Average Cost Of Full Coverage Car Insurance Per Month

Average Cost Of Full Coverage Car Insurance Per Month

What Is Full Coverage Car Insurance?

Full coverage car insurance is a type of policy that covers all the different aspects of your car insurance needs. It is an umbrella policy that covers different elements such as liability, medical payments, uninsured motorist and collision coverage. The coverage can also include any additional riders that you may choose to add on to your policy. The coverage is designed to protect you from financial loss in the event of an accident.

What Does Full Coverage Car Insurance Cost?

The cost of full coverage car insurance can vary greatly depending on factors such as the age and make of the car, the driver’s driving record, and the location the car is driven in. Generally, the cost of full coverage car insurance can range anywhere from around $50 to over $200 per month. Of course, the exact cost of car insurance will depend on the individual’s and car’s specific circumstances.

What Affects The Cost Of Full Coverage Car Insurance?

The cost of full coverage car insurance can depend on several factors, including the age and make of the car, the driver’s driving record, the location the car is driven in, the coverage limits chosen, and the deductible chosen. Generally, drivers with a clean driving record who drive newer cars with higher safety ratings will pay less for full coverage car insurance than drivers with a poor driving record who drive older cars with lower safety ratings.

How To Lower The Cost Of Full Coverage Car Insurance?

There are several strategies that can be used to help lower the cost of full coverage car insurance. First, drivers should shop around to compare rates from different insurance companies. Drivers should also consider raising their deductible to a higher level in order to reduce their premiums. Additionally, drivers may be able to reduce their premiums by taking a driver safety course or by bundling their car insurance with other types of insurance such as home or life insurance.

What Are The Benefits Of Full Coverage Car Insurance?

Full coverage car insurance is beneficial because it provides drivers with financial protection in the event of an accident. It also provides drivers with peace of mind, knowing that they are protected in the event of an accident. Additionally, full coverage car insurance may help drivers who have damaged their credit score by providing them with the opportunity to lower their premiums.

Conclusion

Full coverage car insurance can be beneficial for drivers who want to be protected in the event of an accident. The cost of full coverage car insurance can vary greatly depending on factors such as the age and make of the car, the driver’s driving record, and the location the car is driven in. There are several strategies that can be used to help lower the cost of full coverage car insurance, such as shopping around for the best rates, raising the deductible, and bundling car insurance with other types of insurance.

The Average Auto Insurance Cost Per Month | The Lazy Site

The average cost of car insurance in the US, from coast to coast

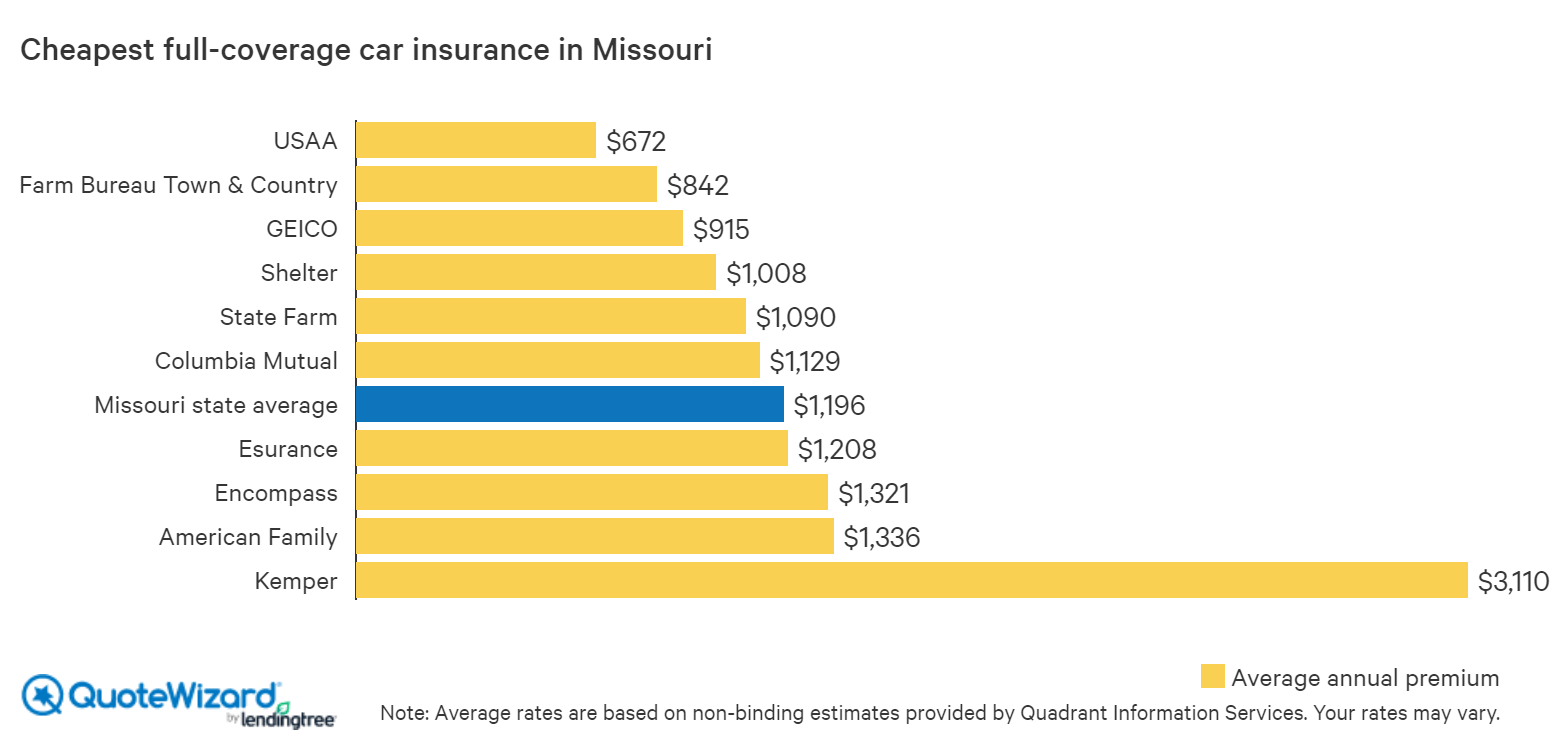

Average Car Insurance Cost In Missouri Per Month

Average Cost of Car Insurance UK 2020 | NimbleFins

What Is The Average Price Of Full Coverage Car Insurance