How Much Is Insurance For A New Driver

Friday, February 6, 2026

Edit

How Much Is Insurance For A New Driver?

Why is Insurance for New Drivers So Expensive?

Getting insurance as a new driver is often expensive because insurers consider new drivers to be a greater risk than experienced drivers. Insurance companies look at a variety of factors when calculating car insurance rates, and one of the biggest factors is the driver’s experience behind the wheel. New drivers are considered high-risk because they are more likely to be involved in an accident due to their lack of experience. This is why they are charged higher rates than more experienced drivers.

In addition, the type of car a new driver buys can also affect their insurance rates. Insurance companies typically charge higher rates for sports cars and luxury vehicles, as these types of cars are more expensive to repair and replace.

Factors that Affect Insurance for New Drivers

In addition to the driver’s experience and the type of car, there are several other factors that can affect the cost of insurance for new drivers. These include where the driver lives, the driver’s age, the driver’s gender, the driver’s credit score, and the driver’s driving record.

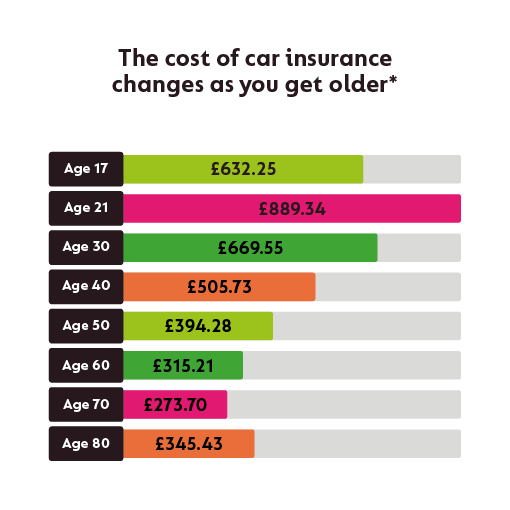

Younger drivers are typically considered high-risk and are charged higher rates than more experienced drivers. Likewise, drivers with bad credit scores may also be charged higher rates. This is because insurers view drivers with poor credit as more likely to make a claim.

How to Get Affordable Insurance for New Drivers

Fortunately, there are some strategies that new drivers can use to get more affordable insurance rates. One of the best ways to get more affordable rates is to shop around and compare quotes from different insurers. Comparing quotes can help new drivers find the best rates available.

New drivers may also be able to get more affordable rates by taking a defensive driving course or participating in a driver’s education program. Insurance companies often offer discounts to drivers who take these types of courses.

Finally, new drivers may be able to get more affordable rates by bundling their insurance with other types of insurance, such as home or life insurance. Bundling multiple policies with the same insurer can often result in lower rates.

How Much Does Insurance Cost for New Drivers?

The cost of insurance for new drivers will vary depending on the driver’s age, gender, credit score, driving record, type of car, and where they live. However, on average, most new drivers can expect to pay between $1,200 and $2,000 per year for car insurance.

Tips to Help New Drivers Save on Car Insurance

New drivers can save money on car insurance by shopping around and comparing quotes, taking a defensive driving course or participating in a driver’s education program, and bundling their insurance with other types of insurance. Additionally, new drivers can also save money by increasing their deductible, opting for a higher deductible, and dropping unnecessary coverage.

Finding affordable car insurance as a new driver can be a challenge, but with a bit of research and due diligence, it is possible to find rates that are more affordable. By taking the time to compare quotes and look for discounts, new drivers can get the coverage they need without breaking the bank.

New Driver Insurance Cost Varies Widely Depending on Your Situation

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins

2021 Car Insurance Rates by Age and Gender - NerdWallet

What do Americans Pay for Car Insurance in 2019?

Car Insurance For New Drivers Over 21 - A Life of Luxury - Personal