Il Cheap Liability Car Insurance Coverage

Tuesday, January 27, 2026

Edit

Cheap Liability Car Insurance Coverage – Get the Best Deal

Finding the right car insurance coverage can be a daunting task. You want the best coverage for the least amount of money. Liability car insurance coverage is generally the cheapest option, and is usually required by law. It can provide financial protection in the event of an accident, and can help you get back on the road quickly.

What is Liability Car Insurance Coverage?

Liability car insurance coverage is designed to protect you from financial losses due to an auto accident. It covers any damages you may cause to another person or property while driving. This includes medical bills, property damage, and repair costs. It also includes legal fees if you are sued for damages caused by the accident.

Cheap Liability Car Insurance Coverage Options

When it comes to car insurance, there are two types of liability coverage: bodily injury and property damage liability. Bodily injury liability covers medical bills and lost wages for anyone injured in an accident that you caused. Property damage liability covers damage to another person’s vehicle or property.

The amount of coverage you need depends on your financial situation. If you have a lot of assets, you may need more coverage. On the other hand, if you have very few assets, you may not need as much coverage. It’s best to speak with an insurance agent to determine the right amount of coverage for you.

Cheap Liability Car Insurance Coverage Savings

There are a few ways to save money on liability car insurance coverage. The first is to shop around for the best rates. Different insurance companies offer different rates, so it pays to shop around. You can also ask for discounts, such as a multi-policy discount if you insure more than one vehicle with the same company.

Another way to save money is to increase your deductible. This is the amount you pay out of pocket before your insurance kicks in. The higher your deductible, the lower your premium. However, you should only increase your deductible if you can afford to pay it in the event of a claim.

Cheap Liability Car Insurance Coverage Tips

There are a few things you can do to ensure you get the best rate on your liability car insurance coverage. Make sure you have a clean driving record – this can make a big difference in the cost of your policy. Also, consider raising your credit score. Insurance companies use credit scores to determine your premium, so a higher score can lead to lower rates.

Finally, ask your insurance agent about any discounts you may qualify for. Insurance companies often offer discounts for good drivers, safe drivers, and members of certain organizations. These discounts can add up to big savings, so make sure you ask about them.

Cheap liability car insurance coverage is a great way to protect yourself financially in the event of an accident. With a little research and some savvy shopping, you can find the coverage you need at a price you can afford.

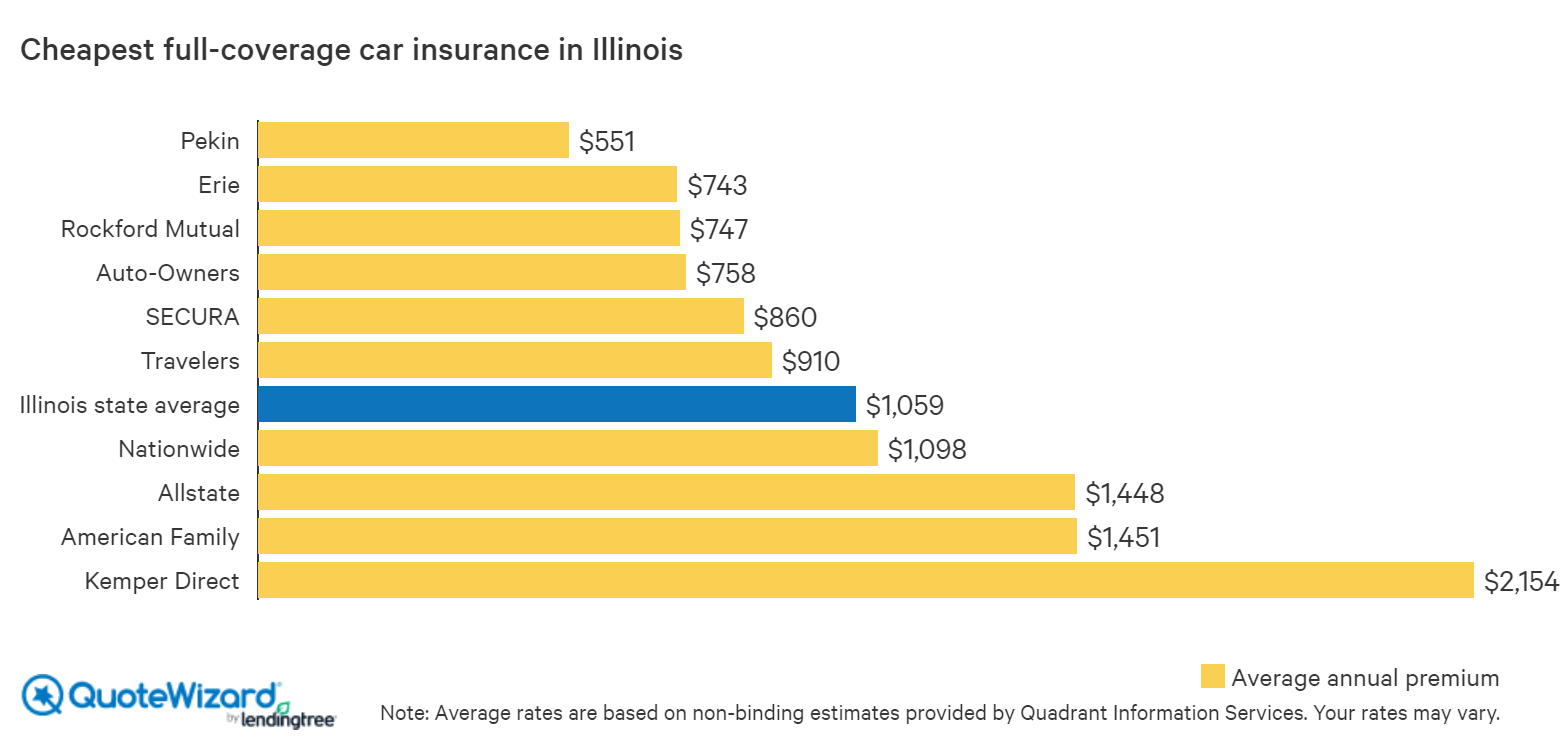

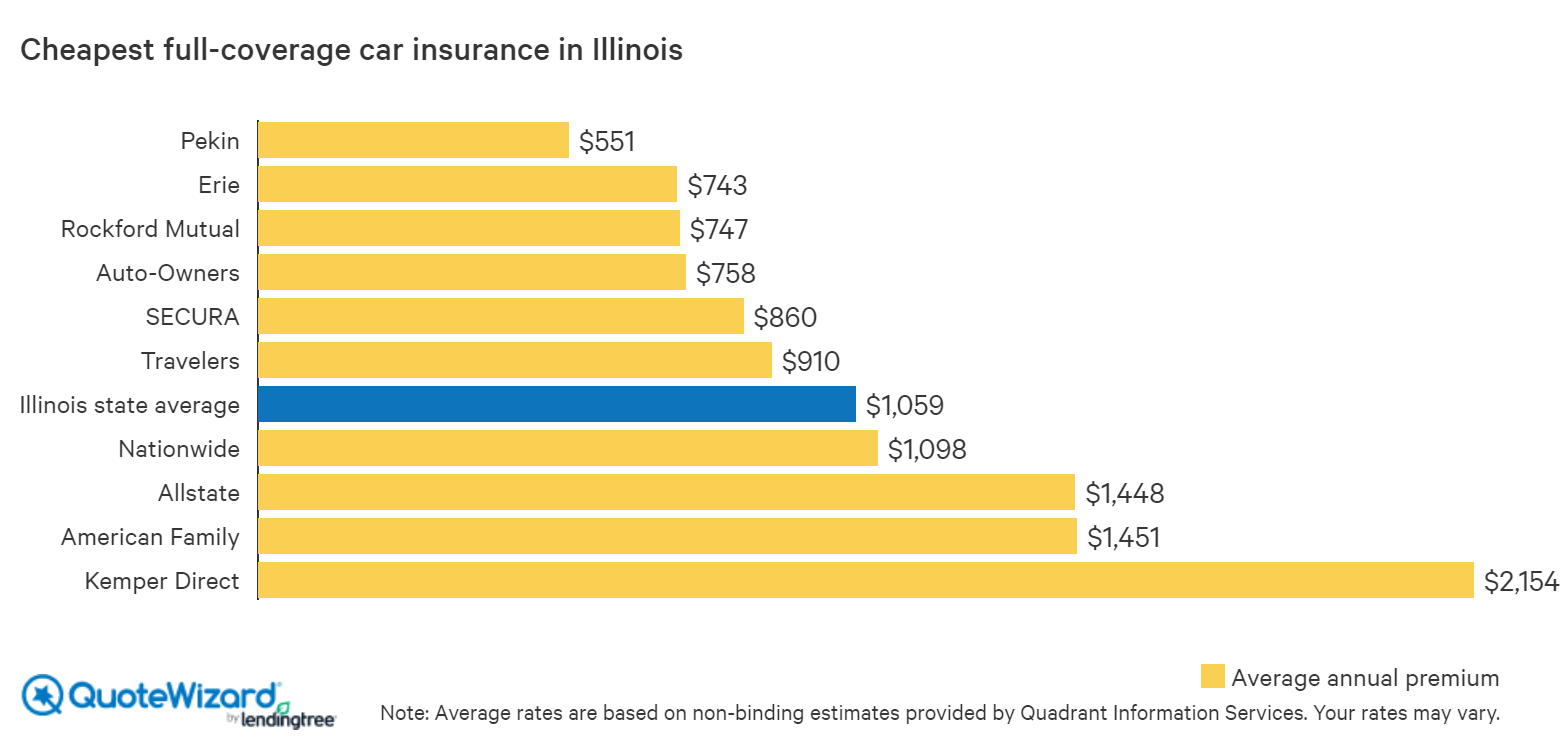

Find Cheap Car Insurance in Illinois | QuoteWizard

Learn the Different Types of Car Insurance Policies

Prepare Yourself For a Next Auto Investment – balslevflores03's blog

Auto Liability Coverage Explained - Harry Levine Insurance

What Is Comprehensive Insurance Coverage? | Allstate