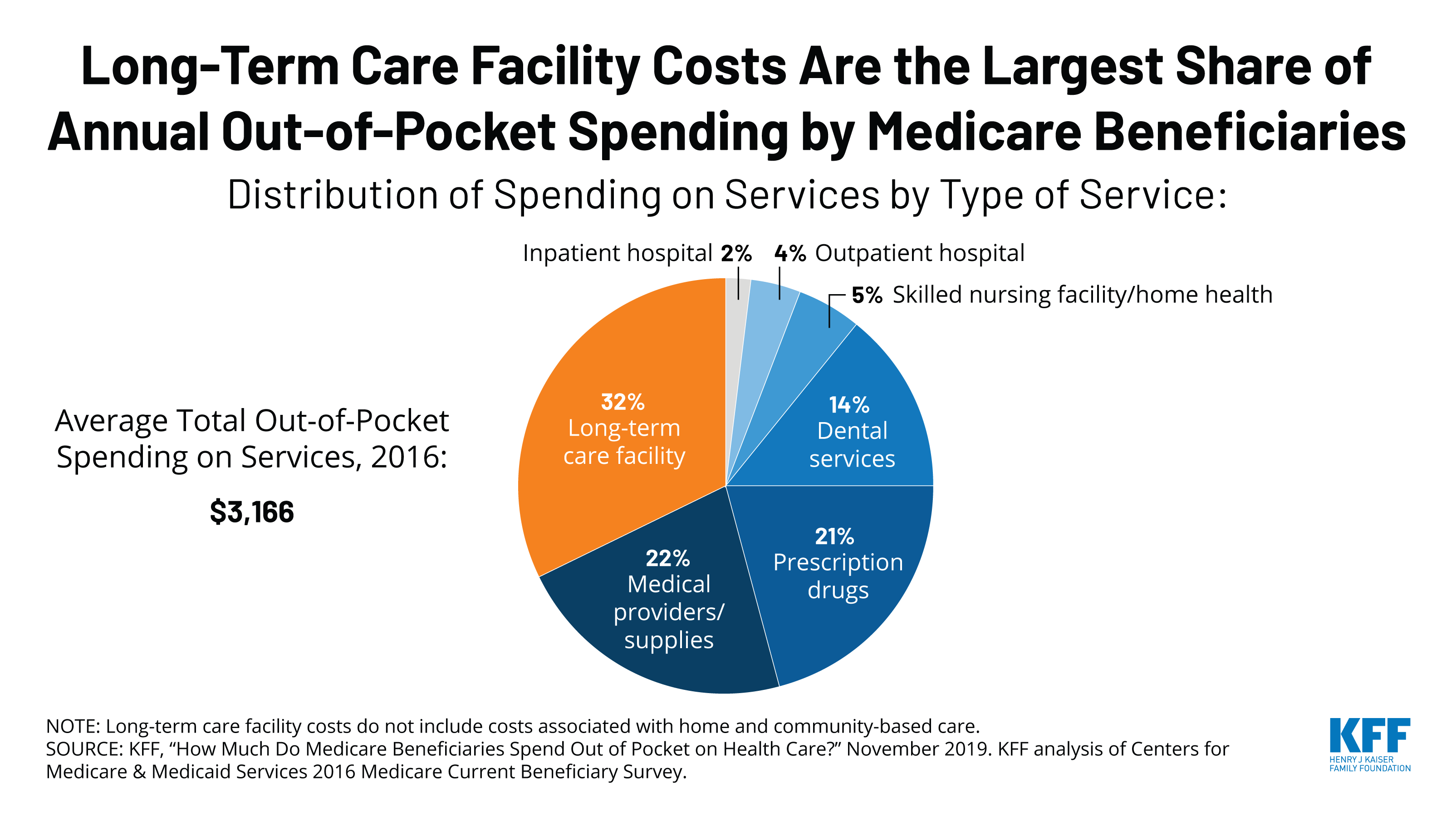

LTCI provides financial assistance for those who need long term care services. It can help protect your savings and assets in the event of an unforeseen need for long term care services. It also provides peace of mind that you will have the resources to cover the cost of care.

What Should I Consider Before Purchasing Long Term Care Insurance?

It is important to consider your needs and budget when shopping for LTCI. Consider how much coverage you need, how much you can afford to pay in premiums, and what benefits you want. Additionally, it is important to understand the terms and conditions of the policy, including any exclusions or limitations.

Conclusion

Long Term Care Insurance can provide peace of mind and financial protection for those who need long term care services. It is important to understand the cost of LTCI and consider your needs and budget when making a decision to purchase. Shopping around for the best rates and understanding the terms and conditions of the policy are important steps to take before making a purchase.

Long-Term Care Insurance: The Ultimate Guide

6 Useful Tips to Avoid Paying $280,000 Health Care Costs in Retirement

Nursing Home Insurance Policy Cost - Insurance Reference

Long-Term Care Facility Costs Are the Largest Share of Annual Out-of

Cost of Care in Arizona – INtouch Senior Services