How Much Is Long term Care Insurance For A 75 Year old

How Much Is Long Term Care Insurance For A 75 Year Old?

What is Long Term Care Insurance?

Long-term care insurance is a type of insurance that helps pay for long-term health care services and supports. It is designed to help cover the costs of long-term care services like nursing home care, in-home care, and assisted living. These services are often not covered by traditional health insurance plans or Medicare. Long-term care insurance can help protect your assets and provide financial security for you and your family.

What Does Long Term Care Insurance Cover?

Long-term care insurance typically covers a variety of services, such as skilled nursing care, in-home health care, assisted living, and adult day care. It can also cover certain medical equipment and supplies, such as wheelchairs and hospital beds. Depending on the policy, it can also cover services like home modifications, home health aides, and respite care.

How Much Does Long Term Care Insurance Cost?

The cost of long-term care insurance depends on several factors, such as your age and health at the time of purchase, the type of policy you choose, and the amount of coverage you desire. Generally, the younger you are when you purchase a policy, the lower the premium will be. For a 75-year-old, the cost of long-term care insurance could range anywhere from a few hundred to several thousand dollars per year.

Is Long Term Care Insurance Worth It?

Long-term care insurance can be a valuable tool for those who want to protect their assets and plan for the future. It can provide peace of mind knowing that you and your family will be protected if you ever require long-term care services. Depending on your age and health, long-term care insurance may be worth the cost.

What Are the Alternatives to Long Term Care Insurance?

If you don't want to purchase long-term care insurance, there are other options available. For example, you may be able to pay for long-term care services out-of-pocket or through Medicaid. You may also be able to use your retirement savings or investments to pay for long-term care services. Finally, many employers offer long-term care insurance as an employee benefit.

Conclusion

Long-term care insurance can be a valuable tool for those who want to protect their assets and plan for the future. The cost of long-term care insurance for a 75-year-old can range from a few hundred to several thousand dollars per year. If you don't want to purchase long-term care insurance, there are other options available, such as paying for long-term care services out-of-pocket, using retirement savings or investments, or taking advantage of an employer-sponsored plan.

What is Long Term Care Insurance? - Medicare Life Health

Life Insurance for 70 to 75 Years Old (You Need to See this Now…)

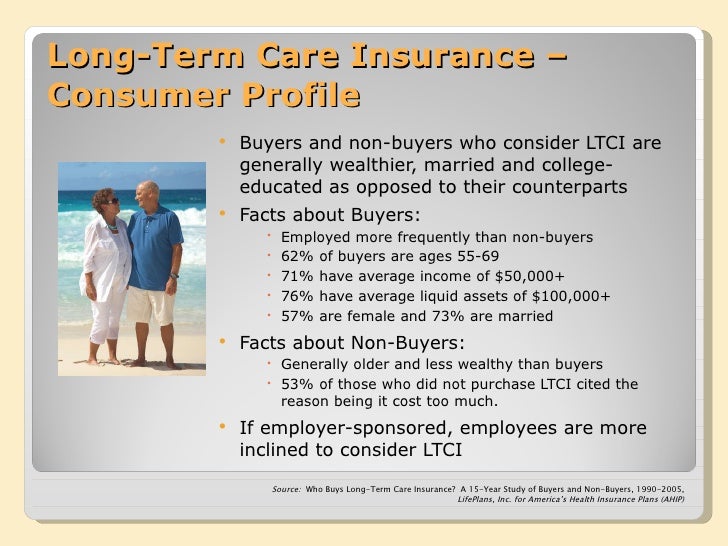

The Basics of Long-Term Care Insurance | Jay Irving

Pension Investors Corporation of Orlando. Business Planning

Long Term Care Insurance