Maryland Car Insurance For High Risk Drivers

Finding Maryland Car Insurance For High Risk Drivers

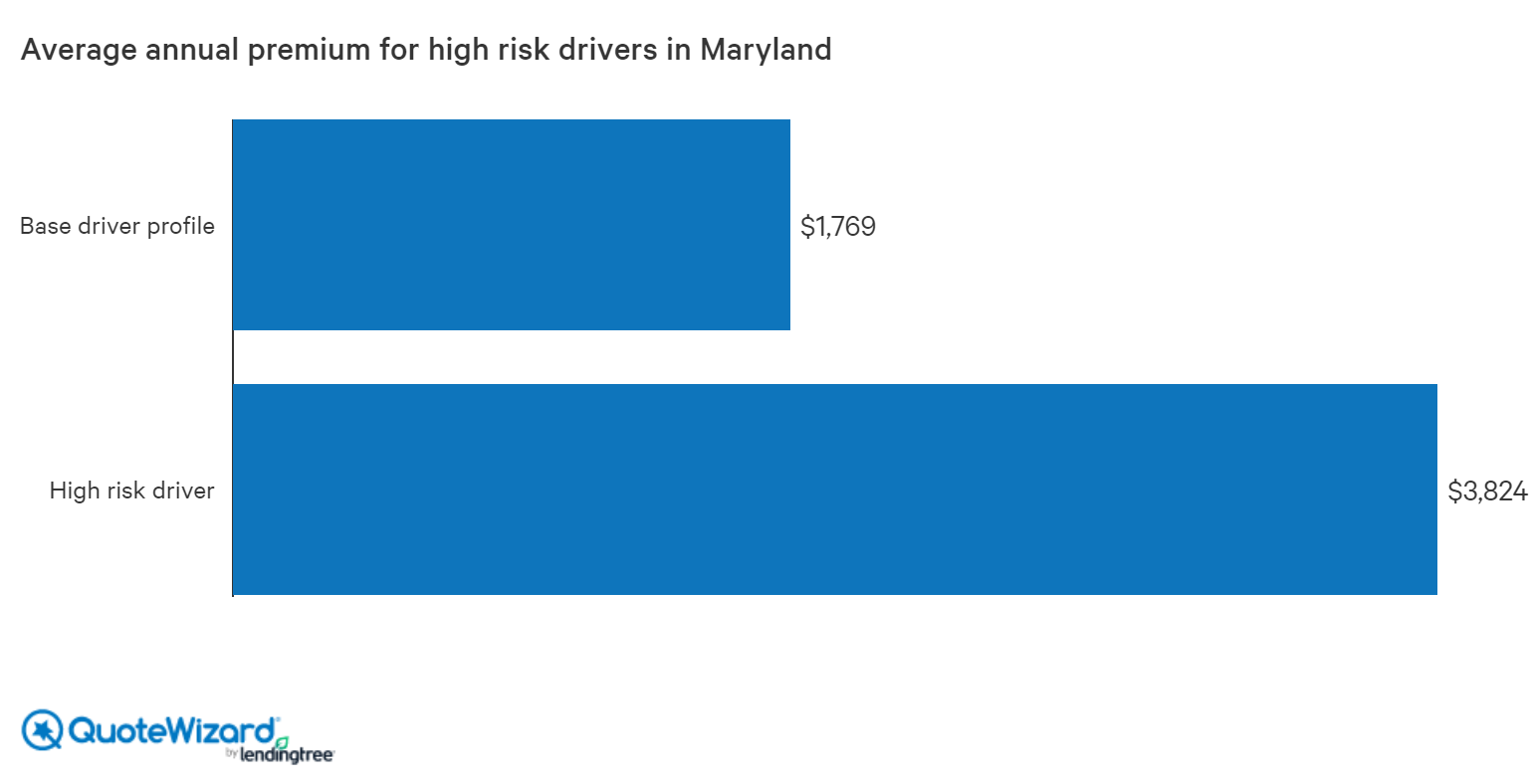

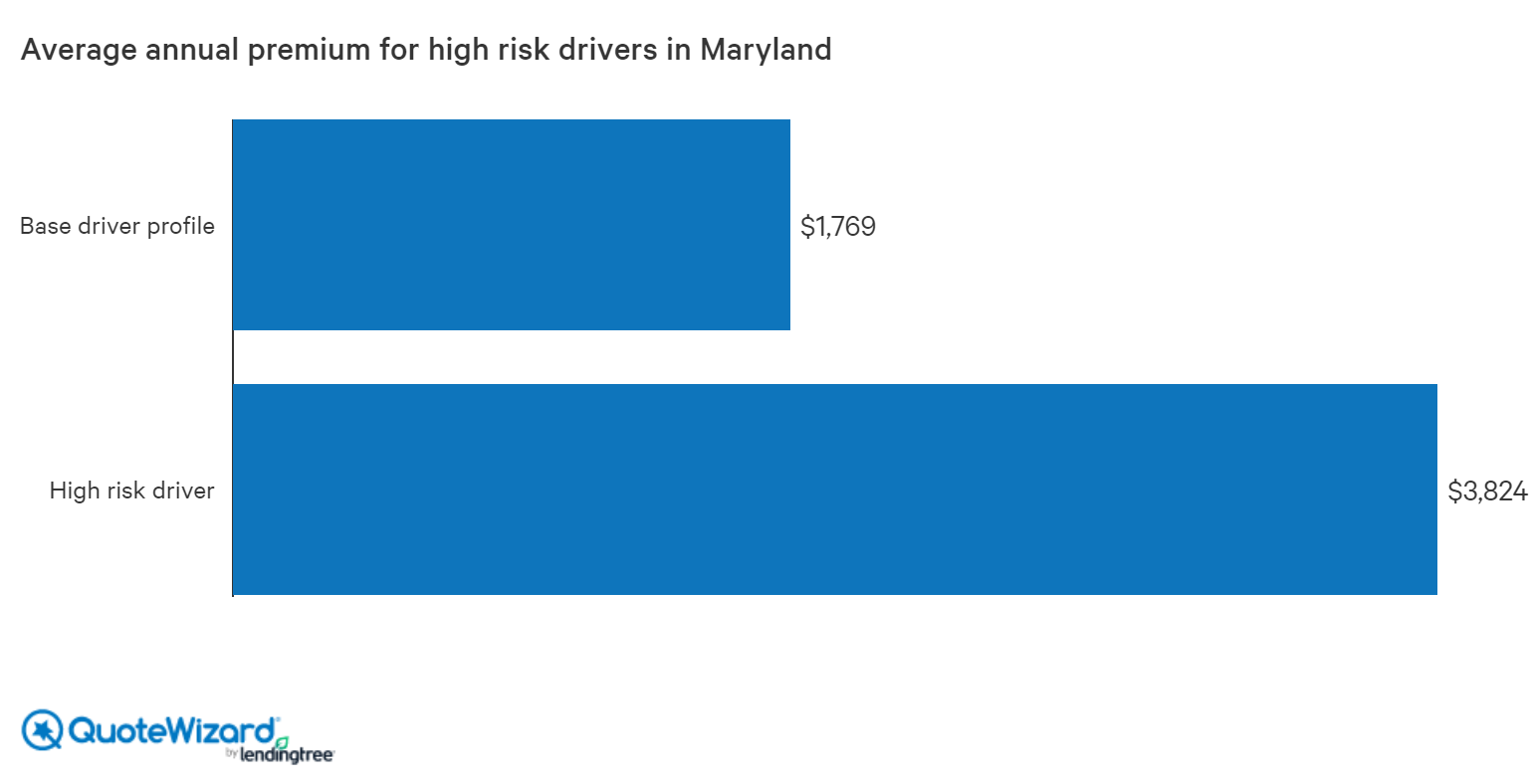

Drivers in Maryland who are considered to be high risk have a difficult time finding affordable car insurance. High risk drivers are typically those who have had a history of auto accidents, traffic violations, or DUI convictions. Many companies will deny coverage or charge much higher premiums for these drivers. Fortunately, there are some options for those in need of Maryland car insurance for high risk drivers.

What is High Risk Car Insurance?

High risk car insurance is a type of coverage specifically designed for individuals who have had difficulty obtaining coverage from other companies due to their driving record. It is typically more expensive than traditional car insurance, but it provides the same coverage as other types of insurance. In some cases, the coverage may be more comprehensive and provide additional benefits such as roadside assistance and rental car coverage.

How to Find Maryland Car Insurance for High Risk Drivers

The best way to find car insurance for high risk drivers in Maryland is to shop around. Different companies will offer different rates and coverage options, so it is important to compare policies to determine which one is best for your needs. There are a few different ways to shop for car insurance. You can contact an insurance agent and ask for a quote, or you can use an online comparison tool to compare rates from multiple companies.

What Factors Impact Rates for High Risk Drivers?

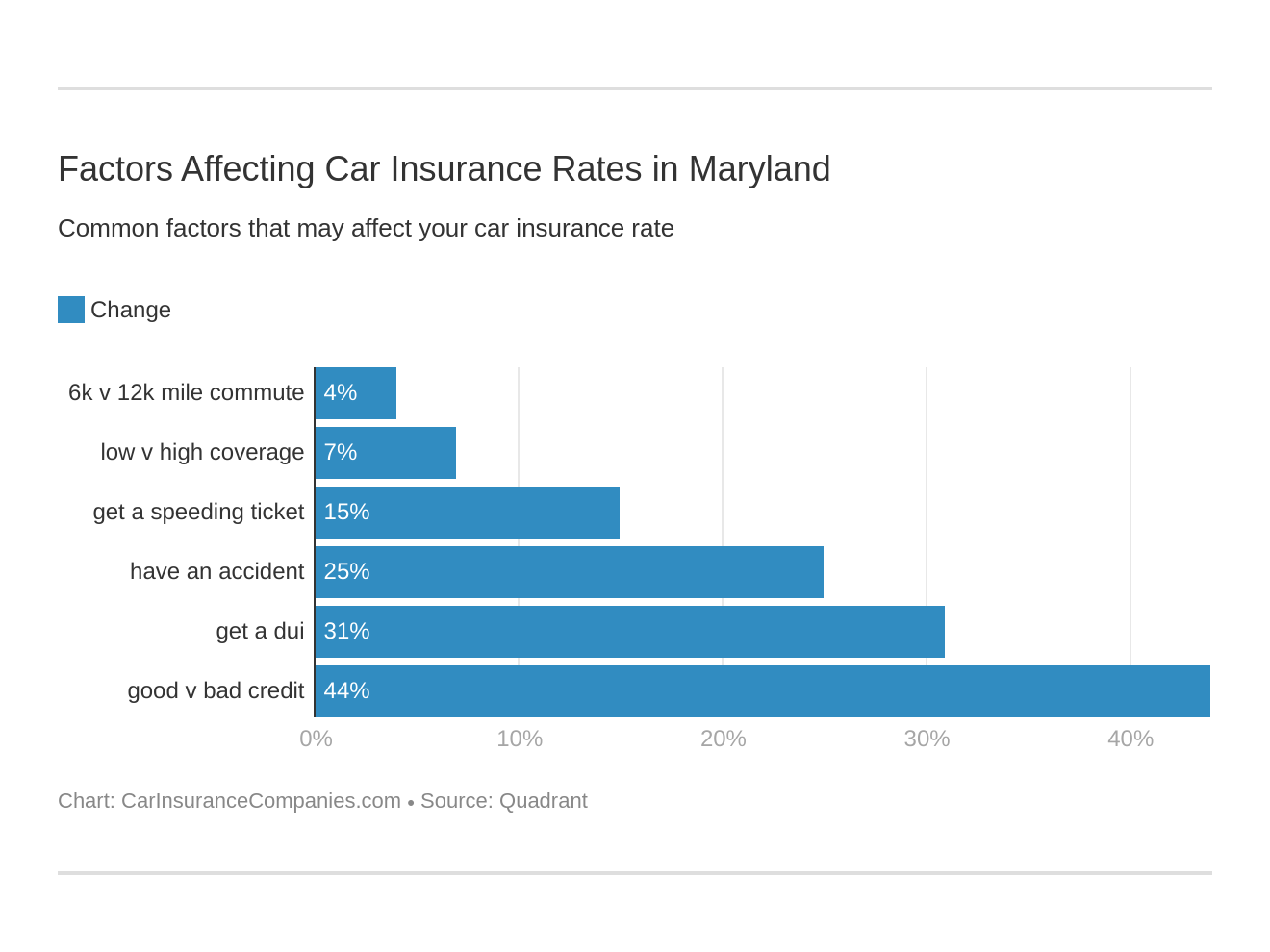

When shopping for car insurance for high risk drivers in Maryland, it is important to understand the factors that can affect your rates. Drivers who have had multiple accidents or violations in the past will typically pay more for coverage than those with a clean driving record. Additionally, drivers with poor credit scores or those who are considered to be a higher risk due to their age or the type of vehicle they are driving may pay more for coverage.

How to Save Money on High Risk Car Insurance in Maryland

While high risk car insurance is more expensive than traditional coverage, there are a few ways to save money. One of the best ways to save money is to take a driver safety course. Taking a course can help you to become a safer driver and may qualify you for discounts with some insurance companies. Additionally, you may be able to save money by bundling your auto insurance with other policies, such as home or life insurance.

How to Choose the Right Coverage for High Risk Drivers

When selecting car insurance for high risk drivers in Maryland, it is important to choose a policy that provides sufficient coverage. A good policy should include liability coverage, which provides protection if you are found to be at fault in an accident. Additionally, you may want to consider adding comprehensive and collision coverage, which can provide protection for your vehicle if it is damaged in an accident or if it is stolen. It is also a good idea to consider adding uninsured or underinsured motorist coverage, as this can provide protection if you are in an accident with another driver who does not have adequate insurance.

Find Cheap Auto Insurance in Maryland (2020) | QuoteWizard

2019 Maryland Car Insurance Report

Average Monthly Car Insurance Maryland - blog.pricespin.net

Maryland Car Insurance Quotes | Get Rates | Insurance Geek

Maryland Car Insurance Guide (Cost + Coverage)